FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

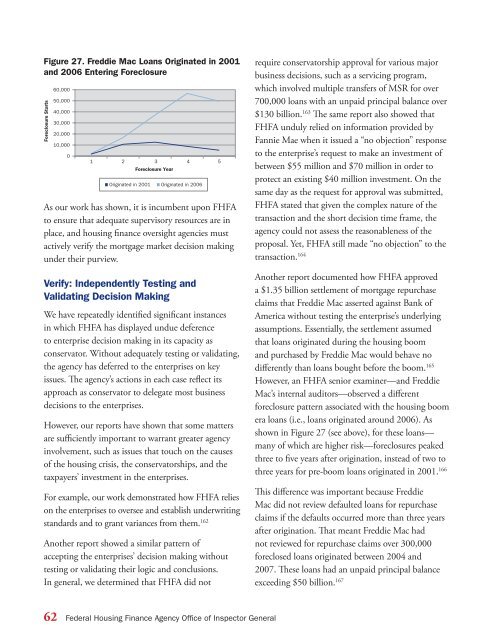

Figure 27. Freddie Mac Loans Originated in 2001<br />

and 2006 Entering Foreclosure<br />

Foreclosure Starts<br />

60,000<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

0<br />

1 2 3 4 5<br />

Foreclosure Year<br />

Originated in 2001 Originated in 2006<br />

As our work has shown, it is incumbent upon FHFA<br />

to ensure that adequate supervisory resources are in<br />

place, and housing finance oversight agencies must<br />

actively verify the mortgage market decision making<br />

under their purview.<br />

Verify: Independently Testing and<br />

Validating Decision Making<br />

Figure 27. Freddie Mac Loans Originated in 2001 and 2006 Entering Foreclosure<br />

We have repeatedly identified significant instances<br />

in which FHFA has displayed undue deference<br />

to enterprise decision making in its capacity as<br />

conservator. Without adequately testing or validating,<br />

the agency has deferred to the enterprises on key<br />

issues. The agency’s actions in each case reflect its<br />

approach as conservator to delegate most business<br />

decisions to the enterprises.<br />

However, our reports have shown that some matters<br />

are sufficiently important to warrant greater agency<br />

involvement, such as issues that touch on the causes<br />

of the housing crisis, the conservatorships, and the<br />

taxpayers’ investment in the enterprises.<br />

For example, our work demonstrated how FHFA relies<br />

on the enterprises to oversee and establish underwriting<br />

standards and to grant variances from them. 162<br />

Another report showed a similar pattern of<br />

accepting the enterprises’ decision making without<br />

testing or validating their logic and conclusions.<br />

In general, we determined that FHFA did not<br />

require conservatorship approval for various major<br />

business decisions, such as a servicing program,<br />

which involved multiple transfers of MSR for over<br />

Originated in 2006<br />

700,000 loans with an Originated unpaid in 2001 principal balance over<br />

$130 billion. 163 The same report also showed that<br />

FHFA unduly relied on information provided by<br />

Fannie Mae when it issued a “no objection” response<br />

to the enterprise’s request to make an investment of<br />

between $55 million and $70 million in order to<br />

protect an existing $40 million investment. On the<br />

same day as the request for approval was submitted,<br />

FHFA stated that given the complex nature of the<br />

transaction and the short decision time frame, the<br />

agency could not assess the reasonableness of the<br />

proposal. Yet, FHFA still made “no objection” to the<br />

transaction. 164<br />

Another report documented how FHFA approved<br />

a $1.35 billion settlement of mortgage repurchase<br />

claims that Freddie Mac asserted against Bank of<br />

America without testing the enterprise’s underlying<br />

assumptions. Essentially, the settlement assumed<br />

that loans originated during the housing boom<br />

and purchased by Freddie Mac would behave no<br />

differently than loans bought before the boom. 165<br />

However, an FHFA senior examiner—and Freddie<br />

Mac’s internal auditors—observed a different<br />

foreclosure pattern associated with the housing boom<br />

era loans (i.e., loans originated around 2006). As<br />

shown in Figure 27 (see above), for these loans—<br />

many of which are higher risk—foreclosures peaked<br />

three to five years after origination, instead of two to<br />

three years for pre-boom loans originated in 2001. 166<br />

This difference was important because Freddie<br />

Mac did not review defaulted loans for repurchase<br />

claims if the defaults occurred more than three years<br />

after origination. That meant Freddie Mac had<br />

not reviewed for repurchase claims over 300,000<br />

foreclosed loans originated between 2004 and<br />

2007. These loans had an unpaid principal balance<br />

exceeding $50 billion. 167<br />

62 Federal Housing Finance Agency Office of Inspector General