Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

62<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

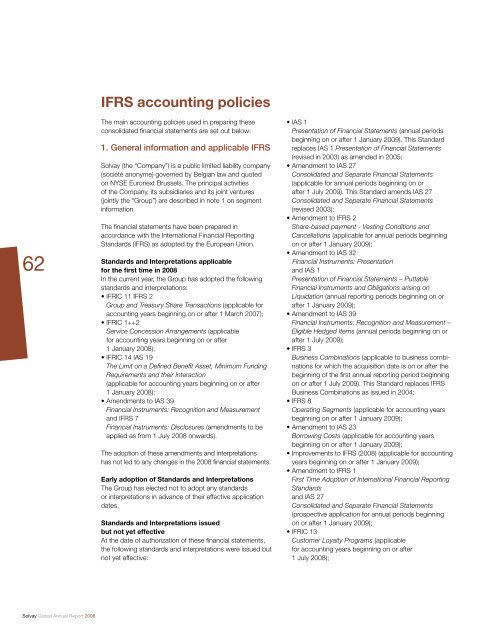

IFRS accounting policies<br />

The main accounting policies used in preparing these<br />

consolidated fi nancial statements are set out below:<br />

1. General information and applicable IFRS<br />

<strong>Solvay</strong> (the “Company”) is a public limited liability company<br />

(société anonyme) governed by Belgian law and quoted<br />

on NYSE Euronext Brussels. The principal activities<br />

of the Company, its subsidiaries and its joint ventures<br />

(jointly the “Group”) are described in note 1 on segment<br />

information.<br />

The fi nancial statements have been prepared in<br />

accordance with the International <strong>Financial</strong> Reporting<br />

Standards (IFRS) as adopted by the European Union.<br />

Standards and Interpretations applicable<br />

for the fi rst time in 2008<br />

In the current year, the Group has adopted the following<br />

standards and interpretations:<br />

• IFRIC 11 IFRS 2<br />

Group and Treasury Share Transactions (applicable for<br />

accounting years beginning on or after 1 March 2007);<br />

• IFRIC 1++2<br />

Service Concession Arrangements (applicable<br />

for accounting years beginning on or after<br />

1 January 2008);<br />

• IFRIC 14 IAS 19<br />

The Limit on a Defi ned Benefi t Asset, Minimum Funding<br />

Requirements and their Interaction<br />

(applicable for accounting years beginning on or after<br />

1 January 2008);<br />

• Amendments to IAS 39<br />

<strong>Financial</strong> Instruments: Recognition and Measurement<br />

and IFRS 7<br />

<strong>Financial</strong> Instruments: Disclosures (amendments to be<br />

applied as from 1 July 2008 onwards).<br />

The adoption of these amendments and interpretations<br />

has not led to any changes in the 2008 fi nancial statements.<br />

Early adoption of Standards and Interpretations<br />

The Group has elected not to adopt any standards<br />

or interpretations in advance of their effective application<br />

dates.<br />

Standards and Interpretations issued<br />

but not yet effective<br />

At the date of authorization of these fi nancial statements,<br />

the following standards and interpretations were issued but<br />

not yet effective:<br />

• IAS 1<br />

Presentation of <strong>Financial</strong> <strong>Statements</strong> (annual periods<br />

beginning on or after 1 January 2009). This Standard<br />

replaces IAS 1 Presentation of <strong>Financial</strong> <strong>Statements</strong><br />

(revised in 2003) as amended in 2005;<br />

• Amendment to IAS 27<br />

Consolidated and Separate <strong>Financial</strong> <strong>Statements</strong><br />

(applicable for annual periods beginning on or<br />

after 1 July 2009). This Standard amends IAS 27<br />

Consolidated and Separate <strong>Financial</strong> <strong>Statements</strong><br />

(revised 2003);<br />

• Amendment to IFRS 2<br />

Share-based payment - Vesting Conditions and<br />

Cancellations (applicable for annual periods beginning<br />

on or after 1 January 2009);<br />

• Amendment to IAS 32<br />

<strong>Financial</strong> Instruments: Presentation<br />

and IAS 1<br />

Presentation of <strong>Financial</strong> <strong>Statements</strong> – Puttable<br />

<strong>Financial</strong> Instruments and Obligations arising on<br />

Liquidation (annual reporting periods beginning on or<br />

after 1 January 2009);<br />

• Amendment to IAS 39<br />

<strong>Financial</strong> Instruments: Recognition and Measurement –<br />

Eligible Hedged Items (annual periods beginning on or<br />

after 1 July 2009);<br />

• IFRS 3<br />

Business Combinations (applicable to business combinations<br />

for which the acquisition date is on or after the<br />

beginning of the fi rst annual reporting period beginning<br />

on or after 1 July 2009). This Standard replaces IFRS<br />

Business Combinations as issued in 2004;<br />

• IFRS 8<br />

Operating Segments (applicable for accounting years<br />

beginning on or after 1 January 2009);<br />

• Amendment to IAS 23<br />

Borrowing Costs (applicable for accounting years<br />

beginning on or after 1 January 2009);<br />

• Improvements to IFRS (2008) (applicable for accounting<br />

years beginning on or after 1 January 2009);<br />

• Amendment to IFRS 1<br />

First Time Adoption of International <strong>Financial</strong> Reporting<br />

Standards<br />

and IAS 27<br />

Consolidated and Separate <strong>Financial</strong> <strong>Statements</strong><br />

(prospective application for annual periods beginning<br />

on or after 1 January 2009);<br />

• IFRIC 13<br />

Customer Loyalty Programs (applicable<br />

for accounting years beginning on or after<br />

1 July 2008);

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)