VGB POWERTECH 7 (2021) - International Journal for Generation and Storage of Electricity and Heat

VGB PowerTech - International Journal for Generation and Storage of Electricity and Heat. Issue 7 (2021). Technical Journal of the VGB PowerTech Association. Energy is us! Optimisation of power plants. Thermal waste utilisation.

VGB PowerTech - International Journal for Generation and Storage of Electricity and Heat. Issue 7 (2021).

Technical Journal of the VGB PowerTech Association. Energy is us!

Optimisation of power plants. Thermal waste utilisation.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

White Paper: German coal phase-out 360° <strong>VGB</strong> PowerTech 7 l <strong>2021</strong><br />

es <strong>of</strong> 100 MW units. The current design is<br />

not capable <strong>of</strong> utilizing the potential <strong>of</strong><br />

small decentralized units which is not only<br />

creating exclusive competition, but also depriving<br />

the grid from a strong potential <strong>for</strong><br />

stabilizing.<br />

5. Security-<strong>of</strong>-supply<br />

German coal phase-out began with the initial<br />

shut-downs last December, but it was<br />

subsequently necessary <strong>for</strong> the Heyden<br />

power plant (875 MW) to be brought back<br />

to meet the dem<strong>and</strong> in cold weeks already<br />

6 times in the past months. This further increased<br />

concerns about the feasibility <strong>of</strong><br />

the phase-out plan. BNetzA has changed<br />

the status <strong>of</strong> Heyden, Datteln 4, Walsum 9<br />

<strong>and</strong> Westfallen to ‘system relevant’ to serve<br />

as grid reserve capacity.<br />

The coal phase-out is overlapping with the<br />

ongoing nuclear phase-out, which makes<br />

the security <strong>of</strong> supply issues even more<br />

prominent. The nuclear phase out has already<br />

been planned following Germany’s<br />

response to the Fukushima incident <strong>and</strong><br />

the decommission dates <strong>of</strong> the last operating<br />

6 power plants are set. Nuclear generation<br />

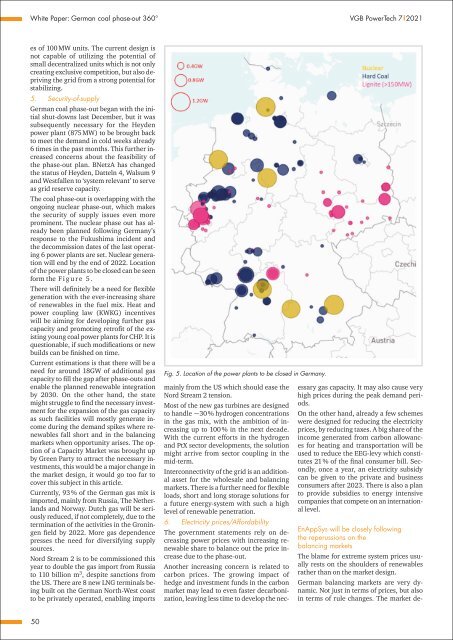

will end by the end <strong>of</strong> 2022. Location<br />

<strong>of</strong> the power plants to be closed can be seen<br />

<strong>for</strong>m the Figure 5.<br />

There will definitely be a need <strong>for</strong> flexible<br />

generation with the ever-increasing share<br />

<strong>of</strong> renewables in the fuel mix. <strong>Heat</strong> <strong>and</strong><br />

power coupling law (KWKG) incentives<br />

will be aiming <strong>for</strong> developing further gas<br />

capacity <strong>and</strong> promoting retr<strong>of</strong>it <strong>of</strong> the existing<br />

