FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

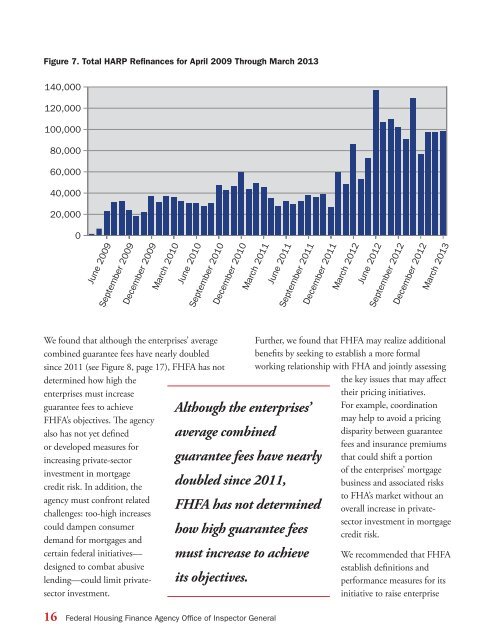

Figure 7. Total HARP Refinances for April 2009 Through March 2013<br />

140,000<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

June 2009<br />

September 2009<br />

December 2009<br />

March 2010<br />

June 2010<br />

September 2010<br />

December 2010<br />

March 2011<br />

June 2011<br />

September 2011<br />

December 2011<br />

March 2012<br />

June 2012<br />

September 2012<br />

December 2012<br />

March 2013<br />

We found that although the enterprises’ average<br />

combined guarantee fees have nearly doubled<br />

since 2011 (see Figure 8, page 17), FHFA has not<br />

determined how high the<br />

enterprises must increase<br />

guarantee fees to achieve<br />

FHFA’s objectives. The agency<br />

also has not yet defined<br />

or developed measures for<br />

increasing private-sector<br />

investment in mortgage<br />

credit risk. In addition, the<br />

agency must confront related<br />

challenges: too-high increases<br />

could dampen consumer<br />

demand for mortgages and<br />

certain federal initiatives—<br />

designed to combat abusive<br />

lending—could limit privatesector<br />

investment.<br />

Although the enterprises’<br />

average combined<br />

guarantee fees have nearly<br />

doubled since 2011,<br />

FHFA has not determined<br />

how high guarantee fees<br />

must increase to achieve<br />

its objectives.<br />

Further, we found that FHFA may realize additional<br />

benefits by seeking to establish a more formal<br />

working relationship with FHA and jointly assessing<br />

the key issues that may affect<br />

their pricing initiatives.<br />

For example, coordination<br />

may help to avoid a pricing<br />

disparity between guarantee<br />

fees and insurance premiums<br />

that could shift a portion<br />

of the enterprises’ mortgage<br />

business and associated risks<br />

to FHA’s market without an<br />

overall increase in privatesector<br />

investment in mortgage<br />

credit risk.<br />

Figure 7. Total HARP Refinances for April 2009 Through March 2013<br />

We recommended that FHFA<br />

establish definitions and<br />

performance measures for its<br />

initiative to raise enterprise<br />

16 Federal Housing Finance Agency Office of Inspector General