SECURITAS AB Annual Report 2011

SECURITAS AB Annual Report 2011

SECURITAS AB Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Clear and Effective Structure for Governance<br />

To meet high standards of corporate<br />

governance, Securitas has created<br />

a clear and effective structure for<br />

responsibility and governance.<br />

Securitas’ governance not only serves<br />

to protect stakeholder interests, but<br />

also ensures value creation.<br />

The overall structure begins with shareholders and<br />

their influence. Strong principal shareholders attract<br />

considerable attention interest and establish commitment<br />

to the success of the business.<br />

Significant shareholders<br />

The principal shareholders in Securitas on December<br />

31, <strong>2011</strong> were Gustaf Douglas, who through his<br />

family and the companies within the Investment<br />

<strong>AB</strong> Latour Group and Förvaltnings <strong>AB</strong> Wasatornet<br />

holds 11.5 percent (11.5) of the capital and 30.0<br />

percent (30.0) of the votes, and Melker Schörling<br />

who through his family and Melker Schörling <strong>AB</strong><br />

holds 5.6 percent (5.6) of the capital and 11.8 percent<br />

(11.8) of the votes. For more detailed information<br />

on shareholders, see the table on page 33.<br />

<strong>Annual</strong> General Meeting<br />

All shareholders are able to exercise their influence<br />

at the <strong>Annual</strong> General Meeting, which is the company’s<br />

highest decision-making body. The Articles<br />

of Association do not contain any limitation on the<br />

number of votes that each shareholder may exercise<br />

at a shareholders’ meeting. Each shareholder<br />

may thus vote for all shares held at the shareholders’<br />

meeting. The <strong>Annual</strong> General Meeting of Securitas<br />

<strong>AB</strong> (publ.) was held on May 4, <strong>2011</strong>, and the<br />

minutes are available on Securitas’ webpage, where<br />

all resolutions passed can be found. Shareholders<br />

representing 60.0 percent of the votes attended<br />

either personally or by proxy. For election and<br />

remuneration of Board members, see page 38.<br />

Compliance with the Swedish Corporate Governance Code (the Code)<br />

As a Swedish public company listed on NASDAQ OMX<br />

Stockholm, Securitas applies the Swedish Corporate<br />

Governance Code (the Code). Securitas complies with<br />

the Code principle of “comply or explain” and has two<br />

deviations to explain for <strong>2011</strong>:<br />

Code Rule 7.3 An audit committee is to comprise no<br />

fewer than three board members.<br />

Comments: The Board of Directors deems that two<br />

members is sufficient to correctly address Securitas’<br />

most important areas in regard to risk and audit issues,<br />

and that the incumbent members have long-standing<br />

and extensive experience in these areas from other<br />

major listed companies.<br />

Code Rule 9.8 For share-based incentive programs, the<br />

vesting period, or the period from the commencement<br />

of an agreement to the date on which the shares are<br />

acquired, is to be no less than three years.<br />

Governance and management<br />

Board of Directors’ report on corporate governance and internal control<br />

Comments: The implementation of the Securitas<br />

Share-based Incentive Scheme in 2010 was based on<br />

the existing bonus structure of the Securitas Group.<br />

In simple terms, the bonus potential was increased in<br />

exchange for a salary freeze and one third of the cash<br />

bonus outcome was to be received in shares in March<br />

of the year following the year when the cash bonus<br />

would have been paid out, provided that the person<br />

remained employed by Securitas at such time. The<br />

shares are acquired through a swap arrangement at the<br />

time the cash bonus is determined and the shares are<br />

released approximately one year later.<br />

Since the program replaces an immediate cash<br />

bonus payout and is not granted in addition to already<br />

existing bonus rights, the Board is of the opinion that<br />

the two-year period from the start of the program until<br />

the release of the shares is well motivated and reasonable<br />

in order to achieve the purpose of the program.<br />

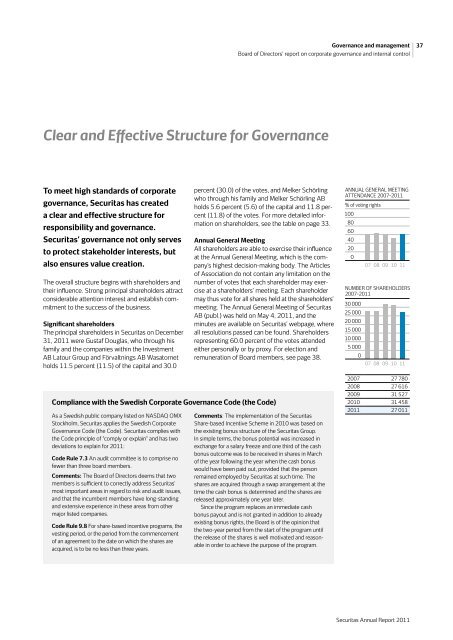

ANNUAL GENERAL MEETING<br />

ATTENDANCE ANNUAL GENERAL 2007–<strong>2011</strong> MEETING<br />

ATTENDANCE 2007–<strong>2011</strong><br />

% of voting rights<br />

% of voting rights<br />

100<br />

100<br />

80<br />

80<br />

60<br />

60<br />

40<br />

40<br />

20<br />

20<br />

0<br />

07 08 09 10 11<br />

07 08 09 10 11<br />

NUMBER OF SHAREHOLDERS<br />

2007–<strong>2011</strong><br />

NUMBER OF SHAREHOLDERS<br />

2007–<strong>2011</strong><br />

30 000<br />

30 000<br />

25 000<br />

25 000<br />

20 000<br />

20 000<br />

15 000<br />

15 000<br />

10 000<br />

10 000<br />

5 000<br />

5 000<br />

0<br />

07 08 09 10 11<br />

07 08 09 10 11<br />

2007 27 780<br />

2008 27 616<br />

2009 31 527<br />

2010 31 458<br />

<strong>2011</strong> 27 011<br />

Securitas <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

37