Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

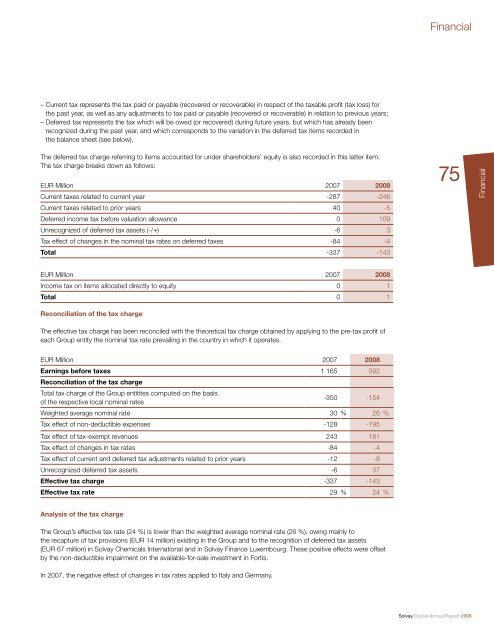

– Current tax represents the tax paid or payable (recovered or recoverable) in respect of the taxable profi t (tax loss) for<br />

the past year, as well as any adjustments to tax paid or payable (recovered or recoverable) in relation to previous years;<br />

– Deferred tax represents the tax which will be owed (or recovered) during future years, but which has already been<br />

recognized during the past year, and which corresponds to the variation in the deferred tax items recorded in<br />

the balance sheet (see below).<br />

The deferred tax charge referring to items accounted for under shareholders’ equity is also recorded in this latter item.<br />

The tax charge breaks down as follows:<br />

EUR Million 2007 2008<br />

Current taxes related to current year -287 -246<br />

Current taxes related to prior years 40 -5<br />

Deferred income tax before valuation allowance 0 109<br />

Unrecognized of deferred tax assets (-/+) -6 3<br />

Tax effect of changes in the nominal tax rates on deferred taxes -84 -4<br />

Total -337 -143<br />

EUR Million 2007 2008<br />

Income tax on items allocated directly to equity 0 1<br />

Total 0 1<br />

Reconciliation of the tax charge<br />

The effective tax charge has been reconciled with the theoretical tax charge obtained by applying to the pre-tax profi t of<br />

each Group entity the nominal tax rate prevailing in the country in which it operates.<br />

EUR Million 2007 2008<br />

Earnings before taxes 1 165 592<br />

Reconciliation of the tax charge<br />

Total tax charge of the Group entitites computed on the basis<br />

of the respective local nominal rates<br />

-350 -154<br />

Weighted average nominal rate 30 % 26 %<br />

Tax effect of non-deductible expenses -128 -195<br />

Tax effect of tax-exempt revenues 243 181<br />

Tax effect of changes in tax rates -84 -4<br />

Tax effect of current and deferred tax adjustments related to prior years -12 -8<br />

Unrecognized deferred tax assets -6 37<br />

Effective tax charge -337 -143<br />

Effective tax rate 29 % 24 %<br />

Analysis of the tax charge<br />

The Group’s effective tax rate (24 %) is lower than the weighted average nominal rate (26 %), owing mainly to<br />

the recapture of tax provisions (EUR 14 million) existing in the Group and to the recognition of deferred tax assets<br />

(EUR 67 million) in <strong>Solvay</strong> Chemicals International and in <strong>Solvay</strong> Finance Luxembourg. These positive effects were offset<br />

by the non-deductible impairment on the available-for-sale investment in Fortis.<br />

In 2007, the negative effect of changes in tax rates applied to Italy and Germany.<br />

<strong>Financial</strong><br />

75<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

<strong>Financial</strong>

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)