Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

90<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

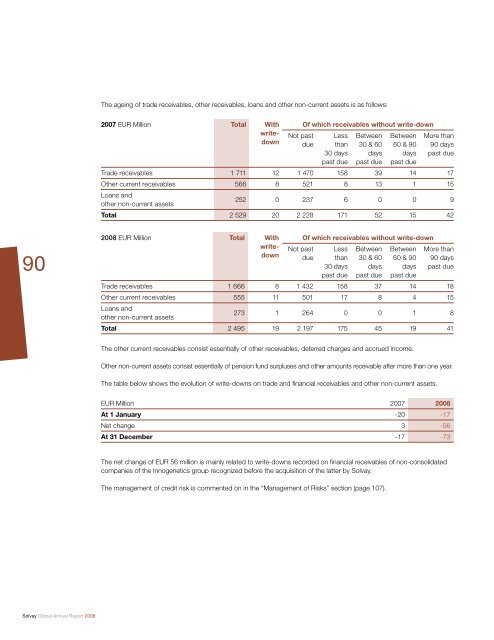

The ageing of trade receivables, other receivables, loans and other non-current assets is as follows:<br />

2007 EUR Million Total With<br />

writedown<br />

Not past<br />

due<br />

Of which receivables without write-down<br />

Less<br />

than<br />

30 days<br />

past due<br />

Between<br />

30 & 60<br />

days<br />

past due<br />

Between<br />

60 & 90<br />

days<br />

past due<br />

More than<br />

90 days<br />

past due<br />

Trade receivables 1 711 12 1 470 158 39 14 17<br />

Other current receivables 566 8 521 8 13 1 15<br />

Loans and<br />

other non-current assets<br />

252 0 237 6 0 0 9<br />

Total 2 529 20 2 228 171 52 15 42<br />

2008 EUR Million Total With<br />

writedown<br />

Not past<br />

due<br />

Of which receivables without write-down<br />

Less<br />

than<br />

30 days<br />

past due<br />

Between<br />

30 & 60<br />

days<br />

past due<br />

Between<br />

60 & 90<br />

days<br />

past due<br />

More than<br />

90 days<br />

past due<br />

Trade receivables 1 666 8 1 432 158 37 14 18<br />

Other current receivables 555 11 501 17 8 4 15<br />

Loans and<br />

other non-current assets<br />

273 1 264 0 0 1 8<br />

Total 2 495 19 2 197 175 45 19 41<br />

The other current receivables consist essentially of other receivables, deferred charges and accrued income.<br />

Other non-current assets consist essentially of pension fund surpluses and other amounts receivable after more than one year.<br />

The table below shows the evolution of write-downs on trade and fi nancial receivables and other non-current assets.<br />

EUR Million 2007 2008<br />

At 1 January -20 -17<br />

Net change 3 -56<br />

At 31 December -17 -73<br />

The net change of EUR 56 million is mainly related to write-downs recorded on fi nancial receivables of non-consolidated<br />

companies of the Innogenetics group recognized before the acquisition of the latter by <strong>Solvay</strong>.<br />

The management of credit risk is commented on in the “Management of Risks” section (page 107).

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)