Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Balance sheet<br />

Total Equity stood at EUR 4 745 million at the end of<br />

2008, up EUR 286 million compared with the end of 2007,<br />

following essentially the booking of the net income for the<br />

year (EUR 449 million) less the dividends paid during the<br />

year (EUR 257 million).<br />

The Group set as a major priority the maintenance of<br />

a solid fi nancial situation, in particular in the current<br />

economic context. Thus 2008 ended with a net debt<br />

to equity ratio of 34% (compared with 29% at the end<br />

of 2007). Net debt at the end of 2008 amounted to<br />

EUR 1 597 million compared with EUR 1 307 million at<br />

the end of 2007. Special efforts were made to manage<br />

working capital in the fourth quarter: its level at the end<br />

of 2008 was lower than at the end of 2007. Investments<br />

and acquisitions in 2008 were fi nanced out of operating<br />

cash fl ow.<br />

The Moody’s and Standard &Poor’s long- and shortterm<br />

ratings for <strong>Solvay</strong> are A/A2 and A1/P1 respectively.<br />

Capital expenditures<br />

and Research & Development<br />

Investments in 2008 represented EUR 1 320 million,<br />

of which about EUR 100 million were for acquisition of<br />

the Alexandria Sodium Carbonate Company soda ash<br />

plant in Egypt and about EUR 190 million for acquisition<br />

of the biotechnology company Innogenetics nv. These<br />

two amounts were not included in the announced budget<br />

of EUR 1 091 million. Initiatives were also taken for<br />

development of Specialty Polymers in India and China<br />

and, in Vinyls, for capacity expansion in Thailand and<br />

modernization of the production unit in Brazil. Other capital<br />

projects targeted improvement in our energy performance.<br />

The 2009 capital expenditures budget has been<br />

adapted to the current economic crisis. It amounts to<br />

EUR 638 million. It is based on two principles: restricting of<br />

investments to the level of depreciation, while maintaining<br />

those related to health, safety and the environment, and<br />

beyond that, concentrating of investments on a very limited<br />

number of strategic projects. These projects are oriented<br />

by priority toward geographic expansion of the Group and<br />

toward the options it has taken in terms of Sustainable<br />

Development.<br />

Research and Development (R&D) expenditures<br />

reached EUR 564 million in 2008 of which about 75%<br />

in the Pharmaceuticals Sector. R&D efforts by the latter<br />

represented EUR 428 million, or 16% of sales.<br />

The R&D expenditures budget for 2009 is EUR 590 million,<br />

of which EUR 435 million, or about 75% of the total, is for<br />

the Pharmaceuticals Sector.<br />

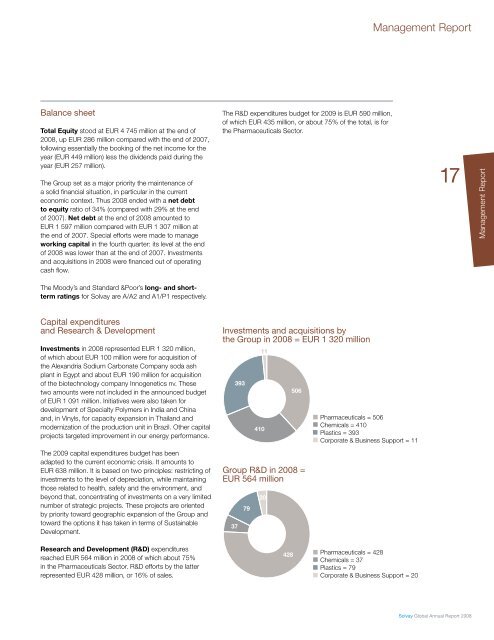

Investments and acquisitions by<br />

the Group in 2008 = EUR 1 320 million<br />

393<br />

11<br />

410<br />

506<br />

Group R&D in 2008 =<br />

EUR 564 million<br />

37<br />

79<br />

20<br />

428<br />

Pharmaceuticals = 506<br />

Chemicals = 410<br />

Plastics = 393<br />

Corporate & Business Support = 11<br />

Pharmaceuticals = 428<br />

Chemicals = 37<br />

Plastics = 79<br />

Corporate & Business Support = 20<br />

Management Report<br />

17<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

Management Report

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)