young coal power plants <strong>for</strong> CHP. It is<br />

questionable, if such modifications or new<br />

builds can be finished on time.<br />

Current estimations is that there will be a<br />

need <strong>for</strong> around 18GW <strong>of</strong> additional gas<br />

capacity to fill the gap after phase-outs <strong>and</strong><br />

enable the planned renewable integration<br />

by 2030. On the other h<strong>and</strong>, the state<br />

might struggle to find the necessary investment<br />

<strong>for</strong> the expansion <strong>of</strong> the gas capacity<br />

as such facilities will mostly generate income<br />

during the dem<strong>and</strong> spikes where renewables<br />

fall short <strong>and</strong> in the balancing<br />

markets when opportunity arises. The option<br />

<strong>of</strong> a Capacity Market was brought up<br />

by Green Party to attract the necessary investments,<br />

this would be a major change in<br />

the market design, it would go too far to<br />

cover this subject in this article.<br />

Currently, 93 % <strong>of</strong> the German gas mix is<br />

imported, mainly from Russia, The Netherl<strong>and</strong>s<br />

<strong>and</strong> Norway. Dutch gas will be seriously<br />

reduced, if not completely, due to the<br />

termination <strong>of</strong> the activities in the Groningen<br />

field by 2022. More gas dependence<br />

presses the need <strong>for</strong> diversifying supply<br />

sources.<br />

Nord Stream 2 is to be commissioned this<br />

year to double the gas import from Russia<br />

to 110 billion m 3 , despite sanctions from<br />

the US. There are 8 new LNG terminals being<br />

built on the German North-West coast<br />

to be privately operated, enabling imports<br />

Fig. 5. Location <strong>of</strong> the power plants to be closed in Germany.<br />

EnAppSys will be closely following<br />

the reperussions on the<br />

balancing markets<br />

The blame <strong>for</strong> extreme system prices usually<br />

rests on the shoulders <strong>of</strong> renewables<br />

rather than on the market design.<br />

German balancing markets are very dynamic.<br />

Not just in terms <strong>of</strong> prices, but also<br />

in terms <strong>of</strong> rule changes. The market demainly<br />

from the US which should ease the<br />

Nord Stream 2 tension.<br />

Most <strong>of</strong> the new gas turbines are designed<br />

to h<strong>and</strong>le ~30 % hydrogen concentrations<br />

in the gas mix, with the ambition <strong>of</strong> increasing<br />

up to 100 % in the next decade.<br />

With the current ef<strong>for</strong>ts in the hydrogen<br />

<strong>and</strong> PtX sector developments, the solution<br />

might arrive from sector coupling in the<br />

mid-term.<br />

Interconnectivity <strong>of</strong> the grid is an additional<br />

asset <strong>for</strong> the wholesale <strong>and</strong> balancing<br />

markets. There is a further need <strong>for</strong> flexible<br />

loads, short <strong>and</strong> long storage solutions <strong>for</strong><br />

a future energy-system with such a high<br />

level <strong>of</strong> renewable penetration.<br />

6. <strong>Electricity</strong> prices/Af<strong>for</strong>dability<br />

The government statements rely on decreasing<br />

power prices with increasing renewable<br />

share to balance out the price increase<br />

due to the phase-out.<br />

Another increasing concern is related to<br />

carbon prices. The growing impact <strong>of</strong><br />

hedge <strong>and</strong> investment funds in the carbon<br />

market may lead to even faster decarbonization,<br />

leaving less time to develop the nec-<br />

essary gas capacity. It may also cause very<br />

high prices during the peak dem<strong>and</strong> periods.<br />

On the other h<strong>and</strong>, already a few schemes<br />

were designed <strong>for</strong> reducing the electricity<br />

prices, by reducing taxes. A big share <strong>of</strong> the<br />

income generated from carbon allowances<br />

<strong>for</strong> heating <strong>and</strong> transportation will be<br />

used to reduce the EEG-levy which constitutes<br />

21 % <strong>of</strong> the final consumer bill. Secondly,<br />

once a year, an electricity subsidy<br />

can be given to the private <strong>and</strong> business<br />

consumers after 2023. There is also a plan<br />

to provide subsidies to energy intensive<br />

companies that compete on an international<br />

level.<br />

50