FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

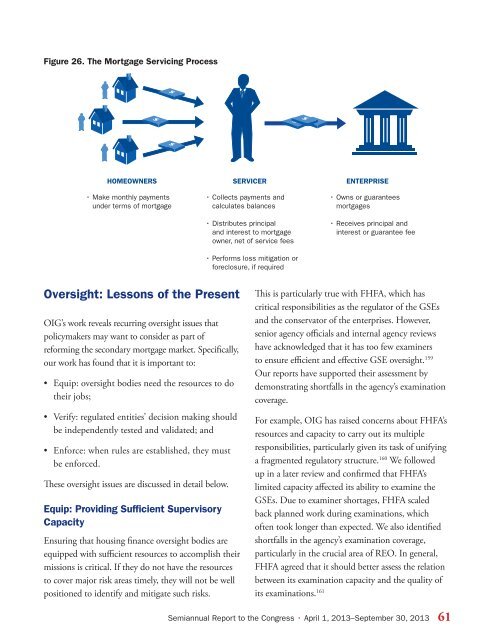

Figure 26. The Mortgage Servicing Process<br />

HOMEOWNERS<br />

SERVICER<br />

ENTERPRISE<br />

• Make monthly payments<br />

under terms of mortgage<br />

• Collects payments and<br />

calculates balances<br />

• Distributes principal<br />

and interest to mortgage<br />

owner, net of service fees<br />

• Performs loss mitigation or<br />

foreclosure, if required<br />

• Owns or guarantees<br />

mortgages<br />

• Receives principal and<br />

interest or guarantee fee<br />

Oversight: Lessons of the Present<br />

OIG’s work reveals recurring oversight issues that<br />

policymakers may want to consider as part of<br />

reforming the secondary mortgage market. Specifically,<br />

our work has found that it is important to:<br />

• Equip: oversight bodies need the resources to do<br />

their jobs;<br />

• Verify: regulated entities’ decision making should<br />

be independently tested and validated; and<br />

• Enforce: when rules are established, they must<br />

be enforced.<br />

These oversight issues are discussed in detail below.<br />

Equip: Providing Sufficient Supervisory<br />

Capacity<br />

Ensuring that housing finance oversight bodies are<br />

equipped with sufficient resources to accomplish their<br />

missions is critical. If they do not have the resources<br />

to cover major risk areas timely, they will not be well<br />

positioned to identify and mitigate such risks.<br />

This is particularly true with FHFA, which has<br />

critical responsibilities as the regulator of the GSEs<br />

and the conservator of the enterprises. However,<br />

senior agency officials and internal agency reviews<br />

have acknowledged that it has too few examiners<br />

to ensure efficient and effective GSE oversight. 159<br />

Our reports have supported their assessment by<br />

demonstrating shortfalls in the agency’s examination<br />

coverage.<br />

For example, OIG has raised concerns about FHFA’s<br />

resources and capacity to carry out its multiple<br />

Figure 26. The Mortgage responsibilities, Servicing Process particularly given its task of unifying<br />

a fragmented regulatory structure. 160 We followed<br />

up in a later review and confirmed that FHFA’s<br />

limited capacity affected its ability to examine the<br />

GSEs. Due to examiner shortages, FHFA scaled<br />

back planned work during examinations, which<br />

often took longer than expected. We also identified<br />

shortfalls in the agency’s examination coverage,<br />

particularly in the crucial area of REO. In general,<br />

FHFA agreed that it should better assess the relation<br />

between its examination capacity and the quality of<br />

its examinations. 161<br />

Semiannual Report to the Congress • April 1, 2013–September 30, 2013 61