I Fiance Apicultural

I Fiance Apicultural

I Fiance Apicultural

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58<br />

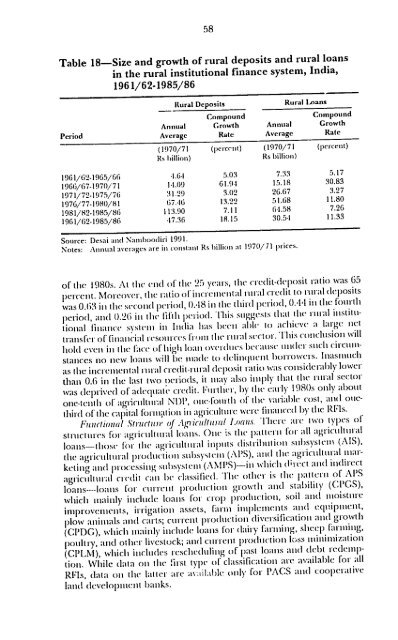

Table 18-Size and growth of rural deposits and ruralloans<br />

in the rural institutional finance system, India,<br />

1961/62-1985/86<br />

Rural Deposits<br />

Rural Loans<br />

Period<br />

Annual<br />

Average<br />

Compound<br />

Growth<br />

Rate<br />

Annual<br />

Average<br />

Compound<br />

Growth<br />

Rate<br />

1961/62-1965/66<br />

1966/67-1970/71<br />

1971/72-1975/76<br />

1976/77-1980/81<br />

1981/82-1985/86<br />

1961/62.1985/86<br />

(1970/71 (percent) (1970/71<br />

Rs billion)<br />

Rs billion)<br />

(percent)<br />

.1.6,1<br />

5.03<br />

7.33<br />

5.17<br />

1-1.09 61.9-1 15.18 30.83<br />

31.29<br />

3.02 26.67 3.27<br />

67.16<br />

13.22 51.68 11.80<br />

113.90<br />

7.11<br />

1.58<br />

7.26<br />

.17.36<br />

18.15<br />

30.5-1<br />

11.33<br />

Source: Desai and Namboodliri 1991.<br />

1970/ 71 prices.<br />

Notes: Annual averages are in constant Rs billion at<br />

1980s. At the etid of ite 25 )ears, the credit-de)osit ratio was 65<br />

of the<br />

pelcelit. Moreover, the ratio of iicnretiielital rrtal creclit to rural deposits<br />

was 0.63 ill tle secotdI period, 0.48 in the third period, 0.44t in the fourth<br />

period, anld 0.26 itihlif It period. This stiggests that ille rural instituable<br />

to adieve :ahrge ilet<br />

tional fitatnce ssttit ill hn(lia ])as bee<br />

transfer of ftialicial rtsoll('c.s fotill tile rItral seclor. This concliusiolt will<br />

in leice of high loan ovet, ltlletS because tilidCer slch c-ircltlit<br />

hold even<br />

tno new loas will be Illiad to delii(ltient I)OITOVcIS. Ililasttltc<br />

stanices<br />

as the incremental rural credit-rural decposit tatio was cottsidlrably lower<br />

than 0.6 in the last two neriods, it 1itay also intpiily that tle tttral se.c:tor<br />

was deprived of adequate credlit. Futlicr, by the carly I980s only about<br />

of tie variable cost, atnd oneone-tenth<br />

of agiicttltual NDP, oite-fottil<br />

third of the capital fbrtttalt ion it agricitltutc wcre fitatwcel by the RFIs.<br />

re of' \lictltilal loans. h'llerc ate two types of<br />

Functional Struict<br />

for all agriculltltal<br />

structtres for agrictllltral loanls. Otie is the patterti<br />

loans-tlose fo tile agricultural iplt)tits (listritiltion tls)sysltlw (AIS),<br />

(A\PS), and the agrictltural marthe<br />

agrictiltural I)rodlctiolt stbsystcni<br />

1te;rct aitd itldircet<br />

ketiig anol J)rocessittg stibsystctli (AMI'S)-iti which<br />

patient of APS<br />

agricultittral crldit call be classificd. 'he other is tlile<br />

loans----loains for curreiclt )rodltction growth and stability (CPGS),<br />

include loats for cro) piroduction, soil and tiioisttirc<br />

which ntainly<br />

ituproetw ellts, irrigatiot assets, farm itlj)leCents atId cliptitent,<br />

plow anitials and carts; curretit j)rodutction diversificatioti antI growth<br />

(CI'DG), which ,naitily inctide loans for dairy farnIing, sheep farning,<br />

tlinitititizatioln<br />

potiltry, and oilier livestock; and cutiet 1)l0(1 cllioti I,,Ss<br />

itil debt recletmp<br />

(CPLM), which includes reschedtittg of past loans<br />

first tyl)e of classification are available for all<br />

tiolt. While dlata ot tile<br />

vliblc only for PACS aiiCI coop)erative<br />

RFIs, data ott the latter are ar<br />

land (lcveloj)lnettt batiks.