new business module

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

96<br />

BUSINESS SKILLS<br />

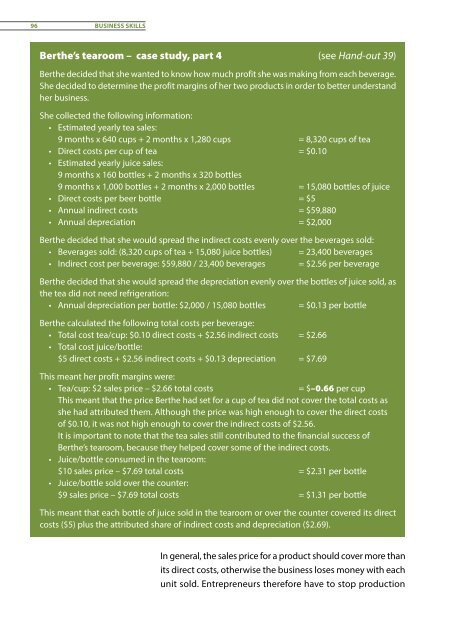

Berthe’s tearoom – case study, part 4 (see Hand-out 39)<br />

Berthe decided that she wanted to know how much profit she was making from each beverage.<br />

She decided to determine the profit margins of her two products in order to better understand<br />

her <strong>business</strong>.<br />

She collected the following information:<br />

• Estimated yearly tea sales:<br />

9 months x 640 cups + 2 months x 1,280 cups = 8,320 cups of tea<br />

• Direct costs per cup of tea = $0.10<br />

• Estimated yearly juice sales:<br />

9 months x 160 bottles + 2 months x 320 bottles<br />

9 months x 1,000 bottles + 2 months x 2,000 bottles = 15,080 bottles of juice<br />

• Direct costs per beer bottle = $5<br />

• Annual indirect costs = $59,880<br />

• Annual depreciation = $2,000<br />

Berthe decided that she would spread the indirect costs evenly over the beverages sold:<br />

• Beverages sold: (8,320 cups of tea + 15,080 juice bottles) = 23,400 beverages<br />

• Indirect cost per beverage: $59,880 / 23,400 beverages = $2.56 per beverage<br />

Berthe decided that she would spread the depreciation evenly over the bottles of juice sold, as<br />

the tea did not need refrigeration:<br />

• Annual depreciation per bottle: $2,000 / 15,080 bottles = $0.13 per bottle<br />

Berthe calculated the following total costs per beverage:<br />

• Total cost tea/cup: $0.10 direct costs + $2.56 indirect costs = $2.66<br />

• Total cost juice/bottle:<br />

$5 direct costs + $2.56 indirect costs + $0.13 depreciation = $7.69<br />

This meant her profit margins were:<br />

• Tea/cup: $2 sales price – $2.66 total costs<br />

= $–0.66 per cup<br />

This meant that the price Berthe had set for a cup of tea did not cover the total costs as<br />

she had attributed them. Although the price was high enough to cover the direct costs<br />

of $0.10, it was not high enough to cover the indirect costs of $2.56.<br />

It is important to note that the tea sales still contributed to the financial success of<br />

Berthe’s tearoom, because they helped cover some of the indirect costs.<br />

• Juice/bottle consumed in the tearoom:<br />

$10 sales price – $7.69 total costs = $2.31 per bottle<br />

• Juice/bottle sold over the counter:<br />

$9 sales price – $7.69 total costs = $1.31 per bottle<br />

This meant that each bottle of juice sold in the tearoom or over the counter covered its direct<br />

costs ($5) plus the attributed share of indirect costs and depreciation ($2.69).<br />

In general, the sales price for a product should cover more than<br />

its direct costs, otherwise the <strong>business</strong> loses money with each<br />

unit sold. Entrepreneurs therefore have to stop production