Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

76<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

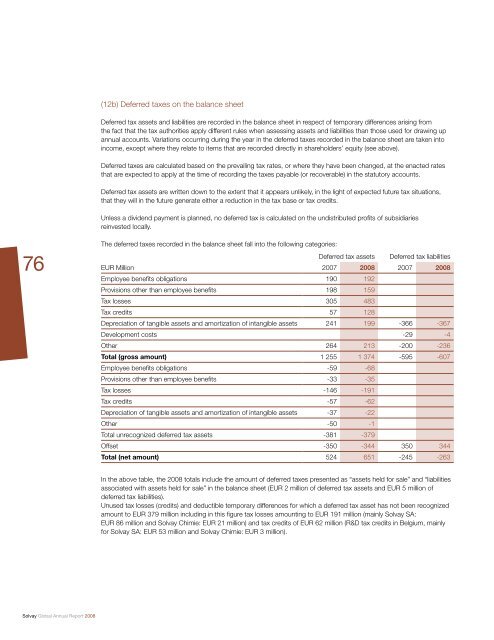

(12b) Deferred taxes on the balance sheet<br />

Deferred tax assets and liabilities are recorded in the balance sheet in respect of temporary differences arising from<br />

the fact that the tax authorities apply different rules when assessing assets and liabilities than those used for drawing up<br />

annual accounts. Variations occurring during the year in the deferred taxes recorded in the balance sheet are taken into<br />

income, except where they relate to items that are recorded directly in shareholders’ equity (see above).<br />

Deferred taxes are calculated based on the prevailing tax rates, or where they have been changed, at the enacted rates<br />

that are expected to apply at the time of recording the taxes payable (or recoverable) in the statutory accounts.<br />

Deferred tax assets are written down to the extent that it appears unlikely, in the light of expected future tax situations,<br />

that they will in the future generate either a reduction in the tax base or tax credits.<br />

Unless a dividend payment is planned, no deferred tax is calculated on the undistributed profi ts of subsidiaries<br />

reinvested locally.<br />

The deferred taxes recorded in the balance sheet fall into the following categories:<br />

Deferred tax assets Deferred tax liabilities<br />

EUR Million 2007 2008 2007 2008<br />

Employee benefi ts obligations 190 192<br />

Provisions other than employee benefi ts 198 159<br />

Tax losses 305 483<br />

Tax credits 57 128<br />

Depreciation of tangible assets and amortization of intangible assets 241 199 -366 -367<br />

Development costs -29 -4<br />

Other 264 213 -200 -236<br />

Total (gross amount) 1 255 1 374 -595 -607<br />

Employee benefi ts obligations -59 -68<br />

Provisions other than employee benefi ts -33 -35<br />

Tax losses -146 -191<br />

Tax credits -57 -62<br />

Depreciation of tangible assets and amortization of intangible assets -37 -22<br />

Other -50 -1<br />

Total unrecognized deferred tax assets -381 -379<br />

Offset -350 -344 350 344<br />

Total (net amount) 524 651 -245 -263<br />

In the above table, the 2008 totals include the amount of deferred taxes presented as “assets held for sale” and “liabilities<br />

associated with assets held for sale” in the balance sheet (EUR 2 million of deferred tax assets and EUR 5 million of<br />

deferred tax liabilities).<br />

Unused tax losses (credits) and deductible temporary differences for which a deferred tax asset has not been recognized<br />

amount to EUR 379 million including in this fi gure tax losses amounting to EUR 191 million (mainly <strong>Solvay</strong> SA:<br />

EUR 86 million and <strong>Solvay</strong> Chimie: EUR 21 million) and tax credits of EUR 62 million (R&D tax credits in Belgium, mainly<br />

for <strong>Solvay</strong> SA: EUR 53 million and <strong>Solvay</strong> Chimie: EUR 3 million).

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)