Financial Statements - Solvay

Financial Statements - Solvay

Financial Statements - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

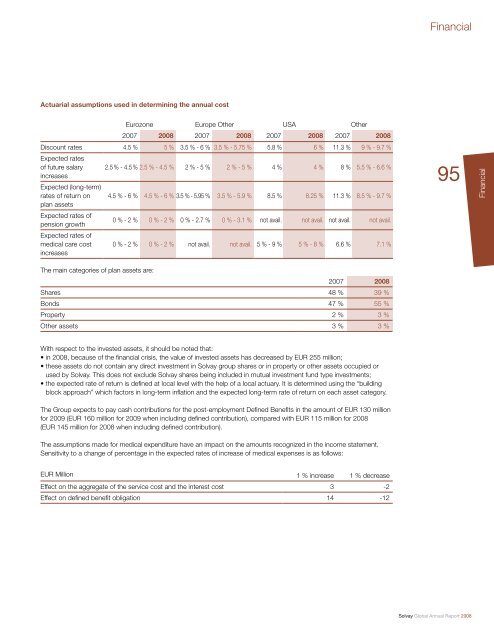

Actuarial assumptions used in determining the annual cost<br />

Eurozone Europe Other USA Other<br />

2007 2008 2007 2008 2007 2008 2007 2008<br />

Discount rates<br />

Expected rates<br />

4.5 % 5 % 3.5 % - 6 % 3.5 % - 5.75 % 5.8 % 6 % 11.3 % 9 % - 9.7 %<br />

of future salary<br />

increases<br />

Expected (long-term)<br />

2.5 % - 4.5 % 2.5 % - 4.5 % 2 % - 5 % 2 % - 5 % 4 % 4 % 8 % 5.5 % - 6.6 %<br />

rates of return on<br />

plan assets<br />

4.5 % - 6 % 4.5 % - 6 % 3.5 % - 5.95 % 3.5 % - 5.9 % 8.5 % 8.25 % 11.3 % 8.5 % - 9.7 %<br />

Expected rates of<br />

pension growth<br />

Expected rates of<br />

0 % - 2 % 0 % - 2 % 0 % - 2.7 % 0 % - 3.1 % not avail. not avail. not avail. not avail.<br />

medical care cost<br />

increases<br />

0 % - 2 % 0 % - 2 % not avail. not avail. 5 % - 9 % 5 % - 8 % 6.6 % 7.1 %<br />

The main categories of plan assets are:<br />

2007 2008<br />

Shares 48 % 39 %<br />

Bonds 47 % 55 %<br />

Property 2 % 3 %<br />

Other assets 3 % 3 %<br />

With respect to the invested assets, it should be noted that:<br />

• in 2008, because of the fi nancial crisis, the value of invested assets has decreased by EUR 255 million;<br />

• these assets do not contain any direct investment in <strong>Solvay</strong> group shares or in property or other assets occupied or<br />

used by <strong>Solvay</strong>. This does not exclude <strong>Solvay</strong> shares being included in mutual investment fund type investments;<br />

• the expected rate of return is defi ned at local level with the help of a local actuary. It is determined using the “building<br />

block approach” which factors in long-term infl ation and the expected long-term rate of return on each asset category.<br />

The Group expects to pay cash contributions for the post-employment Defi ned Benefi ts in the amount of EUR 130 million<br />

for 2009 (EUR 160 million for 2009 when including defi ned contribution), compared with EUR 115 million for 2008<br />

(EUR 145 million for 2008 when including defi ned contribution).<br />

The assumptions made for medical expenditure have an impact on the amounts recognized in the income statement.<br />

Sensitivity to a change of percentage in the expected rates of increase of medical expenses is as follows:<br />

EUR Million 1 % increase 1 % decrease<br />

Effect on the aggregate of the service cost and the interest cost 3 -2<br />

Effect on defi ned benefi t obligation 14 -12<br />

<strong>Financial</strong><br />

95<br />

<strong>Solvay</strong> Global Annual Report 2008<br />

<strong>Financial</strong>

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)