Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

from the translation of the accounts for these companies have<br />

been included in the Income Statement.<br />

Classification of foreign subsidiaries<br />

In one respect the SFASC’s standard require that the user choose<br />

translation procedures based on each specific situation. This<br />

applies to the classification of the foreign subsidiaries as either<br />

independent or integrated companies. This classification leads<br />

directly to the choice of translation method. The accounts of<br />

independent companies are translated according to the currentrate<br />

method, and integrated companies according to the monetary<br />

method.<br />

Based on the criteria defined for classification of companies,<br />

the majority of <strong>Atlas</strong> <strong>Copco</strong>’s subsidiaries have been defined as<br />

independent companies. Companies in high-inflation countries,<br />

primarily Latin America are translated according to the monetary<br />

method. The operational currency of these companies is the<br />

USD, and is therefore translated in two stages.<br />

In the first stage, translation is made to USD in accordance<br />

with the monetary method, whereby translation differences<br />

arising are charged to consolidated income. In the second stage,<br />

the company’s balance sheet items are translated to SEK using<br />

the year-end rate and the income statement items are translated<br />

at the average rate for the year. The resulting translation differences<br />

are transferred directly to shareholders’ equity.<br />

Inventories<br />

Inventories are valued at the lower of cost or market, in accordance<br />

with the FIFO principle and the net sales value. Group<br />

inventories are reported net of deductions for obsolescence and<br />

for internal profits arising in connection with deliveries from the<br />

production companies to the sales companies. Transfer pricing<br />

between the companies is based on market prices.<br />

Receivables and liabilities in foreign currencies<br />

Receivables and liabilities in foreign currencies are translated at<br />

the year-end rate.<br />

In case of currency exchange through a swap agreement, the<br />

loan is valued at the year-end rate for the swapped currency. If<br />

the swapped loan, translated at the year-end rate for the original<br />

currency, exceeds the booked liability, the difference is included<br />

in contingent liabilities.<br />

Exchange rates for major currencies used in the year-end<br />

accounts are shown on page 33.<br />

Financial investments<br />

Financial and other investments that are to be held to maturity<br />

are valued at amortised cost.<br />

Investments intended for trading are valued at the lower of<br />

cost or market.<br />

Derivative instruments<br />

When calculating the value of the forward contracts, options<br />

and swaps outstanding, provision is made for unrealized losses<br />

to the extent these exceed unrealized gains. Unrealized gains that<br />

exceed unrealized losses are not recognized as revenue.<br />

Hedging of net investments<br />

Prior to 1998 forward contracts and currency swaps in foreign<br />

currencies have been entered into in order to hedge the Group’s<br />

16 ATLAS COPCO <strong>1999</strong><br />

net assets in foreign subsidiaries (see page 32). In the Group<br />

accounts the valuation is based on market value and current<br />

rates. Foreign exchange gains and losses on such contracts, less<br />

current and deferred tax, are not included in income for the year,<br />

but are offset against translation differences arising in connection<br />

with the translation of the foreign subsidiaries’ net assets.<br />

Premium and discounts are amortized straight-line over<br />

the life of the contracts and reported in interest income and<br />

expense.<br />

Hedging of commercial flows<br />

The Group uses forward exchange contracts to hedge certain<br />

future transactions based on budgeted volume, so called commercial<br />

flow hedges. Unrealized gains and losses on such forward<br />

exchange contracts are deferred and recognized in the<br />

income statement in the same period that the hedged transaction<br />

is recognized.<br />

Product development costs and warranty costs<br />

Research and development costs are expensed as incurred.<br />

Estimated costs of product warranties are charged against<br />

cost of goods sold at the time the products are sold.<br />

Depreciation<br />

Depreciation according to plan is calculated based on the original<br />

cost using the straight-line method over the estimated useful life<br />

of the asset.<br />

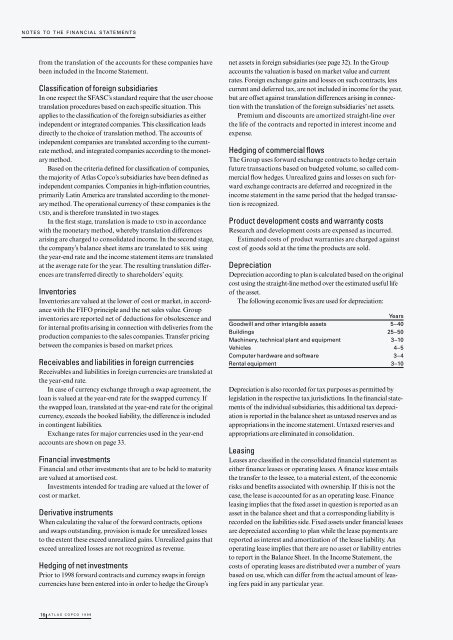

The following economic lives are used for depreciation:<br />

Years<br />

Goodwill and other intangible assets 5–40<br />

Buildings 25–50<br />

Machinery, technical plant and equipment 3–10<br />

Vehicles 4–5<br />

Computer hardware and software 3–4<br />

Rental equipment 3–10<br />

Depreciation is also recorded for tax purposes as permitted by<br />

legislation in the respective tax jurisdictions. In the financial statements<br />

of the individual subsidiaries, this additional tax depreciation<br />

is reported in the balance sheet as untaxed reserves and as<br />

appropriations in the income statement. Untaxed reserves and<br />

appropriations are eliminated in consolidation.<br />

Leasing<br />

Leases are classified in the consolidated financial statement as<br />

either finance leases or operating leases. A finance lease entails<br />

the transfer to the lessee, to a material extent, of the economic<br />

risks and benefits associated with ownership. If this is not the<br />

case, the lease is accounted for as an operating lease. Finance<br />

leasing implies that the fixed asset in question is reported as an<br />

asset in the balance sheet and that a corresponding liability is<br />

recorded on the liabilities side. Fixed assets under financial leases<br />

are depreciated according to plan while the lease payments are<br />

reported as interest and amortization of the lease liability. An<br />

operating lease implies that there are no asset or liability entries<br />

to report in the Balance Sheet. In the Income Statement, the<br />

costs of operating leases are distributed over a number of years<br />

based on use, which can differ from the actual amount of leasing<br />

fees paid in any particular year.