I Fiance Apicultural

I Fiance Apicultural

I Fiance Apicultural

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

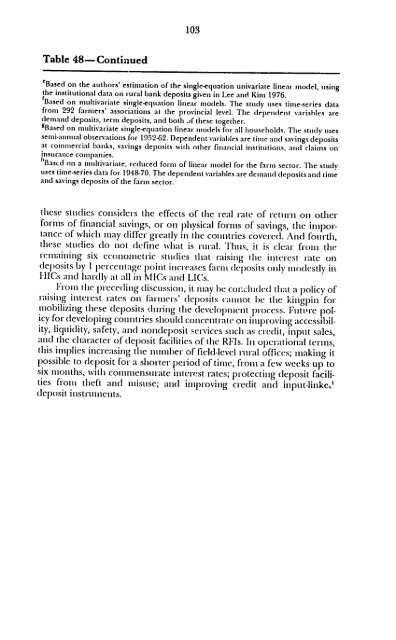

Table 48- Continued<br />

103<br />

eBased on the authors' estimation of the single-equation univariate linear model, using<br />

the institutional data on rural bank deposits given in Lee and Kim 1976.<br />

'Based on multivariate single-equation linear models. The study uses time-series data<br />

from 292 farmers' associations at the provincial level. The (epen(lent variables are<br />

demand deposits, term deposits, and both jf these together.<br />

gBased on tnultivariate single-equation linear models for all households. The study uses<br />

semi-annual observations for 1952-62. )ependent variables are time and savings deposits<br />

at commercial banks, savings deposits with other financial institutions, and claims on<br />

insurance companies.<br />

hBascd on a multivariate, reduced form of linear model for the farm sector. The study<br />

uses time-series data for 1948-70. The dependent variables are demand deposits and time<br />

and savings deposits of the farmn sector.<br />

these studies considers the effects of the real rate of rettrn ol other<br />

forms of financial savings, or on physical forms of savings, the inportance<br />

of whichi may differ greatly in the countries covered. And foturth,<br />

these studies do not define what is rural. lhtts, it is clear fiot the<br />

rtetaining six econometric studies that raising le interest rate on<br />

deposits by I perccntage point increases fatrn deposits only modestly in<br />

HICs and hardly at all in MICs and LICs.<br />

Irom the prece(ling discussion, it lay be Cotluded that a policy of<br />

raising interest rates otn fanters' deposits catnot be the kingpin for<br />

mobilizing these deposits dtring the development process. Futtt'e policy<br />

for developing couintries should concentrate on intprovitlg acccssibility,<br />

liquidity, safety, and nondeposit services such as credit, input sales,<br />

and the character of deposit facilities of the RFIs. In operational terms,<br />

this implies increasing the number of field-level rtt-al offices; making it<br />

possible to deposit for a shorter period of time, fi-om a few weeks up to<br />

six tnionths, with commenstirate intercst rates; protecting deposit facilities<br />

fiton theft and itistise; and improving credit and inpttt-linkc"<br />

deposit iinstrttments.