In Fonderia 6 2023

Sesto numero del 2023 di In Fonderia

Sesto numero del 2023 di In Fonderia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

0,6%<br />

0,6%<br />

3,9%<br />

1,9%<br />

6,0%<br />

-0,6%<br />

-1,8%<br />

IN PRIMO PIANO<br />

-0,6%<br />

-1,8%-12,3%<br />

Acciaio Alluminio Ghisa Superleghe Zinco e Altri nf<br />

Steel Aluminiun Cast iron Superalloys Zinc and other nf<br />

2021 2022 -12,3%<br />

Acciaio Alluminio Ghisa Superleghe Zinco e Altri nf<br />

Steel Aluminiun Cast iron Superalloys Zinc The and overall other nf profitability ratio, the ROE (Return<br />

On Equity), rose however from 0.9% in<br />

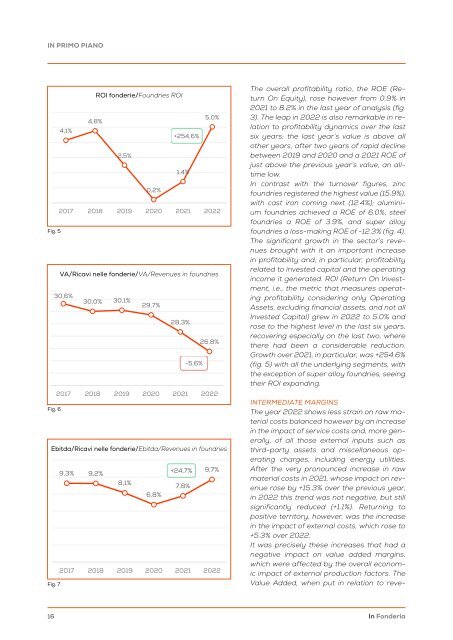

ROI fonderie ROI fonderie/Foundries ROI<br />

2021 2022<br />

2021 to 8.2% in the last year of analysis (fig.<br />

ROI fonderie<br />

5,0% 3). The leap in 2022 is also remarkable in relation<br />

to profitability dynamics over the last<br />

4,8%<br />

4,1%<br />

+254,6%<br />

six years: the last year’s value is above all<br />

4,8%<br />

5,0% other years, after two years of rapid decline<br />

4,1%<br />

2,5%<br />

between 2019 and 2020 and a 2021 ROE of<br />

+254,6%<br />

just above the previous year’s value, an alltime<br />

1,4%<br />

low.<br />

2,5%<br />

<strong>In</strong> contrast with the turnover figures, zinc<br />

0,2%<br />

foundries registered the highest value (15.9%),<br />

2017 2018 2019 2020<br />

0,2%<br />

1,4%<br />

2021 2022<br />

with cast iron coming next (12.4%); aluminium<br />

foundries achieved a ROE of 6.0%, steel<br />

foundries a ROE of 3.9%, and super alloy<br />

VA/Ricavi Fig. 5 nelle fonderie<br />

foundries a loss-making ROE of -12.3% (fig. 4).<br />

2017 2018 2019 2020 2021 2022 The significant growth in the sector’s revenues<br />

brought with it an important increase<br />

VA/Ricavi in profitability and, in particular, profitability<br />

30,6% nelle fonderie<br />

30,0% 30,1%<br />

related to invested capital and the operating<br />

VA/Ricavi nelle fonderie/VA/Revenues 29,7% in foundries<br />

income it generated. ROI (Return On <strong>In</strong>vestment,<br />

28,3%<br />

i.e., the metric that measures operat-<br />

30,6%<br />

ing profitability considering only Operating<br />

30,0% 30,1%<br />

29,7%<br />

26,8% Assets, excluding financial assets, and not all<br />

<strong>In</strong>vested Capital) grew in 2022 to 5.0% and<br />

28,3%<br />

rose to the highest level in the last six years,<br />

-5,6%<br />

recovering especially on the last two, where<br />

26,8%<br />

there had been a considerable reduction.<br />

2017 2018 2019 2020<br />

Growth over 2021, in particular, was +254.6%<br />

2021 2022<br />

-5,6%<br />

(fig. 5) with all the underlying segments, with<br />

the exception of super alloy foundries, seeing<br />

their ROI expanding.<br />

Fig. 6<br />

2017 2018 2019 2020 2021 2022<br />

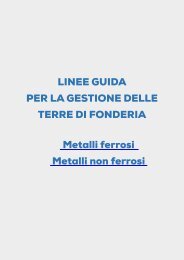

Ebitda/Ricavi nelle fonderie<br />

Ebitda/Ricavi nelle fonderie/Ebitda/Revenues in foundries<br />

Fig. 7<br />

9,3% 9,2%<br />

Debt/Equity Fonderie<br />

8,1%<br />

6,8%<br />

+24,7%<br />

7,8%<br />

9,7%<br />

2017 2018 2019 2020 2021 2022<br />

<br />

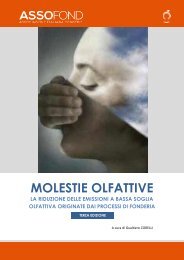

INTERMEDIATE MARGINS<br />

The year 2022 shows less strain on raw material<br />

costs balanced however by an increase<br />

in the impact of service costs and, more generally,<br />

of all those external inputs such as<br />

third-party assets and miscellaneous operating<br />

charges, including energy utilities.<br />

After the very pronounced increase in raw<br />

material costs in 2021, whose impact on revenue<br />

rose by +15.3% over the previous year,<br />

in 2022 this trend was not negative, but still<br />

significantly reduced (+1.1%). Returning to<br />

positive territory, however, was the increase<br />

in the impact of external costs, which rose to<br />

+5.3% over 2022.<br />

It was precisely these increases that had a<br />

negative impact on value added margins,<br />

which were affected by the overall economic<br />

impact of external production factors. The<br />

Value Added, when put in relation to reve-<br />

16<br />

1,44 1,44<br />

1,45<br />

1,44<br />

1,41<br />

<strong>In</strong> <strong>Fonderia</strong>