Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(20) Capital increase / redemption<br />

As in 2007, the <strong>Solvay</strong> group reimbursed in 2008 to minority shareholders a portion of the capital of our natural carbonate<br />

activities in the United States (EUR -12 million).<br />

(21) Acquisition / sale of treasury shares<br />

At the end of December 2007, <strong>Solvay</strong> S.A. held 2 638 000 treasury shares to cover the share options offered to<br />

Group executives. At the end of 2008, the company held 2 567 568 treasury shares, which have been deducted from<br />

consolidated shareholders’ equity.<br />

As it has in every year since 1999, the Board of Directors renewed the share option plan offered to executive staff (around<br />

300 persons) with a view to involving them more closely in the long-term development of the Group. The majority of<br />

the managers in question subscribed the options offered them in 2008 with an exercise price of EUR 58.81, representing<br />

the average stock market price of the share for the 30 days prior to the offer.<br />

The 3-year vesting period is followed by a 5-year exercise period, at the end of which any unexercised options expire.<br />

The settlement method is in equity.<br />

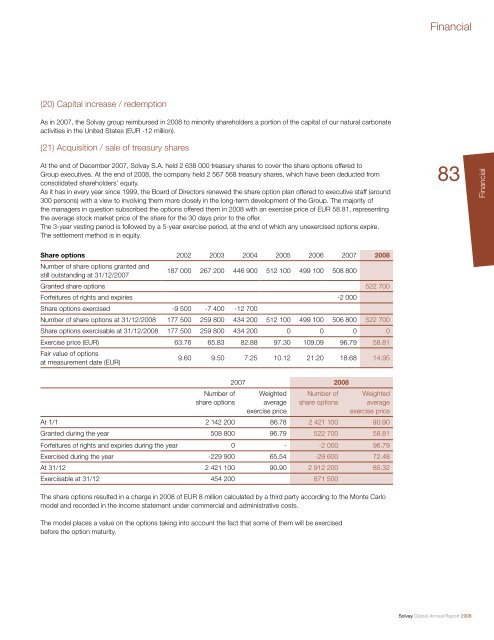

Share options 2002 2003 2004 2005 2006 2007 2008<br />

Number of share options granted and<br />

still outstanding at 31/12/2007<br />

187 000 267 200 446 900 512 100 499 100 508 800<br />

Granted share options 522 700<br />

Forfeitures of rights and expiries -2 000<br />

Share options exercised -9 500 -7 400 -12 700<br />

Number of share options at 31/12/2008 177 500 259 800 434 200 512 100 499 100 506 800 522 700<br />

Share options exercisable at 31/12/2008 177 500 259 800 434 200 0 0 0 0<br />

Exercise price (EUR) 63.76 65.83 82.88 97.30 109.09 96.79 58.81<br />

Fair value of options<br />

at measurement date (EUR)<br />

9.60 9.50 7.25 10.12 21.20 18.68 14.95<br />

Number of<br />

share options<br />

2007 2008<br />

Weighted<br />

average<br />

exercise price<br />

Number of<br />

share options<br />

Weighted<br />

average<br />

exercise price<br />

At 1/1 2 142 200 86.78 2 421 100 90.90<br />

Granted during the year 508 800 96.79 522 700 58.81<br />

Forfeitures of rights and expiries during the year 0 - -2 000 96.79<br />

Exercised during the year -229 900 65.54 -29 600 72.48<br />

At 31/12 2 421 100 90.90 2 912 200 85.32<br />

Exercisable at 31/12 454 200 871 500<br />

The share options resulted in a charge in 2008 of EUR 8 million calculated by a third party according to the Monte Carlo<br />

model and recorded in the income statement under commercial and administrative costs.<br />

The model places a value on the options taking into account the fact that some of them will be exercised<br />

before the option maturity.<br />

<strong>Financial</strong><br />

83<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

<strong>Financial</strong>

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)