FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

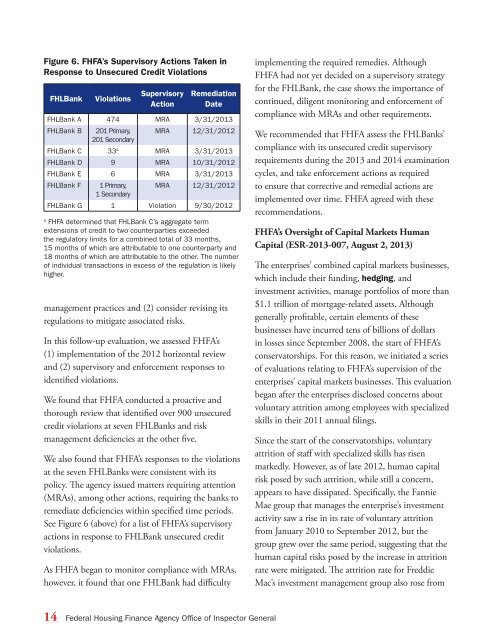

Figure 6. FHFA’s Supervisory Actions Taken in<br />

Response to Unsecured Credit Violations<br />

FHLBank<br />

Violations<br />

Supervisory<br />

Action<br />

Remediation<br />

Date<br />

FHLBank A 474 MRA 3/31/2013<br />

FHLBank B<br />

201 Primary,<br />

201 Secondary<br />

MRA 12/31/2012<br />

FHLBank C 33 a MRA 3/31/2013<br />

FHLBank D 9 MRA 10/31/2012<br />

FHLBank E 6 MRA 3/31/2013<br />

FHLBank F<br />

1 Primary,<br />

1 Secondary<br />

MRA 12/31/2012<br />

FHLBank G 1 Violation 9/30/2012<br />

a<br />

FHFA determined that FHLBank C’s aggregate term<br />

extensions of credit to two counterparties exceeded<br />

the regulatory limits for a combined total of 33 months,<br />

15 months of which are attributable to one counterparty and<br />

18 months of which are attributable to the other. The number<br />

of individual transactions in excess of the regulation is likely<br />

higher.<br />

management practices and (2) consider revising its<br />

regulations to mitigate associated risks.<br />

In this follow-up evaluation, we assessed FHFA’s<br />

(1) implementation of the 2012 horizontal review<br />

and (2) supervisory and enforcement responses to<br />

identified violations.<br />

We found that FHFA conducted a proactive and<br />

thorough review that identified over 900 unsecured<br />

credit violations at seven FHLBanks and risk<br />

management deficiencies at the other five.<br />

We also found that FHFA’s responses to the violations<br />

at the seven FHLBanks were consistent with its<br />

policy. The agency issued matters requiring attention<br />

(MRAs), among other actions, requiring the banks to<br />

remediate deficiencies within specified time periods.<br />

See Figure 6 (above) for a list of FHFA’s supervisory<br />

actions in response to FHLBank unsecured credit<br />

violations.<br />

As FHFA began to monitor compliance with MRAs,<br />

however, it found that one FHLBank had difficulty<br />

implementing the required remedies. Although<br />

FHFA had not yet decided on a supervisory strategy<br />

for the FHLBank, the case shows the importance of<br />

continued, diligent monitoring and enforcement of<br />

compliance with MRAs and other requirements.<br />

We recommended that FHFA assess the FHLBanks’<br />

compliance with its unsecured credit supervisory<br />

requirements during the 2013 and 2014 examination<br />

cycles, and take enforcement actions as required<br />

to ensure that corrective and remedial actions are<br />

implemented over time. FHFA agreed with these<br />

recommendations.<br />

FHFA’s Oversight of Capital Markets Human<br />

Capital (ESR-2013-007, August 2, 2013)<br />

The enterprises’ combined capital markets businesses,<br />

which include their funding, hedging, and<br />

investment activities, manage portfolios of more than<br />

$1.1 trillion of mortgage-related assets. Although<br />

generally profitable, certain elements of these<br />

businesses have incurred tens of billions of dollars<br />

in losses since September 2008, the start of FHFA’s<br />

conservatorships. For this reason, we initiated a series<br />

of evaluations relating to FHFA’s supervision of the<br />

enterprises’ capital markets businesses. This evaluation<br />

began after the enterprises disclosed concerns about<br />

voluntary attrition among employees with specialized<br />

skills in their 2011 annual filings.<br />

Since the start of the conservatorships, voluntary<br />

attrition of staff with specialized skills has risen<br />

markedly. However, as of late 2012, human capital<br />

risk posed by such attrition, while still a concern,<br />

appears to have dissipated. Specifically, the Fannie<br />

Mae group that manages the enterprise’s investment<br />

activity saw a rise in its rate of voluntary attrition<br />

from January 2010 to September 2012, but the<br />

group grew over the same period, suggesting that the<br />

human capital risks posed by the increase in attrition<br />

rate were mitigated. The attrition rate for Freddie<br />

Mac’s investment management group also rose from<br />

14 Federal Housing Finance Agency Office of Inspector General