Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

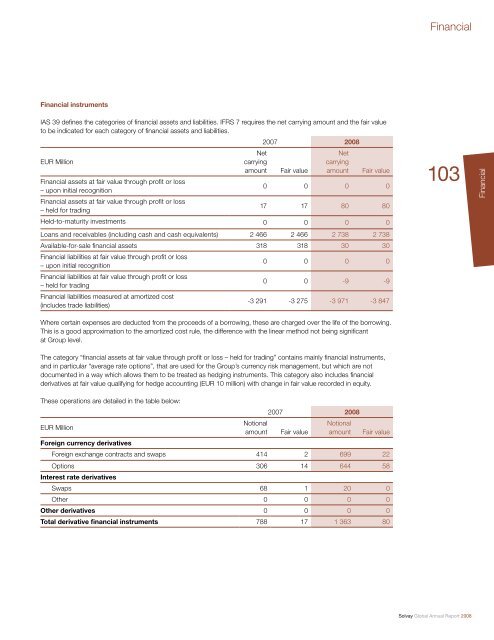

<strong>Financial</strong> instruments<br />

IAS 39 defi nes the categories of fi nancial assets and liabilities. IFRS 7 requires the net carrying amount and the fair value<br />

to be indicated for each category of fi nancial assets and liabilities.<br />

2007 2008<br />

EUR Million<br />

<strong>Financial</strong> assets at fair value through profi t or loss<br />

– upon initial recognition<br />

<strong>Financial</strong> assets at fair value through profi t or loss<br />

– held for trading<br />

Net<br />

carrying<br />

amount Fair value<br />

Net<br />

carrying<br />

amount Fair value<br />

0 0 0 0<br />

17 17 80 80<br />

Held-to-maturity investments 0 0 0 0<br />

Loans and receivables (including cash and cash equivalents) 2 466 2 466 2 738 2 738<br />

Available-for-sale fi nancial assets 318 318 30 30<br />

<strong>Financial</strong> liabilities at fair value through profi t or loss<br />

– upon initial recognition<br />

<strong>Financial</strong> liabilities at fair value through profi t or loss<br />

– held for trading<br />

<strong>Financial</strong> liabilities measured at amortized cost<br />

(includes trade liabilities)<br />

0 0 0 0<br />

0 0 -9 -9<br />

-3 291 -3 275 -3 971 -3 847<br />

Where certain expenses are deducted from the proceeds of a borrowing, these are charged over the life of the borrowing.<br />

This is a good approximation to the amortized cost rule, the difference with the linear method not being signifi cant<br />

at Group level.<br />

The category “fi nancial assets at fair value through profi t or loss – held for trading” contains mainly fi nancial instruments,<br />

and in particular “average rate options”, that are used for the Group’s currency risk management, but which are not<br />

documented in a way which allows them to be treated as hedging instruments. This category also includes fi nancial<br />

derivatives at fair value qualifying for hedge accounting (EUR 10 million) with change in fair value recorded in equity.<br />

These operations are detailed in the table below:<br />

EUR Million<br />

2007 2008<br />

Notional<br />

amount Fair value<br />

Notional<br />

amount Fair value<br />

Foreign currency derivatives<br />

Foreign exchange contracts and swaps 414 2 699 22<br />

Options<br />

Interest rate derivatives<br />

306 14 644 58<br />

Swaps 68 1 20 0<br />

Other 0 0 0 0<br />

Other derivatives 0 0 0 0<br />

Total derivative fi nancial instruments 788 17 1 363 80<br />

<strong>Financial</strong><br />

103<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

<strong>Financial</strong>

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)