VGB POWERTECH 7 (2021) - International Journal for Generation and Storage of Electricity and Heat

VGB PowerTech - International Journal for Generation and Storage of Electricity and Heat. Issue 7 (2021). Technical Journal of the VGB PowerTech Association. Energy is us! Optimisation of power plants. Thermal waste utilisation.

VGB PowerTech - International Journal for Generation and Storage of Electricity and Heat. Issue 7 (2021).

Technical Journal of the VGB PowerTech Association. Energy is us!

Optimisation of power plants. Thermal waste utilisation.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>VGB</strong> PowerTech 7 l <strong>2021</strong> White Paper: German coal phase-out 360°<br />

north, coinciding with nuclear <strong>and</strong> coal<br />

phase-outs in the south. The reserve payments<br />

<strong>for</strong> the grid reserves are also determined<br />

in the phase-out tenders.<br />

A second option is to be selected as ‘capacity<br />

reserve’(EnWG 13e), which is based on<br />

tenders <strong>for</strong> 2-year periods. Capacity reserves<br />

follow behind the power <strong>and</strong> balancing<br />

markets to be activated, in case clearing<br />

actions cannot be found in these markets.<br />

Capacity reserve plants receive payment<br />

<strong>for</strong> the available capacity from the tender<br />

process <strong>and</strong> are compensated <strong>for</strong> operational<br />

costs upon activation. The next tenders<br />

<strong>for</strong> capacity reserve to serve between<br />

October 2022 to 2024 will be held on December<br />

<strong>2021</strong>.<br />

Issues<br />

Such a fundamental change in the power<br />

supply will have consequences in both<br />

wholesale <strong>and</strong> balancing markets <strong>and</strong> requires<br />

smart allocation <strong>of</strong> the resources.<br />

There are concerns regarding to security<br />

<strong>of</strong> supply, grid stability <strong>and</strong> electricity<br />

prices.<br />

1. € 4.35 billion compensation<br />

<strong>for</strong> RWE <strong>and</strong> LEAG<br />

The compensation amounts attracted<br />

many strong objections, stating that these<br />

companies are being favoured against the<br />

law <strong>and</strong> free market competition, specifically<br />

due to the government not disclosing<br />

the agreements, initially. Many argue that<br />

with the increasing carbon prices <strong>and</strong> further<br />

renewable penetration, coal plants<br />

would not be able to compete in the market<br />

sooner than the phase-out plan. In March<br />

<strong>2021</strong>, the European Commission started an<br />

in-depth investigation <strong>for</strong> the compensations<br />

to these companies, in the context <strong>of</strong><br />

state-aid <strong>and</strong> competition regulations <strong>of</strong><br />

European Single Market.<br />

On the other h<strong>and</strong>, Uniper has recently announced<br />

its intention <strong>for</strong> legal proceedings<br />

against the Netherl<strong>and</strong>s’ government <strong>for</strong><br />

the coal phase-out without compensation<br />

under Energy Charter Treaty (signed by 58<br />

parties around the globe including the<br />

EU). France, Spain <strong>and</strong> Belgium already<br />

made a call to leave the treaty due to its incompatibility<br />

with the European laws <strong>and</strong><br />

Paris Agreement, yet as <strong>of</strong> now the treaty is<br />

binding.<br />

2. The Datteln 4<br />

Datteln 4 is a 1.1GW hard coal power plant<br />

which was commissioned in June 2020,<br />

since the authorization <strong>for</strong> commissioning<br />

was given be<strong>for</strong>e the phase-out plans. There<br />

was an ef<strong>for</strong>t to stop it going online, but the<br />

government could not come to an agreement<br />

with the operator. Since it is more efficient<br />

<strong>and</strong> has lower emissions than older<br />

plants, the decision was to keep the facility<br />

<strong>and</strong> launch special tenders in 2023, 2024<br />

<strong>and</strong> 2025 <strong>for</strong> the additional phase-out capacity.<br />

The plant is owned by Uniper which<br />

Installed capacity targets EEG <strong>2021</strong>,<br />

WindSeeG in GW<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Onshore wind Offshore wind PV Other renewables Hydropower<br />

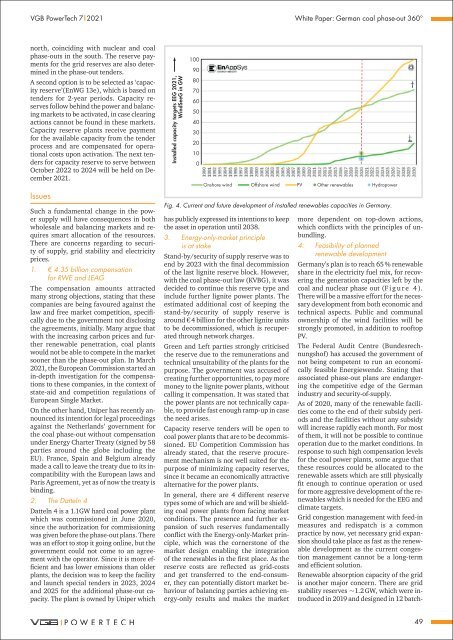

Fig. 4. Current <strong>and</strong> future development <strong>of</strong> installed renewables capacities in Germany.<br />

