Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

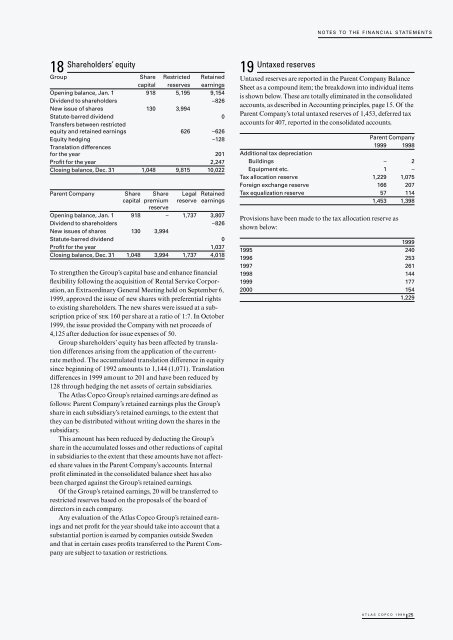

18<br />

Shareholders’ equity<br />

Group Share Restricted Retained<br />

capital reserves earnings<br />

Opening balance, Jan. 1 918 5,195 9,154<br />

Dividend to shareholders –826<br />

New issue of shares 130 3,994<br />

Statute-barred dividend 0<br />

Transfers between restricted<br />

equity and retained earnings 626 –626<br />

Equity hedging –128<br />

Translation differences<br />

for the year 201<br />

Profit for the year 2,247<br />

Closing balance, Dec. 31 1,048 9,815 10,022<br />

Parent Company Share Share Legal Retained<br />

capital premium reserve earnings<br />

reserve<br />

Opening balance, Jan. 1 918 – 1,737 3,807<br />

Dividend to shareholders –826<br />

New issues of shares 130 3,994<br />

Statute-barred dividend 0<br />

Profit for the year 1,037<br />

Closing balance, Dec. 31 1,048 3,994 1,737 4,018<br />

To strengthen the Group’s capital base and enhance financial<br />

flexibility following the acquisition of Rental Service Corporation,<br />

an Extraordinary General Meeting held on September 6,<br />

<strong>1999</strong>, approved the issue of new shares with preferential rights<br />

to existing shareholders. The new shares were issued at a subscription<br />

price of SEK 160 per share at a ratio of 1:7. In October<br />

<strong>1999</strong>, the issue provided the Company with net proceeds of<br />

4,125 after deduction for issue expenses of 50.<br />

Group shareholders’ equity has been affected by translation<br />

differences arising from the application of the currentrate<br />

method. The accumulated translation difference in equity<br />

since beginning of 1992 amounts to 1,144 (1,071). Translation<br />

differences in <strong>1999</strong> amount to 201 and have been reduced by<br />

128 through hedging the net assets of certain subsidiaries.<br />

The <strong>Atlas</strong> <strong>Copco</strong> Group’s retained earnings are defined as<br />

follows: Parent Company’s retained earnings plus the Group’s<br />

share in each subsidiary’s retained earnings, to the extent that<br />

they can be distributed without writing down the shares in the<br />

subsidiary.<br />

This amount has been reduced by deducting the Group’s<br />

share in the accumulated losses and other reductions of capital<br />

in subsidiaries to the extent that these amounts have not affected<br />

share values in the Parent Company’s accounts. Internal<br />

profit eliminated in the consolidated balance sheet has also<br />

been charged against the Group’s retained earnings.<br />

Of the Group’s retained earnings, 20 will be transferred to<br />

restricted reserves based on the proposals of the board of<br />

directors in each company.<br />

Any evaluation of the <strong>Atlas</strong> <strong>Copco</strong> Group’s retained earnings<br />

and net profit for the year should take into account that a<br />

substantial portion is earned by companies outside Sweden<br />

and that in certain cases profits transferred to the Parent Company<br />

are subject to taxation or restrictions.<br />

19<br />

Untaxed reserves<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Untaxed reserves are reported in the Parent Company Balance<br />

Sheet as a compound item; the breakdown into individual items<br />

is shown below. These are totally eliminated in the consolidated<br />

accounts, as described in Accounting principles, page 15. Of the<br />

Parent Company’s total untaxed reserves of 1,453, deferred tax<br />

accounts for 407, reported in the consolidated accounts.<br />

Parent Company<br />

<strong>1999</strong> 1998<br />

Additional tax depreciation<br />

Buildings – 2<br />

Equipment etc. 1 –<br />

Tax allocation reserve 1,229 1,075<br />

Foreign exchange reserve 166 207<br />

Tax equalization reserve 57 114<br />

1,453 1,398<br />

Provisions have been made to the tax allocation reserve as<br />

shown below:<br />

<strong>1999</strong><br />

1995 240<br />

1996 253<br />

1997 261<br />

1998 144<br />

<strong>1999</strong> 177<br />

2000 154<br />

1,229<br />

ATLAS COPCO <strong>1999</strong> 25