SECURITAS AB Annual Report 2011

SECURITAS AB Annual Report 2011

SECURITAS AB Annual Report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

100 <strong>Annual</strong> <strong>Report</strong><br />

Notes and comments to the consolidated financial statements<br />

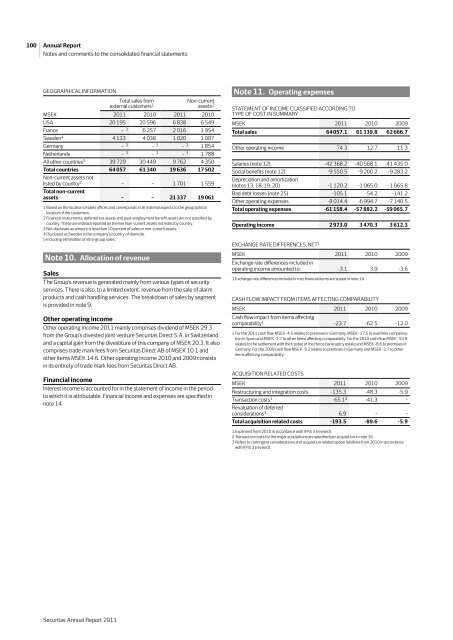

GEOGRAPHICAL INfORMATION<br />

Total sales from<br />

external customers 1<br />

Non-current<br />

assets 2<br />

MSEK <strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

uSA 20 195 20 596 6 838 6 549<br />

france – 3 6 257 2 016 1 954<br />

Sweden4 4 133 4 038 1 020 1 007<br />

Germany – 3 – 3 – 3 1 854<br />

Netherlands – 3 – 3 – 3 1 788<br />

All other countries5 39 729 30 449 9 762 4 350<br />

Total countries<br />

Non-current assets not<br />

64 057 61 340 19 636 17 502<br />

listed by country2 Total non-current<br />

– – 1 701 1 559<br />

assets – – 21 337 19 061<br />

1 Based on the location of sales offices and corresponds in all material aspects to the geographical<br />

location of the customers.<br />

2 Financial instruments, deferred tax assets and post-employment benefit assets are not specified by<br />

country. These are instead reported on the line Non-current assets not listed by country.<br />

3 Not disclosed as amount is less than 10 percent of sales or non-current assets.<br />

4 Disclosed as Sweden is the company’s country of domicile.<br />

5 Including elimination of intra-group sales.<br />

Note 10. Allocation of revenue<br />

Sales<br />

The Group’s revenue is generated mainly from various types of security<br />

services. There is also, to a limited extent, revenue from the sale of alarm<br />

products and cash handling services. The breakdown of sales by segment<br />

is provided in note 9.<br />

Other operating income<br />

Other operating income <strong>2011</strong> mainly comprises dividend of MSEK 29.3<br />

from the Group’s divested joint venture Securitas Direct S.A. in Switzerland<br />

and a capital gain from the divestiture of this company of MSEK 20.3. It also<br />

comprises trade mark fees from Securitas Direct <strong>AB</strong> of MSEK 10.1 and<br />

other items MSEK 14.6. Other operating income 2010 and 2009 consists<br />

in its entirety of trade mark fees from Securitas Direct <strong>AB</strong>.<br />

Financial income<br />

Interest income is accounted for in the statement of income in the period<br />

to which it is attributable. Financial income and expenses are specified in<br />

note 14.<br />

Securitas <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

Note 11. Operating expenses<br />

STATEMENT Of INCOME CLASSIfIED ACCORDING TO<br />

TyPE Of COST IN SuMMARy<br />

MSEK <strong>2011</strong> 2010 2009<br />

Total sales 64 057.1 61 339.8 62 666.7<br />

Other operating income 74.3 12.7 11.3<br />

Salaries (note 12) -42 368.2 -40 568.1 -41 435.0<br />

Social benefits (note 12)<br />

Depreciation and amortization<br />

-9 550.5 -9 200.2 -9 283.2<br />

(notes 13, 18, 19, 20) -1 120.2 -1 065.0 -1 065.8<br />

Bad debt losses (note 25) -105.1 -54.2 -141.2<br />

Other operating expenses -8 014.4 -6 994.7 -7 140.5<br />

Total operating expenses -61 158.4 -57 882.2 -59 065.7<br />

Operating income 2 973.0 3 470.3 3 612.3<br />

EXCHANGE RATE DIFFERENCES, NET 1<br />

MSEK<br />

Exchange rate differences included in<br />

<strong>2011</strong> 2010 2009<br />

operating income amounted to: -3.1 3.9 -3.6<br />

1 Exchange rate differences included in net financial items are stated in note 14.<br />

CASH FLOW IMPACT FROM ITEMS AFFECTING COMPAR<strong>AB</strong>ILITY<br />

MSEK<br />

Cash flow impact from items affecting<br />

<strong>2011</strong> 2010 2009<br />

comparability1 -23.7 -62.5 -12.0<br />

1 For the <strong>2011</strong> cash flow MSEK -4.5 relates to premises in Germany, MSEK -17.5 to overtime compensation<br />

in Spain and MSEK -1.7 to other items affecting comparability. For the 2010 cash flow MSEK -53.9<br />

relates to the settlement with the trustee of the Heros bankruptcy estate and MSEK -8.6 to premises in<br />

Germany. For the 2009 cash flow MSEK -9.3 relates to premises in Germany and MSEK -2.7 to other<br />

items affecting comparability.<br />

ACQUISITION RELATED COSTS<br />

MSEK <strong>2011</strong> 2010 2009<br />

Restructuring and integration costs -135.3 -48.3 -5.9<br />

Transaction costs1 -65.12 Revaluation of deferred<br />

-41.3 –<br />

considerations3 6.9 – –<br />

Total acquisition related costs -193.5 -89.6 -5.9<br />

1 Expensed from 2010 in accordance with IFRS 3 (revised).<br />

2 Transaction costs for the major acquisitions are specified per acquisition in note 16.<br />

3 Refers to contingent considerations and acquisition related option liabilities from 2010 in accordance<br />

with IFRS 3 (revised).