I Fiance Apicultural

I Fiance Apicultural

I Fiance Apicultural

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34<br />

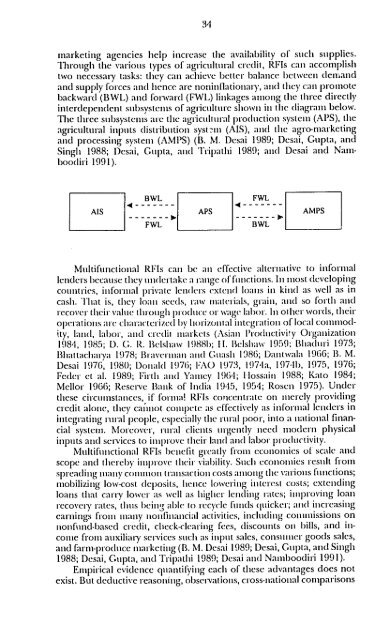

marketing agencies help increase the availability of such supplies.<br />

Through tile various types of agricultural credit, RFIs can accomplish<br />

two necessary tasks: they can achieve better balance between demand<br />

and supply forces and hence are noninflationary, and they can promote<br />

backward (BWL) and forward (FWL) linkages among the three directly<br />

interdependent subsystems of agdiculture shown in the diagram below.<br />

The three subsystems are the agricultural production system (APS), the<br />

agricultural inputs distribution systnn (AIS), and the agro-marketing<br />

and processing system (AMPS) (B. M. Desai 1989; Desai, Gupta, and<br />

Singh 1988; Dcsai, Gupta, and Tripathi 1989; and Desai and Namboodiri<br />

1991).<br />

BWL FWL<br />

AIS APS AMPS<br />

FWL BWL<br />

Multifunctional RFIs can be an effective alternative to informal<br />

lenders because they undertake a range of functions. Inmost developing<br />

countries, informal private lenders extend loans in kind as well as in<br />

cash. That is, they loan seeds, raw materials, grain, and so forth and<br />

recover their value through produce or wage labor. In other words, their<br />

operations are characterized by horizonutal integration of local conmmodity,<br />

land, labor, and credit markets (Asian lroductivity Organization<br />

1984t, 1985; D. G. R. Belshaw 1988b; i. Belshaw 1959; Blhaduri 1973;<br />

IBhattachaliya 1978; Braverman and Guash 1986; Dantwala 1966; B. M.<br />

Desai 1976, 1980; Donald 1976; FAO 1973, 1974la, 197,11, 1975, 1976;<br />

Feder et al. 1989; Firth- and Yamey 196,t; Hossain 1988; Kato 1984;<br />

Mellor 1966; Reserve Bank of India 19,15, 1954; Rosen 1975). Under<br />

these circumstances, if forma! RFIs concentrate on merely providing<br />

credit alone, they cannot compete as effectively as informal lenders in<br />

integrating rural people, especially the rural poor, into a national financial<br />

system. Moreover, rural clients urgently need modern physical<br />

inputs and services to improve their land and labor productivity.<br />

Multifunctional RFIs benefit greatly from economies of scale and<br />

scope and thereby improve their viability. Such economics result fr'om<br />

spreading mnany commnion transaction costs among the various Functions;<br />

mobilizing low-cost deposits, hence lowering inte rest costs; extending<br />

loans that carry lower as well as higher lending rates; improving loan<br />

recovci- ,rates, thus being able to recycle finds quicker; and increasing<br />

earnings froim many nonfinancial activities, including commissions on<br />

nonfund-based credit, check-clearing fees, discounts on bills, and income<br />

from auxiliary services such as input sales, consumer goods sales,<br />

and farm-produce marketing (B. M.Desai 1989; Dcsai, Gupta, and Singh<br />

1988; Desai, Gupta, and Tripathi 1989; Desai and Namboodiri 1991).<br />

Empirical evidence quantifying each of these advantages does not<br />

exist. But deductive reasoning, observations, cross-national comparisons