Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The acquisitions in 2008 consist mainly of:<br />

• the recognition of milestones and earn-outs payable to the former Fournier shareholders (EUR 200 million),<br />

• the acquisition of Innogenetics nv in Belgium (EUR 189 million),<br />

• the acquisition of Alexandria Sodium Carbonate Co, a sodium carbonate manufacturer located in Egypt (EUR 107 million),<br />

• the acquisition of Ajedium in the United States (EUR 8 million).<br />

“Other” (EUR 49 million) refers to companies of non-signifi cant size which are neither consolidated nor accounted for by<br />

the equity method and includes mainly the following acquisitions in 2008:<br />

• Rusvinyl in Russia (EUR 14 million),<br />

• Solalban Energia in Argentina (EUR 11 million),<br />

• <strong>Solvay</strong> Biochemicals Thailand (EUR 8 million),<br />

• The joint venture for H 2 O 2 in Thailand (EUR 8 million).<br />

The disposal of subsidiaries amounts to EUR 100 million and is mainly related to the sale of <strong>Solvay</strong> Engineered Polymers<br />

for EUR 90 million, generating a capital gain of EUR 30 million.<br />

The acquisition of tangible/intangible assets in 2008 relates to various projects, many of them extending over several years:<br />

• the conversion of mercury electrolysis units to membrane electrolysis and the extension of VCM/PVC manufacturing<br />

units at Santo André (Brazil);<br />

• the construction of a hydrogen peroxide unit in a joint venture with BASF and an oxychlorination unit at Zandvliet<br />

(Belgium);<br />

• the SIMCOR ® co-promotion agreement in Pharmaceuticals;<br />

• the capacity increase at the Devnya soda plant (Bulgaria);<br />

• the PVDF capacity increase at Tavaux (France);<br />

• the Fluorolink capacity increase at Spinetta (Italy).<br />

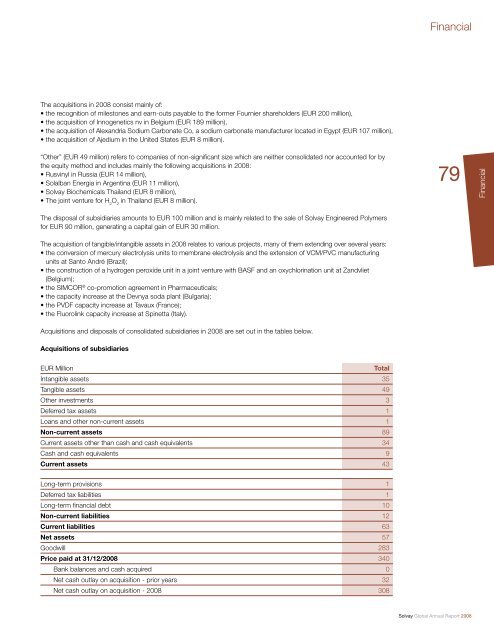

Acquisitions and disposals of consolidated subsidiaries in 2008 are set out in the tables below.<br />

Acquisitions of subsidiaries<br />

EUR Million Total<br />

Intangible assets 35<br />

Tangible assets 49<br />

Other investments 3<br />

Deferred tax assets 1<br />

Loans and other non-current assets 1<br />

Non-current assets 89<br />

Current assets other than cash and cash equivalents 34<br />

Cash and cash equivalents 9<br />

Current assets 43<br />

Long-term provisions 1<br />

Deferred tax liabilities 1<br />

Long-term fi nancial debt 10<br />

Non-current liabilities 12<br />

Current liabilities 63<br />

Net assets 57<br />

Goodwill 283<br />

Price paid at 31/12/2008 340<br />

Bank balances and cash acquired 0<br />

Net cash outlay on acquisition - prior years 32<br />

Net cash outlay on acquisition - 2008 308<br />

<strong>Financial</strong><br />

79<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

<strong>Financial</strong>

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)