FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

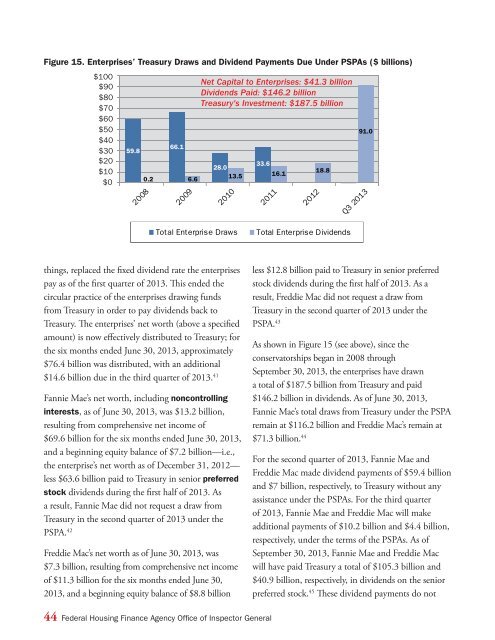

Figure 15. Enterprises’ Treasury Draws and Dividend Payments Due Under PSPAs ($ billions)<br />

$100<br />

$90<br />

$80<br />

$70<br />

$60<br />

$50<br />

$40<br />

$30<br />

$20<br />

$10<br />

$0<br />

59.8<br />

0.2<br />

2008<br />

66.1<br />

6.6<br />

2009<br />

Net Capital to Enterprises: $41.3 billion<br />

Dividends Paid: $146.2 billion<br />

Treasury's Investment: $187.5 billion<br />

33.6<br />

28.0<br />

13.5 16.1<br />

2010<br />

2011<br />

2012<br />

18.8<br />

91.0<br />

Q3 2013<br />

Total Enterprise Draws<br />

Total Enterprise Dividends<br />

things, replaced the fixed dividend rate the enterprises<br />

pay as of the first quarter of 2013. This ended the<br />

circular practice of the enterprises drawing funds<br />

from Treasury in order to pay dividends back to<br />

Treasury. The enterprises’ net worth (above a specified<br />

amount) is now effectively distributed to Treasury; for<br />

the six months ended June 30, 2013, approximately<br />

$76.4 billion was distributed, with an additional<br />

$14.6 billion due in the third quarter of 2013. 41<br />

Freddie Mac’s net worth as of June 30, 2013, was<br />

$7.3 billion, resulting from comprehensive net income<br />

of $11.3 billion for the six months ended June 30,<br />

2013, and a beginning equity balance of $8.8 billion<br />

less $12.8 billion paid to Treasury in senior preferred<br />

stock dividends during the first half of 2013. As a<br />

result, Freddie Mac did not request a draw from<br />

Treasury in the second quarter of 2013 under the<br />

PSPA. 43<br />

As shown in Figure 15 (see above), since the<br />

conservatorships began in 2008 through<br />

September 30, 2013, the enterprises have drawn<br />

a total of $187.5 billion from Treasury and paid<br />

Fannie Mae’s net worth, including noncontrolling $146.2 billion in dividends. As of June 30, 2013,<br />

interests,<br />

Figure<br />

as<br />

15.<br />

of June<br />

Enterprises'<br />

30, 2013, was<br />

Treasury<br />

$13.2 billion,<br />

Draws and Dividend<br />

Fannie Mae’s<br />

Payments<br />

total draws<br />

Due<br />

from<br />

Under<br />

Treasury<br />

PSPAs<br />

under the PSPA<br />

resulting from comprehensive net income of remain at $116.2 billion and Freddie Mac’s remain at<br />

$69.6 billion for the six months ended June 30, 2013, $71.3 billion. 44<br />

and a beginning equity balance of $7.2 billion—i.e.,<br />

the enterprise’s net worth as of December 31, 2012—<br />

less $63.6 billion paid to Treasury in senior preferred<br />

stock dividends during the first half of 2013. As<br />

a result, Fannie Mae did not request a draw from<br />

Treasury in the second quarter of 2013 under the<br />

PSPA. 42<br />

For the second quarter of 2013, Fannie Mae and<br />

Freddie Mac made dividend payments of $59.4 billion<br />

and $7 billion, respectively, to Treasury without any<br />

assistance under the PSPAs. For the third quarter<br />

of 2013, Fannie Mae and Freddie Mac will make<br />

additional payments of $10.2 billion and $4.4 billion,<br />

respectively, under the terms of the PSPAs. As of<br />

September 30, 2013, Fannie Mae and Freddie Mac<br />

will have paid Treasury a total of $105.3 billion and<br />

$40.9 billion, respectively, in dividends on the senior<br />

preferred stock. 45 These dividend payments do not<br />

44 Federal Housing Finance Agency Office of Inspector General