FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

included loosened underwriting standards, poor risk<br />

management, and servicers with little incentive to<br />

prevent foreclosures.<br />

Loosened Underwriting Standards<br />

Single-Family<br />

As discussed in one of our reports, Fannie Mae’s basic<br />

underwriting standards for mortgage loans secured<br />

by single-family homes have not changed much. On<br />

the other hand, the enterprise has granted variances<br />

that have had the effect of modifying its underwriting<br />

standards over time. Essentially, variances allow<br />

lenders to deviate from underwriting standards<br />

for mortgage loans they sell to the enterprises; for<br />

instance, the enterprises may allow no down payment<br />

instead of the minimum 5% they typically require. 130<br />

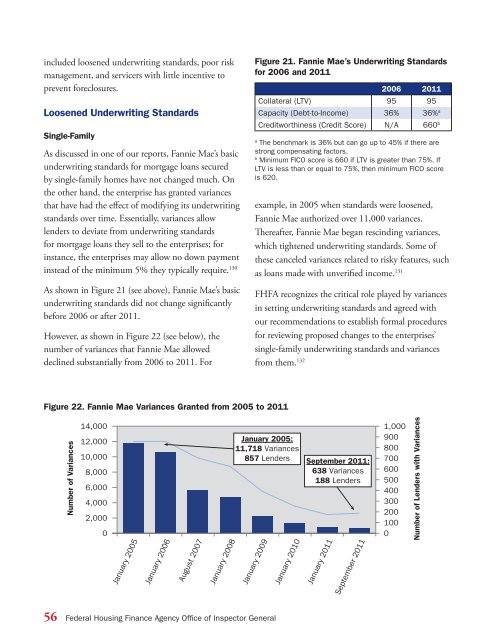

As shown in Figure 21 (see above), Fannie Mae’s basic<br />

underwriting standards did not change significantly<br />

before 2006 or after 2011.<br />

However, as shown in Figure 22 (see below), the<br />

number of variances that Fannie Mae allowed<br />

declined substantially from 2006 to 2011. For<br />

Figure 21. Fannie Mae’s Underwriting Standards<br />

for 2006 and 2011<br />

2006 2011<br />

Collateral (LTV) 95 95<br />

Capacity (Debt-to-Income) 36% 36% a<br />

Creditworthiness (Credit Score) N/A 660 b<br />

a<br />

The benchmark is 36% but can go up to 45% if there are<br />

strong compensating factors.<br />

b<br />

Minimum FICO score is 660 if LTV is greater than 75%. If<br />

LTV is less than or equal to 75%, then minimum FICO score<br />

is 620.<br />

example, in 2005 when standards were loosened,<br />

Fannie Mae authorized over 11,000 variances.<br />

Thereafter, Fannie Mae began rescinding variances,<br />

which tightened underwriting standards. Some of<br />

these canceled variances related to risky features, such<br />

as loans made with unverified income. 131<br />

FHFA recognizes the critical role played by variances<br />

in setting underwriting standards and agreed with<br />

our recommendations to establish formal procedures<br />

for reviewing proposed changes to the enterprises’<br />

single-family underwriting standards and variances<br />

from them. 132<br />

Figure 22. Fannie Mae Variances Granted from 2005 to 2011<br />

Number of Variances<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

January 2005<br />

January 2006<br />

August 2007<br />

January 2008<br />

January 2005:<br />

11,718 Variances<br />

857 Lenders September 2011:<br />

638 Variances<br />

188 Lenders<br />

January 2009<br />

January 2010<br />

January 2011<br />

September 2011<br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Number of Lenders with Variances<br />

56 Federal Housing Finance Agency Office of Inspector General