has publicly expressed its intentions to keep<br />

the asset in operation until 2038.<br />

3. Energy-only-market principle<br />

is at stake<br />

St<strong>and</strong>-by/security <strong>of</strong> supply reserve was to<br />

end by 2023 with the final decommission<br />

<strong>of</strong> the last lignite reserve block. However,<br />

with the coal phase-out law (KVBG), it was<br />

decided to continue this reserve type <strong>and</strong><br />

include further lignite power plants. The<br />

estimated additional cost <strong>of</strong> keeping the<br />

st<strong>and</strong>-by/security <strong>of</strong> supply reserve is<br />

around € 4 billion <strong>for</strong> the other lignite units<br />

to be decommissioned, which is recuperated<br />

through network charges.<br />

Green <strong>and</strong> Left parties strongly criticised<br />

the reserve due to the remunerations <strong>and</strong><br />

technical unsuitability <strong>of</strong> the plants <strong>for</strong> the<br />

purpose. The government was accused <strong>of</strong><br />

creating further opportunities, to pay more<br />

money to the lignite power plants, without<br />

calling it compensation. It was stated that<br />

the power plants are not technically capable,<br />

to provide fast enough ramp-up in case<br />

the need arises.<br />

Capacity reserve tenders will be open to<br />

coal power plants that are to be decommissioned.<br />

EU Competition Commission has<br />

already stated, that the reserve procurement<br />

mechanism is not well suited <strong>for</strong> the<br />

purpose <strong>of</strong> minimizing capacity reserves,<br />

since it became an economically attractive<br />

alternative <strong>for</strong> the power plants.<br />

In general, there are 4 different reserve<br />

types some <strong>of</strong> which are <strong>and</strong> will be shielding<br />

coal power plants from facing market<br />

conditions. The presence <strong>and</strong> further expansion<br />

<strong>of</strong> such reserves fundamentally<br />

conflict with the Energy-only-Market principle,<br />

which was the cornerstone <strong>of</strong> the<br />

market design enabling the integration<br />

<strong>of</strong> the renewables in the first place. As the<br />

reserve costs are reflected as grid-costs<br />

<strong>and</strong> get transferred to the end-consumer,<br />

they can potentially distort market behaviour<br />

<strong>of</strong> balancing parties achieving energy-only<br />

results <strong>and</strong> makes the market<br />

more dependent on top-down actions,<br />

which conflicts with the principles <strong>of</strong> unbundling.<br />

4. Feasibility <strong>of</strong> planned<br />

renewable development<br />

Germany’s plan is to reach 65 % renewable<br />

share in the electricity fuel mix, <strong>for</strong> recovering<br />

the generation capacities left by the<br />

coal <strong>and</strong> nuclear phase out (F i g u r e 4 ).<br />

There will be a massive ef<strong>for</strong>t <strong>for</strong> the necessary<br />

development from both economic <strong>and</strong><br />

technical aspects. Public <strong>and</strong> communal<br />

ownership <strong>of</strong> the wind facilities will be<br />

strongly promoted, in addition to ro<strong>of</strong>top<br />

PV.<br />

The Federal Audit Centre (Bundesrechnungsh<strong>of</strong>)<br />

has accused the government <strong>of</strong><br />

not being competent to run an economically<br />

feasible Energiewende. Stating that<br />

associated phase-out plans are endangering<br />

the competitive edge <strong>of</strong> the German<br />

industry <strong>and</strong> security-<strong>of</strong>-supply.<br />

As <strong>of</strong> 2020, many <strong>of</strong> the renewable facilities<br />

come to the end <strong>of</strong> their subsidy periods<br />

<strong>and</strong> the facilities without any subsidy<br />

will increase rapidly each month. For most<br />

<strong>of</strong> them, it will not be possible to continue<br />

operation due to the market conditions. In<br />

response to such high compensation levels<br />

<strong>for</strong> the coal power plants, some argue that<br />

these resources could be allocated to the<br />

renewable assets which are still physically<br />

fit enough to continue operation or used<br />

<strong>for</strong> more aggressive development <strong>of</strong> the renewables<br />

which is needed <strong>for</strong> the EEG <strong>and</strong><br />

climate targets.<br />

Grid congestion management with feed-in<br />

measures <strong>and</strong> redispatch is a common<br />

practice by now, yet necessary grid expansion<br />

should take place as fast as the renewable<br />

development as the current congestion<br />

management cannot be a long-term<br />

<strong>and</strong> efficient solution.<br />

Renewable absorption capacity <strong>of</strong> the grid<br />

is another major concern. There are grid<br />

stability reserves ~1.2 GW, which were introduced<br />

in 2019 <strong>and</strong> designed in 12 batch-<br />

49