Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Goodwill<br />

The Group applies an amortization period of 40 years for goodwill<br />

arising from the acquisitions of the U.S. companies Milwaukee<br />

Electric Tool Corporation in 1995 (approximately USD 440 m.),<br />

Prime Service, Inc. in 1997 (approximately USD 870 m.) and<br />

Rental Service Corporation in <strong>1999</strong> (approximately USD 860 m.).<br />

This provides the most accurate picture of the strategic acquisitions’<br />

impact on the <strong>Atlas</strong> <strong>Copco</strong> Group’s earnings and financial<br />

position.<br />

In taking this position, <strong>Atlas</strong> <strong>Copco</strong> deviated from that part<br />

of the present recommendations of the Swedish Financial<br />

Accounting Standards Council, which prescribes amortization<br />

of goodwill over a maximum of 20 years. This does, however, not<br />

conflict with the legislation now in effect. Neither does this deviation<br />

represent a breach of the registration contract with the<br />

Stockholm Stock Exchange.<br />

During 1996, the Swedish Financial Accounting Standards<br />

Council implemented a general review of its recommendation<br />

and published a new version, which became effective on January<br />

1, 1997. However, with regard to the maximum amortization<br />

period for goodwill, the Council has elected to delay its recommendation<br />

pending the position to be adopted by the International<br />

Accounting Standards Committee (IASC). IASC has<br />

agreed on a standard, effective as from January 1, 2000, whereby<br />

goodwill is to be amortized over its economic life. This means<br />

that the amortization period can exceed 20 years. The Swedish<br />

Financial Accounting Standards Council has in November <strong>1999</strong><br />

issued a draft standard on amortization of goodwill in accordance<br />

with IASC’s standard. The standard is intended to be effective<br />

as from January 1, 2001.<br />

<strong>Atlas</strong> <strong>Copco</strong>’s recent strategic acquisitions involve three large<br />

American groups with operations and sales mainly in the United<br />

States. The companies generate large operating cash flows and<br />

derive ongoing operating benefits from very strong brand names<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

and extensive customer lists. In these cases there are strong reasons<br />

for the choice of an amortization period longer than 20 years. One<br />

reason being that it provides the most accurate picture of the<br />

acquisition to the financial markets. Another important reason for<br />

applying a longer amortization period is attributable to competitive<br />

factors. <strong>Atlas</strong> <strong>Copco</strong> needs to be in the same position as other<br />

parties in calculating the economic consequences of the purchase<br />

price and in the subsequent financial reporting of the acquisition.<br />

Currently, profitable companies command a price on the market,<br />

which to a very large extent exceeds reported shareholders’equity.<br />

Consequently, the accounting for goodwill becomes significant.<br />

Since <strong>Atlas</strong> <strong>Copco</strong> is an international group with 97 percent<br />

of its sales outside Sweden – a country where there are no<br />

comparable competitors to the acquired companies – it is of<br />

major importance that the financial statements is internationally<br />

comparable. It is therefore necessary that the Swedish<br />

companies can apply rules equivalent to those of foreign competitors.<br />

These rules permit amortization of goodwill over<br />

periods of up to 40 years.<br />

For purposes of comparison, the impact on earnings resulting<br />

from the application of goodwill amortization over periods<br />

of 20 and 40 years is shown below:<br />

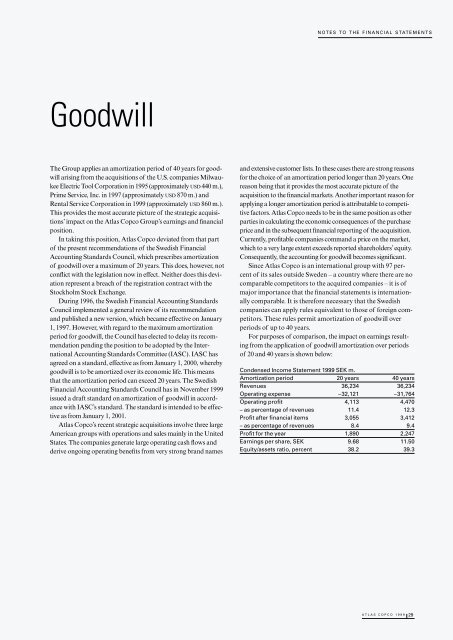

Condensed Income Statement <strong>1999</strong> SEK m.<br />

Amortization period 20 years 40 years<br />

Revenues 36,234 36,234<br />

Operating expense –32,121 –31,764<br />

Operating profit 4,113 4,470<br />

– as percentage of revenues 11.4 12.3<br />

Profit after financial items 3,055 3,412<br />

– as percentage of revenues 8.4 9.4<br />

Profit for the year 1,890 2,247<br />

Earnings per share, SEK 9.68 11.50<br />

Equity/assets ratio, percent 38.2 39.3<br />

ATLAS COPCO <strong>1999</strong> 29