FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Figure 12. Enterprises’ Annual Net Income (Loss)<br />

2006 Through Second Quarter 2013 ($ billions)<br />

$100<br />

$80<br />

$60<br />

$40<br />

$20<br />

$0<br />

($20)<br />

($40)<br />

($60)<br />

($80)<br />

($100)<br />

($120)<br />

2006<br />

2007<br />

2008<br />

Fannie Mae<br />

2009<br />

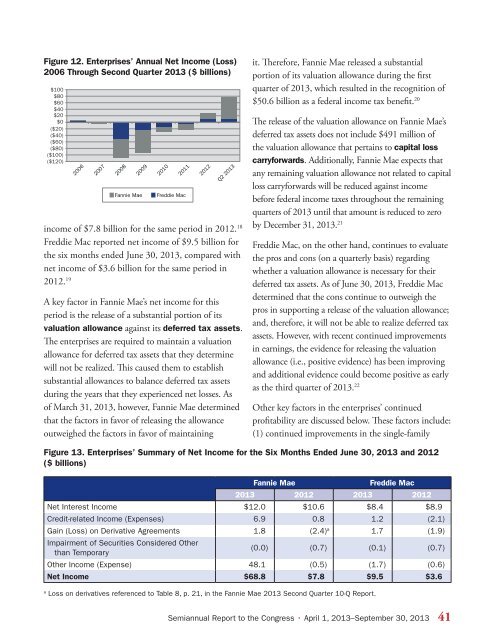

Figure 12. Enterprises’ Annual Net Income (Loss) 2006 Through Second Quarter 2013 ($ billions)<br />

2010<br />

Freddie Mac<br />

2011<br />

2012<br />

Q2 2013<br />

income of $7.8 billion for the same period in 2012. 18<br />

Freddie Mac reported net income of $9.5 billion for<br />

the six months ended June 30, 2013, compared with<br />

net income of $3.6 billion for the same period in<br />

2012. 19<br />

A key factor in Fannie Mae’s net income for this<br />

period is the release of a substantial portion of its<br />

valuation allowance against its deferred tax assets.<br />

The enterprises are required to maintain a valuation<br />

allowance for deferred tax assets that they determine<br />

will not be realized. This caused them to establish<br />

substantial allowances to balance deferred tax assets<br />

during the years that they experienced net losses. As<br />

of March 31, 2013, however, Fannie Mae determined<br />

that the factors in favor of releasing the allowance<br />

outweighed the factors in favor of maintaining<br />

it. Therefore, Fannie Mae released a substantial<br />

portion of its valuation allowance during the first<br />

quarter of 2013, which resulted in the recognition of<br />

Freddie Mac<br />

$50.6 billion as a federal income tax benefit. 20<br />

Fannie Mae<br />

The release of the valuation allowance on Fannie Mae’s<br />

deferred tax assets does not include $491 million of<br />

the valuation allowance that pertains to capital loss<br />

carryforwards. Additionally, Fannie Mae expects that<br />

any remaining valuation allowance not related to capital<br />

loss carryforwards will be reduced against income<br />

before federal income taxes throughout the remaining<br />

quarters of 2013 until that amount is reduced to zero<br />

by December 31, 2013. 21<br />

Freddie Mac, on the other hand, continues to evaluate<br />

the pros and cons (on a quarterly basis) regarding<br />

whether a valuation allowance is necessary for their<br />

deferred tax assets. As of June 30, 2013, Freddie Mac<br />

determined that the cons continue to outweigh the<br />

pros in supporting a release of the valuation allowance;<br />

and, therefore, it will not be able to realize deferred tax<br />

assets. However, with recent continued improvements<br />

in earnings, the evidence for releasing the valuation<br />

allowance (i.e., positive evidence) has been improving<br />

and additional evidence could become positive as early<br />

as the third quarter of 2013. 22<br />

Other key factors in the enterprises’ continued<br />

profitability are discussed below. These factors include:<br />

(1) continued improvements in the single-family<br />

Figure 13. Enterprises’ Summary of Net Income for the Six Months Ended June 30, 2013 and 2012<br />

($ billions)<br />

Fannie Mae<br />

Freddie Mac<br />

2013 2012 2013 2012<br />

Net Interest Income $12.0 $10.6 $8.4 $8.9<br />

Credit-related Income (Expenses) 6.9 0.8 1.2 (2.1)<br />

Gain (Loss) on Derivative Agreements 1.8 (2.4) a 1.7 (1.9)<br />

Impairment of Securities Considered Other<br />

than Temporary<br />

(0.0) (0.7) (0.1) (0.7)<br />

Other Income (Expense) 48.1 (0.5) (1.7) (0.6)<br />

Net Income $68.8 $7.8 $9.5 $3.6<br />

a<br />

Loss on derivatives referenced to Table 8, p. 21, in the Fannie Mae 2013 Second Quarter 10-Q Report.<br />

Semiannual Report to the Congress • April 1, 2013–September 30, 2013 41