Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

16<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

Energy situation<br />

During the fi rst part of 2008, energy prices soared, before<br />

falling suddenly during the second half in the wake of the<br />

global economic crisis.<br />

The <strong>Solvay</strong> group’s energy bill rose noticeably in 2008,<br />

though the Group’s proactive energy policy kept the rise<br />

well below that of market prices. The 2008 net energy bill<br />

represents 10% of sales, compared with 8% in 2007.<br />

The key features of the Group’s energy policy are<br />

improving the energy effi ciency of its industrial processes,<br />

diversifying energy sources, using cogeneration and<br />

renewable energies, and setting up partnerships and<br />

energy integration projects.<br />

In 2008 this policy took concrete form in the decision<br />

to build a cogeneration unit using secondary fuels<br />

on the Bernburg (Germany) site in partnership with<br />

Tönsmeier and a cogeneration unit supplied by biomass<br />

on the Tavaux (France) site, in partnership with Dalkia.<br />

In Argentina, <strong>Solvay</strong> Indupa has secured a supply of<br />

competitively priced energy by partnering with a local<br />

energy group to build an electricity generating plant on its<br />

Bahia Blanca site.<br />

Depending on the specifi c market conditions of each<br />

activity, price rises are also negotiated to compensate the<br />

rise in energy costs.<br />

In response to the rapidly-evolving energy situation,<br />

<strong>Solvay</strong> announced in 2008 the creation of a dedicated<br />

subsidiary with the primary objective of supplying and<br />

covering the main energy needs (electricity, gas, coal,<br />

coke, etc.) of its Sectors and SBUs.<br />

Comments on the key fi gures<br />

Income statement<br />

Non-recurring items amounted to EUR 20 million in<br />

2008 compared with EUR 31 million in 2007.<br />

These include:<br />

– the reversal of the impairment on the trona mine<br />

(natural soda ash) in the USA (EUR 92 million);<br />

– the capital gain (EUR 30 million) on the sale of <strong>Solvay</strong><br />

Engineered Polymers in the USA;<br />

– non-recurring restructuring charges in the<br />

Pharmaceuticals Sector (EUR 48 million for the<br />

“INSPIRE” project) and the Chemicals Sector<br />

(EUR 12 million asset depreciation as part of the<br />

restructuring of the Girindus activities in Germany).<br />

Charges on net indebtedness (EUR 93 million) were<br />

higher than in 2007, in line with the increase in net average<br />

indebtedness. At the end of December 2008, 95% of the<br />

fi nancial debt was covered at an average fi xed rate of<br />

5.4% for a duration of 7.4 years. The fi rst signifi cant debt<br />

maturity will not occur until 2014.<br />

Income from investments included the extraordinary<br />

write-down (EUR -309 million) of holdings in Fortis<br />

(non-cash charge), posted at closing at the end of 2008<br />

(EUR 0.929 per share). This holding was acquired by<br />

the Group between the two world wars. More recently, it<br />

generated capital gains close to EUR 200 million (in 1998<br />

and 2007) and a dividend of EUR 20 million in 2007.<br />

Income Taxes amounted to EUR -143 million.<br />

The effective tax rate is 24% compared with 29% in 2007.<br />

The 2008 tax rate benefi ted from the reversal of provisions<br />

following the favorable outcome of tax inspections and the<br />

write up of earlier tax losses, but was negatively affected<br />

by the non-deductible write down of holdings in Fortis.<br />

Net income of the Group (EUR 449 million) is down<br />

46% on 2007. Minority interests are EUR 44 million<br />

compared with EUR 47 million in 2007. Net earnings per<br />

share is EUR 4.92 in 2008 (as against EUR 9.46 in 2007).<br />

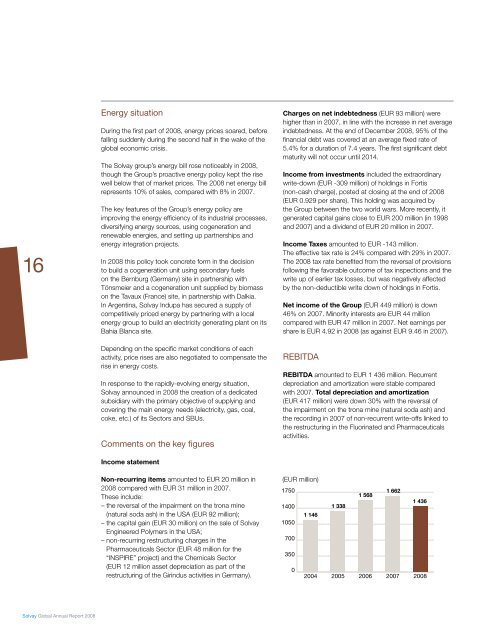

REBITDA<br />

REBITDA amounted to EUR 1 436 million. Recurrent<br />

depreciation and amortization were stable compared<br />

with 2007. Total depreciation and amortization<br />

(EUR 417 million) were down 30% with the reversal of<br />

the impairment on the trona mine (natural soda ash) and<br />

the recording in 2007 of non-recurrent write-offs linked to<br />

the restructuring in the Fluorinated and Pharmaceuticals<br />

activities.<br />

(EUR million)<br />

1750<br />

1400<br />

1050<br />

700<br />

350<br />

0<br />

1 146<br />

2004<br />

1 338<br />

2005<br />

1 568<br />

2006<br />

1 662<br />

2007<br />

1 436<br />

2008

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)