Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

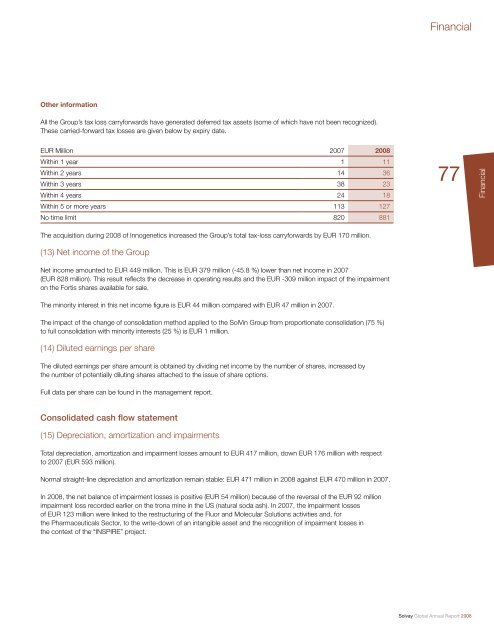

Other information<br />

All the Group’s tax loss carryforwards have generated deferred tax assets (some of which have not been recognized).<br />

These carried-forward tax losses are given below by expiry date.<br />

EUR Million 2007 2008<br />

Within 1 year 1 11<br />

Within 2 years 14 36<br />

Within 3 years 38 23<br />

Within 4 years 24 18<br />

Within 5 or more years 113 127<br />

No time limit 820 881<br />

The acquisition during 2008 of Innogenetics increased the Group’s total tax-loss carryforwards by EUR 170 million.<br />

(13) Net income of the Group<br />

Net income amounted to EUR 449 million. This is EUR 379 million (-45.8 %) lower than net income in 2007<br />

(EUR 828 million). This result refl ects the decrease in operating results and the EUR -309 million impact of the impairment<br />

on the Fortis shares available for sale.<br />

The minority interest in this net income fi gure is EUR 44 million compared with EUR 47 million in 2007.<br />

The impact of the change of consolidation method applied to the SolVin Group from proportionate consolidation (75 %)<br />

to full consolidation with minority interests (25 %) is EUR 1 million.<br />

(14) Diluted earnings per share<br />

The diluted earnings per share amount is obtained by dividing net income by the number of shares, increased by<br />

the number of potentially diluting shares attached to the issue of share options.<br />

Full data per share can be found in the management report.<br />

Consolidated cash fl ow statement<br />

(15) Depreciation, amortization and impairments<br />

Total depreciation, amortization and impairment losses amount to EUR 417 million, down EUR 176 million with respect<br />

to 2007 (EUR 593 million).<br />

Normal straight-line depreciation and amortization remain stable: EUR 471 million in 2008 against EUR 470 million in 2007.<br />

In 2008, the net balance of impairment losses is positive (EUR 54 million) because of the reversal of the EUR 92 million<br />

impairment loss recorded earlier on the trona mine in the US (natural soda ash). In 2007, the impairment losses<br />

of EUR 123 million were linked to the restructuring of the Fluor and Molecular Solutions activities and, for<br />

the Pharmaceuticals Sector, to the write-down of an intangible asset and the recognition of impairment losses in<br />

the context of the “INSPIRE” project.<br />

<strong>Financial</strong><br />

77<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

<strong>Financial</strong>

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)