Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

For the Pharmaceuticals Sector, which represents 75 % of the Group’s R&D expense budgets, the 3.2 % increase is<br />

explained by higher expenses for the write-off of clinical supply for SLV308 phase III combined with higher bifeprunox<br />

expenses related to the termination of 4 clinical studies. On the other hand, expenses have been reduced by the reversal<br />

of the Bipolar provision of EUR 25 million that was included in the bifeprunox development with Wyeth.<br />

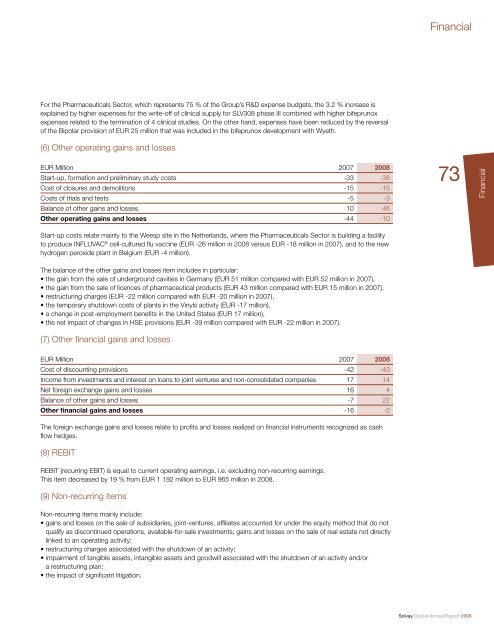

(6) Other operating gains and losses<br />

EUR Million 2007 2008<br />

Start-up, formation and preliminary study costs -33 -38<br />

Cost of closures and demolitions -15 -15<br />

Costs of trials and tests -5 -3<br />

Balance of other gains and losses 10 46<br />

Other operating gains and losses -44 -10<br />

Start-up costs relate mainly to the Weesp site in the Netherlands, where the Pharmaceuticals Sector is building a facility<br />

to produce INFLUVAC ® cell-cultured fl u vaccine (EUR -26 million in 2008 versus EUR -18 million in 2007), and to the new<br />

hydrogen peroxide plant in Belgium (EUR -4 million).<br />

The balance of the other gains and losses item includes in particular:<br />

• the gain from the sale of underground cavities in Germany (EUR 51 million compared with EUR 52 million in 2007),<br />

• the gain from the sale of licences of pharmaceutical products (EUR 43 million compared with EUR 15 million in 2007),<br />

• restructuring charges (EUR -22 million compared with EUR -20 million in 2007),<br />

• the temporary shutdown costs of plants in the Vinyls activity (EUR -17 million),<br />

• a change in post-employment benefi ts in the United States (EUR 17 million),<br />

• the net impact of changes in HSE provisions (EUR -39 million compared with EUR -22 million in 2007).<br />

(7) Other fi nancial gains and losses<br />

EUR Million 2007 2008<br />

Cost of discounting provisions -42 -43<br />

Income from investments and interest on loans to joint ventures and non-consolidated companies 17 14<br />

Net foreign exchange gains and losses 16 4<br />

Balance of other gains and losses -7 22<br />

Other fi nancial gains and losses -16 -2<br />

The foreign exchange gains and losses relate to profi ts and losses realized on fi nancial instruments recognized as cash<br />

fl ow hedges.<br />

(8) REBIT<br />

REBIT (recurring EBIT) is equal to current operating earnings, i.e. excluding non-recurring earnings.<br />

This item decreased by 19 % from EUR 1 192 million to EUR 965 million in 2008.<br />

(9) Non-recurring items<br />

Non-recurring items mainly include:<br />

• gains and losses on the sale of subsidiaries, joint-ventures, affi liates accounted for under the equity method that do not<br />

qualify as discontinued operations, available-for-sale investments; gains and losses on the sale of real estate not directly<br />

linked to an operating activity;<br />

• restructuring charges associated with the shutdown of an activity;<br />

• impairment of tangible assets, intangible assets and goodwill associated with the shutdown of an activity and/or<br />

a restructuring plan;<br />

• the impact of signifi cant litigation.<br />

<strong>Financial</strong><br />

73<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

<strong>Financial</strong>

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)