Cardinia Shire Council - Annual Report 2017-18

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

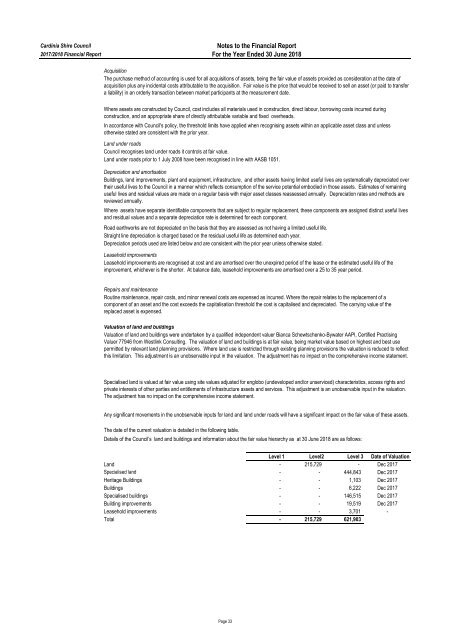

<strong>Cardinia</strong> <strong>Shire</strong> <strong>Council</strong><br />

<strong>2017</strong>/20<strong>18</strong> Financial <strong>Report</strong><br />

4.2 Non-financial assets<br />

(a) Inventories<br />

Notes to the Financial <strong>Report</strong><br />

For the Year Ended 30 June 20<strong>18</strong><br />

20<strong>18</strong> <strong>2017</strong><br />

$'000<br />

$'000<br />

Inventories held for distribution 26 5<br />

Total inventories 26 5<br />

Inventories held for distribution are measured at cost, adjusted when applicable for any loss of service potential. All other inventories,<br />

including land held for sale, are measured at the lower of cost and net realisable value. Where inventories are acquired for no cost or<br />

nominal consideration, they are measured at current replacement cost at the date of acquisition.<br />

(b) Other assets<br />

Prepayments 548 840<br />

Accrued income 425 430<br />

Deposits on asset purchases 800 1061<br />

Total other assets 1,773 2,331<br />

(c) Intangible assets<br />

Software 587 638<br />

Total intangible assets 587 638<br />

Software<br />

$'000<br />

Gross carrying amount<br />

Balance at 1 July <strong>2017</strong> 2,123<br />

Other Additions 129<br />

Disposals (14)<br />

Balance at 30 June 20<strong>18</strong> 2,238<br />

Accumulated amortisation<br />

and Balance impairment at 1 July <strong>2017</strong> (1,485)<br />

Amortisation expense (212)<br />

Disposals 14<br />

Balance at 30 June 20<strong>18</strong> (1,683)<br />

Work in progress at 30 June <strong>2017</strong><br />

Work in progress at 30 June 20<strong>18</strong><br />

-<br />

32<br />

Net book value at 30 June <strong>2017</strong> 638<br />

Net book value at 30 June 20<strong>18</strong> 587<br />

Intangible assets with finite lives are amortised as an expense on a systematic basis over the asset's useful life. Amortisation is generally<br />

calculated on a straight line basis, at a rate that allocates the asset value, less any estimated residual value over its estimated useful life.<br />

Estimates of the remaining useful lives and amortisation method are reviewed at least annually, and adjustments made where appropriate.<br />

Page 22