Fresh Point Magazine - B2B24 - Il Sole 24 Ore

Fresh Point Magazine - B2B24 - Il Sole 24 Ore

Fresh Point Magazine - B2B24 - Il Sole 24 Ore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

saving units produced by GNA, and Tecnoceam,<br />

which makes labour-saving corer and slicer lines.<br />

Recession spells market downswing<br />

The fresh-cut market as a whole has posted explosive<br />

growth rates over the last decade, and today Italy is<br />

the second largest market in Europe behind the UK.<br />

According to Ismea-Nielsen survey data, the industry<br />

posted its first, and only, minus signs, albeit to a very<br />

limited extent, only in 2008, when volumes were off<br />

1.4% and receipts slid 3.8%. The performance had<br />

competitors and rivals scrambling to find the right<br />

response, a situation that led some to revisit their<br />

marketing strategies and pricing policies and others<br />

to accelerate pursuit of suitable alliances with big<br />

retail. Yet by the following year the market had<br />

rebounded considerably, with receipts up 5.8% for a<br />

€700 million turnover and sales volumes at 146 thousand<br />

tons, up a solid 11% on the year.<br />

A number of reasons can be adduced for the trade’s hiccup,<br />

some arising from external factors like the global<br />

financial meltdown and others from internal sources like<br />

efficiency-induced restructuring in the supply chain.<br />

For example, it’s easy to see that the recession-buffeted<br />

economy led consumers to seek out lower-priced<br />

items of similar kind. Note in this connection that<br />

among the rate variations from 2005 to 2009 shown in<br />

Table 1 fresh-cut sales fell in 2008 whereas turnover of<br />

fresh and frozen vegetables rose. Even if some market<br />

surveys suggest that the price factor has little influence<br />

on consumer preferences, it is likely that a fair<br />

share of the consuming public decided to buy fresh<br />

bulk produce in times of a pinched economy.<br />

Yet despite this line of reasoning, the following year<br />

saw fresh-cut vegetable items posting a solid performance<br />

in terms of both volume and receipts. This<br />

was a sure signal showing that in actual fact the<br />

industry proved to be resilient enough to respond rapidly<br />

to ebb and flow of market forces.<br />

The lion’s share of the fresh-cut trade today goes to<br />

salads, with a market share of 86% in 2009, followed<br />

by heat’n’eat, raw and dressed bowls of vegetables<br />

with 9%, 4% and 2% shares, respectively.<br />

Most of the fresh-cut salad sales belong to crispy<br />

mixed items at 34%, even though single-portions of<br />

rocket, baby leaf and garden valerian together combine<br />

for a 35% share and have been the trade’s most<br />

dynamic sector for several years now (Fig. 2).<br />

Figure 3 shows that consumer demand in Italy is<br />

mostly located in the northwest quadrant, which<br />

accounts for 41% of receipts and 40% of volume.<br />

While the South still represents no more than 12% in<br />

turnover and 13% in volume, the last few years have<br />

seen regions in the South gain in both categories. In<br />

effect, Ismea-Nielsen survey data show that fresh-cut<br />

items accounted for 2.7% of all vegetable purchases<br />

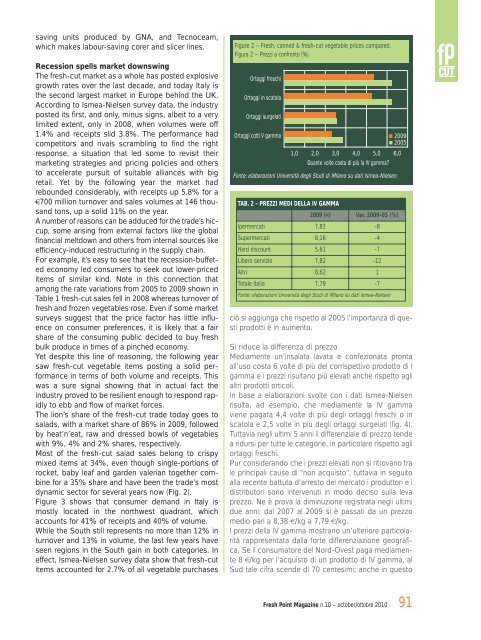

Figure 2 – <strong>Fresh</strong>, canned & fresh-cut vegetable prices compared.<br />

Figura 2 – Prezzi a confronto (%).<br />

Ortaggi freschi<br />

Ortaggi in scatola<br />

Ortaggi surgelati<br />

Ortaggi cotti V gamma<br />

1,0<br />

TAB. 2 - PREZZI MEDI DELLA IV GAMMA<br />

2,0 3,0 4,0 5,0 6,0<br />

Quante volte costa di più la IV gamma?<br />

Fonte: elaborazioni Università degli Studi di Milano su dati Ismea-Nielsen<br />

2009 (€) Var. 2009-05 (%)<br />

Ipermercati 7,83 -8<br />

Supermercati 8,16 -4<br />

Hard discount 5,61 -7<br />

Libero servizio 7,82 -12<br />

Altri 8,62 1<br />

Totale Italia 7,79 -7<br />

Fonte: elaborazioni Università degli Studi di Milano su dati Ismea-Nielsen<br />

ciò si aggiunga che rispetto al 2005 l’importanza di questi<br />

prodotti è in aumento.<br />

Si riduce la differenza di prezzo<br />

Mediamente un’insalata lavata e confezionata pronta<br />

all’uso costa 6 volte di più del corrispettivo prodotto di I<br />

gamma e i prezzi risultano più elevati anche rispetto agli<br />

altri prodotti orticoli.<br />

In base a elaborazioni svolte con i dati Ismea-Nielsen<br />

risulta, ad esempio, che mediamente la IV gamma<br />

viene pagata 4,4 volte di più degli ortaggi freschi o in<br />

scatola e 2,5 volte in più degli ortaggi surgelati (fig. 4).<br />

Tuttavia negli ultimi 5 anni il differenziale di prezzo tende<br />

a ridursi per tutte le categorie, in particolare rispetto agli<br />

ortaggi freschi.<br />

Pur considerando che i prezzi elevati non si ritrovano tra<br />

le principali cause di “non acquisto”, tuttavia in seguito<br />

alla recente battuta d’arresto del mercato i produttori e i<br />

distributori sono intervenuti in modo deciso sulla leva<br />

prezzo. Ne è prova la diminuzione registrata negli ultimi<br />

due anni: dal 2007 al 2009 si è passati da un prezzo<br />

medio pari a 8,38 €/kg a 7,79 €/kg.<br />

I prezzi della IV gamma mostrano un’ulteriore particolarità<br />

rappresentata dalla forte differenziazione geografica.<br />

Se il consumatore del Nord-Ovest paga mediamente<br />

8 €/kg per l’acquisto di un prodotto di IV gamma, al<br />

Sud tale cifra scende di 70 centesimi; anche in questo<br />

<strong>Fresh</strong> <strong>Point</strong> <strong>Magazine</strong> n.10 – october/ottobre 2010<br />

2009<br />

2005<br />

91