Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE BOARD OF DIRECTORS’ REPORT<br />

ATLAS COPCO GROUP<br />

SEK 13,894 m. (873), mainly related to the RSC acquisition.<br />

Net cash flow for the year, including SEK 832 m. (787) for the<br />

dividend and SEK 4,125 m. for the new issue of shares, equaled<br />

SEK –8,188 m. (489).<br />

The Group’s net indebtedness (defined as the difference<br />

between interest-bearing liabilities and liquid assets) ended at<br />

SEK 19,325 m. (10,052), of which SEK 1,450 m. (1,940) was<br />

attributable to pension provisions. The decrease in pension<br />

provisions reflected the creation of a pension trust in Sweden<br />

during <strong>1999</strong> that is not consolidated in the Group’s accounts.<br />

The SEK 522 m. capitalization of the fund simultaneously<br />

reduced liquid assets and thus did not affect reported net<br />

indebtedness. The debt/equity ratio (defined as net indebtedness<br />

divided by shareholders’ equity) was 92 percent (65).<br />

Summary Cash Flow Analysis<br />

<strong>1999</strong> 1998<br />

Operating cash surplus after tax 4,595 4,162<br />

of which depreciation added back 2,616 1,876<br />

Change in working capital 20 –557<br />

Cash flow from operations 4,615 3,605<br />

Investments in tangible fixed assets –3,281 –2,447<br />

Sale of tangible fixed assets 1,079 991<br />

Company acquisitions/divestments –13,894 –873<br />

Cash flow from investments –16,096 –2,329<br />

Dividends paid –832 –787<br />

New issue of shares 4,125 –<br />

Net cash flow –8,188 489<br />

Shareholders’ equity<br />

At December 31, <strong>1999</strong>, Group shareholders’ equity, including<br />

Personnel<br />

<strong>1999</strong> 1998<br />

Average number of<br />

employees, total 24,249 23,857<br />

Sweden 2,532 2,633<br />

Outside Sweden<br />

Business areas<br />

21,717 21,224<br />

Compressor Technique<br />

Construction and<br />

8,288 8,565<br />

Mining Technique 4,123 4,572<br />

Industrial Technique 7,133 7,831<br />

Rental Service 4,572 2,773<br />

Other 133 116<br />

The average number of employees in the <strong>Atlas</strong> <strong>Copco</strong> Group<br />

increased in <strong>1999</strong>, by 392 to 24,249 (23,857). The proportion of<br />

employees in Swedish units was 10 percent (11). See also Note<br />

2. At year-end, the Group had a total of 26,134 employees<br />

(23,393). For comparable units, the number of employees<br />

decreased by 928 during the year.<br />

Option plan<br />

In 1997, an option plan was introduced providing the possibility<br />

of annual grants of call options on <strong>Atlas</strong> <strong>Copco</strong> shares for 25–30<br />

8 ATLAS COPCO <strong>1999</strong><br />

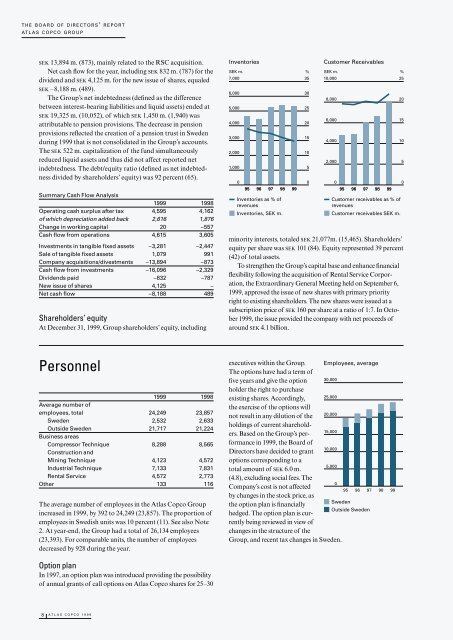

Inventories<br />

SEK m. %<br />

7,000<br />

35<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

95 96 97 98 99<br />

Inventories as % of<br />

revenues<br />

Inventories, SEK m.<br />

minority interests, totaled SEK 21,077m. (15,465). Shareholders’<br />

equity per share was SEK 101 (84). Equity represented 39 percent<br />

(42) of total assets.<br />

To strengthen the Group’s capital base and enhance financial<br />

flexibility following the acquisition of Rental Service Corporation,<br />

the Extraordinary General Meeting held on September 6,<br />

<strong>1999</strong>, approved the issue of new shares with primary priority<br />

right to existing shareholders. The new shares were issued at a<br />

subscription price of SEK 160 per share at a ratio of 1:7. In October<br />

<strong>1999</strong>, the issue provided the company with net proceeds of<br />

around SEK 4.1 billion.<br />

executives within the Group.<br />

The options have had a term of<br />

Employees, average<br />

five years and give the option<br />

holder the right to purchase<br />

30,000<br />

existing shares. Accordingly,<br />

the exercise of the options will<br />

25,000<br />

not result in any dilution of the<br />

holdings of current sharehold-<br />

20,000<br />

ers. Based on the Group’s performance<br />

in <strong>1999</strong>, the Board of<br />

15,000<br />

Directors have decided to grant<br />

options corresponding to a<br />

10,000<br />

total amount of SEK 6.0 m.<br />

(4.8), excluding social fees. The<br />

5,000<br />

Company’s cost is not affected<br />

by changes in the stock price, as<br />

0<br />

95 96 97<br />

the option plan is financially<br />

Sweden<br />

hedged. The option plan is currently<br />

being reviewed in view of<br />

changes in the structure of the<br />

Outside Sweden<br />

Group, and recent tax changes in Sweden.<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Customer Receivables<br />

SEK m. %<br />

10,000<br />

25<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

95 96 97 98 99<br />

Customer receivables as % of<br />

revenues<br />

Customer receivables SEK m.<br />

98<br />

99<br />

20<br />

15<br />

10<br />

5<br />

0