Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fair value of fi nancial debts<br />

For fl oating rate fi nancial debts, the fair value is equal to the face value (see also note 31). The fair value of the Group’s<br />

fi xed rate debt at the end of 2008 is as follows:<br />

• EMTN EUR 500 million 2014: EUR 501 million,<br />

• EMTN EUR 500 million 2018: EUR 474 million,<br />

• Hybrid EUR 500 million 2104: EUR 372 million.<br />

The fair value is based on the quoted market price at the end of 2008.<br />

Cash and cash equivalents<br />

Cash and cash equivalents amounted to EUR 883 million, up by EUR 308 million from end-2007, mainly because the Group<br />

secured EUR 455 million of funding using its Belgian Treasury Bill program, thereby reducing its liquidity risk at year-end.<br />

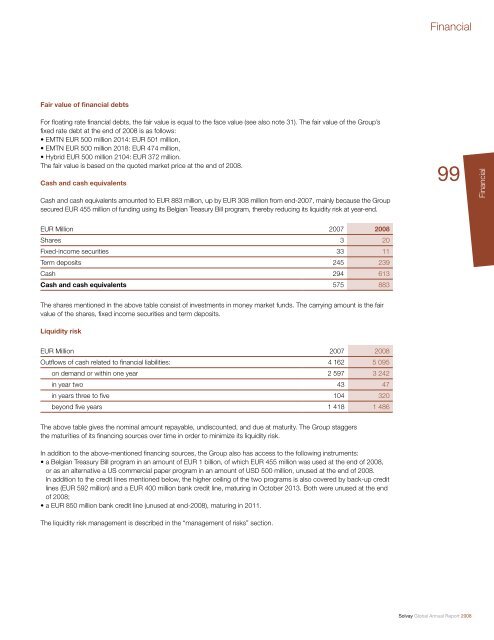

EUR Million 2007 2008<br />

Shares 3 20<br />

Fixed-income securities 33 11<br />

Term deposits 245 239<br />

Cash 294 613<br />

Cash and cash equivalents 575 883<br />

The shares mentioned in the above table consist of investments in money market funds. The carrying amount is the fair<br />

value of the shares, fi xed income securities and term deposits.<br />

Liquidity risk<br />

EUR Million 2007 2008<br />

Outfl ows of cash related to fi nancial liabilities: 4 162 5 095<br />

on demand or within one year 2 597 3 242<br />

in year two 43 47<br />

in years three to fi ve 104 320<br />

beyond fi ve years 1 418 1 486<br />

The above table gives the nominal amount repayable, undiscounted, and due at maturity. The Group staggers<br />

the maturities of its fi nancing sources over time in order to minimize its liquidity risk.<br />

In addition to the above-mentioned fi nancing sources, the Group also has access to the following instruments:<br />

• a Belgian Treasury Bill program in an amount of EUR 1 billion, of which EUR 455 million was used at the end of 2008,<br />

or as an alternative a US commercial paper program in an amount of USD 500 million, unused at the end of 2008.<br />

In addition to the credit lines mentioned below, the higher ceiling of the two programs is also covered by back-up credit<br />

lines (EUR 592 million) and a EUR 400 million bank credit line, maturing in October 2013. Both were unused at the end<br />

of 2008;<br />

• a EUR 850 million bank credit line (unused at end-2008), maturing in 2011.<br />

The liquidity risk management is described in the “management of risks” section.<br />

<strong>Financial</strong><br />

99<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

<strong>Financial</strong>

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)