Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

20<br />

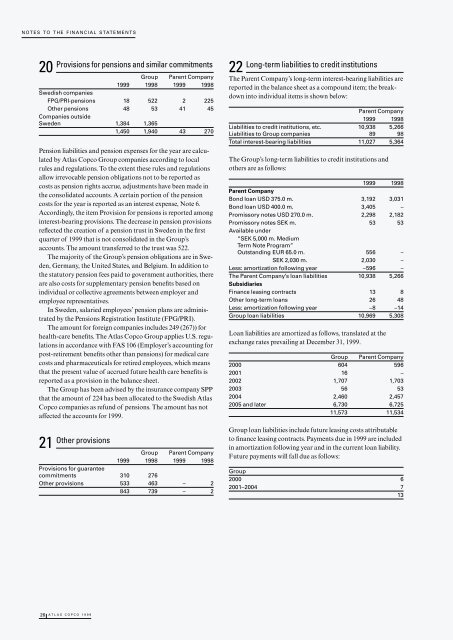

Provisions for pensions and similar commitments<br />

Group Parent Company<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Swedish companies<br />

FPG/PRI-pensions 18 522 2 225<br />

Other pensions<br />

Companies outside<br />

48 53 41 45<br />

Sweden 1,384 1,365<br />

1,450 1,940 43 270<br />

Pension liabilities and pension expenses for the year are calculated<br />

by <strong>Atlas</strong> <strong>Copco</strong> Group companies according to local<br />

rules and regulations. To the extent these rules and regulations<br />

allow irrevocable pension obligations not to be reported as<br />

costs as pension rights accrue, adjustments have been made in<br />

the consolidated accounts. A certain portion of the pension<br />

costs for the year is reported as an interest expense, Note 6.<br />

Accordingly, the item Provision for pensions is reported among<br />

interest-bearing provisions. The decrease in pension provisions<br />

reflected the creation of a pension trust in Sweden in the first<br />

quarter of <strong>1999</strong> that is not consolidated in the Group’s<br />

accounts. The amount transferred to the trust was 522.<br />

The majority of the Group’s pension obligations are in Sweden,<br />

Germany, the United States, and Belgium. In addition to<br />

the statutory pension fees paid to government authorities, there<br />

are also costs for supplementary pension benefits based on<br />

individual or collective agreements between employer and<br />

employee representatives.<br />

In Sweden, salaried employees’ pension plans are administrated<br />

by the Pensions Registration Institute (FPG/PRI).<br />

The amount for foreign companies includes 249 (267)) for<br />

health-care benefits. The <strong>Atlas</strong> <strong>Copco</strong> Group applies U.S. regulations<br />

in accordance with FAS 106 (Employer’s accounting for<br />

post-retirement benefits other than pensions) for medical care<br />

costs and pharmaceuticals for retired employees, which means<br />

that the present value of accrued future health care benefits is<br />

reported as a provision in the balance sheet.<br />

The Group has been advised by the insurance company SPP<br />

that the amount of 224 has been allocated to the Swedish <strong>Atlas</strong><br />

<strong>Copco</strong> companies as refund of pensions. The amount has not<br />

affected the accounts for <strong>1999</strong>.<br />

21<br />

Other provisions<br />

Group Parent Company<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Provisions for guarantee<br />

commitments 310 276<br />

Other provisions 533 463 – 2<br />

843 739 – 2<br />

26 ATLAS COPCO <strong>1999</strong><br />

22<br />

Long-term liabilities to credit institutions<br />

The Parent Company’s long-term interest-bearing liabilities are<br />

reported in the balance sheet as a compound item; the breakdown<br />

into individual items is shown below:<br />

Parent Company<br />

<strong>1999</strong> 1998<br />

Liabilities to credit institutions, etc. 10,938 5,266<br />

Liabilities to Group companies 89 98<br />

Total interest-bearing liabilities 11,027 5,364<br />

The Group’s long-term liabilities to credit institutions and<br />

others are as follows:<br />

<strong>1999</strong> 1998<br />

Parent Company<br />

Bond loan USD 375.0 m. 3,192 3,031<br />

Bond loan USD 400.0 m. 3,405 –<br />

Promissory notes USD 270.0 m. 2,298 2,182<br />

Promissory notes SEK m.<br />

Available under<br />

“SEK 5,000 m. Medium<br />

Term Note Program”<br />

53 53<br />

Outstanding EUR 65.0 m. 556 –<br />

SEK 2,030 m. 2,030 –<br />

Less: amortization following year –596 –<br />

The Parent Company’s loan liabilities<br />

Subsidiaries<br />

10,938 5,266<br />

Finance leasing contracts 13 8<br />

Other long-term loans 26 48<br />

Less: amortization following year –8 –14<br />

Group loan liabilities 10,969 5,308<br />

Loan liabilities are amortized as follows, translated at the<br />

exchange rates prevailing at December 31, <strong>1999</strong>.<br />

Group Parent Company<br />

2000 604 596<br />

2001 16 –<br />

2002 1,707 1,703<br />

2003 56 53<br />

2004 2,460 2,457<br />

2005 and later 6,730 6,725<br />

11,573 11,534<br />

Group loan liabilities include future leasing costs attributable<br />

to finance leasing contracts. Payments due in <strong>1999</strong> are included<br />

in amortization following year and in the current loan liability.<br />

Future payments will fall due as follows:<br />

Group<br />

2000 6<br />

2001–2004 7<br />

13