Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

60<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

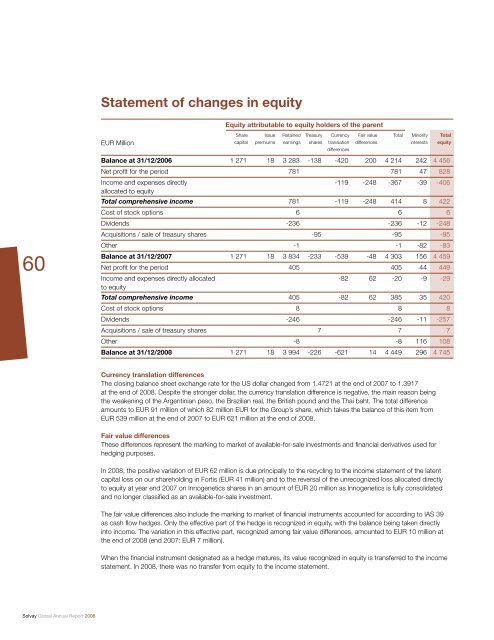

Statement of changes in equity<br />

EUR Million<br />

Equity attributable to equity holders of the parent<br />

Share<br />

capital<br />

Issue Retained Treasury Currency<br />

premiums earnings shares translation<br />

differences<br />

Fair value<br />

differences<br />

Total Minority<br />

interests<br />

Balance at 31/12/2006 1 271 18 3 283 -138 -420 200 4 214 242 4 456<br />

Net profi t for the period 781 781 47 828<br />

Income and expenses directly<br />

allocated to equity<br />

Total<br />

equity<br />

-119 -248 -367 -39 -406<br />

Total comprehensive income 781 -119 -248 414 8 422<br />

Cost of stock options 6 6 6<br />

Dividends -236 -236 -12 -248<br />

Acquisitions / sale of treasury shares -95 -95 -95<br />

Other -1 -1 -82 -83<br />

Balance at 31/12/2007 1 271 18 3 834 -233 -539 -48 4 303 156 4 459<br />

Net profi t for the period 405 405 44 449<br />

Income and expenses directly allocated<br />

to equity<br />

-82 62 -20 -9 -29<br />

Total comprehensive income 405 -82 62 385 35 420<br />

Cost of stock options 8 8 8<br />

Dividends -246 -246 -11 -257<br />

Acquisitions / sale of treasury shares 7 7 7<br />

Other -8 -8 116 108<br />

Balance at 31/12/2008 1 271 18 3 994 -226 -621 14 4 449 296 4 745<br />

Currency translation differences<br />

The closing balance sheet exchange rate for the US dollar changed from 1.4721 at the end of 2007 to 1.3917<br />

at the end of 2008. Despite the stronger dollar, the currency translation difference is negative, the main reason being<br />

the weakening of the Argentinian peso, the Brazilian real, the British pound and the Thai baht. The total difference<br />

amounts to EUR 91 million of which 82 million EUR for the Group’s share, which takes the balance of this item from<br />

EUR 539 million at the end of 2007 to EUR 621 million at the end of 2008.<br />

Fair value differences<br />

These differences represent the marking to market of available-for-sale investments and fi nancial derivatives used for<br />

hedging purposes.<br />

In 2008, the positive variation of EUR 62 million is due principally to the recycling to the income statement of the latent<br />

capital loss on our shareholding in Fortis (EUR 41 million) and to the reversal of the unrecognized loss allocated directly<br />

to equity at year end 2007 on Innogenetics shares in an amount of EUR 20 million as Innogenetics is fully consolidated<br />

and no longer classifi ed as an available-for-sale investment.<br />

The fair value differences also include the marking to market of fi nancial instruments accounted for according to IAS 39<br />

as cash fl ow hedges. Only the effective part of the hedge is recognized in equity, with the balance being taken directly<br />

into income. The variation in this effective part, recognized among fair value differences, amounted to EUR 10 million at<br />

the end of 2008 (end 2007: EUR 7 million).<br />

When the fi nancial instrument designated as a hedge matures, its value recognized in equity is transferred to the income<br />

statement. In 2008, there was no transfer from equity to the income statement.

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)