Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

86<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

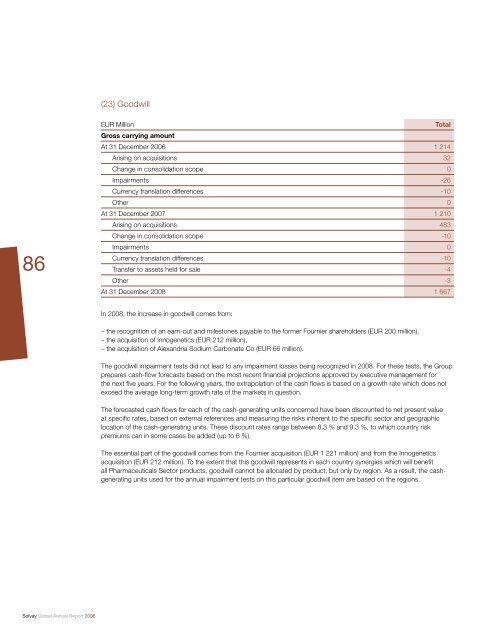

(23) Goodwill<br />

EUR Million Total<br />

Gross carrying amount<br />

At 31 December 2006 1 214<br />

Arising on acquisitions 32<br />

Change in consolidation scope 0<br />

Impairments -26<br />

Currency translation differences -10<br />

Other 0<br />

At 31 December 2007 1 210<br />

Arising on acquisitions 483<br />

Change in consolidation scope -10<br />

Impairments 0<br />

Currency translation differences -10<br />

Transfer to assets held for sale -4<br />

Other -3<br />

At 31 December 2008 1 667<br />

In 2008, the increase in goodwill comes from:<br />

– the recognition of an earn-out and milestones payable to the former Fournier shareholders (EUR 200 million),<br />

– the acquisition of Innogenetics (EUR 212 million),<br />

– the acquisition of Alexandria Sodium Carbonate Co (EUR 66 million).<br />

The goodwill impairment tests did not lead to any impairment losses being recognized in 2008. For these tests, the Group<br />

prepares cash-fl ow forecasts based on the most recent fi nancial projections approved by executive management for<br />

the next fi ve years. For the following years, the extrapolation of the cash fl ows is based on a growth rate which does not<br />

exceed the average long-term growth rate of the markets in question.<br />

The forecasted cash fl ows for each of the cash-generating units concerned have been discounted to net present value<br />

at specifi c rates, based on external references and measuring the risks inherent to the specifi c sector and geographic<br />

location of the cash-generating units. These discount rates range between 8.3 % and 9.3 %, to which country risk<br />

premiums can in some cases be added (up to 6 %).<br />

The essential part of the goodwill comes from the Fournier acquisition (EUR 1 221 million) and from the Innogenetics<br />

acquisition (EUR 212 million). To the extent that this goodwill represents in each country synergies which will benefi t<br />

all Pharmaceuticals Sector products, goodwill cannot be allocated by product, but only by region. As a result, the cashgenerating<br />

units used for the annual impairment tests on this particular goodwill item are based on the regions.

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)