Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

23<br />

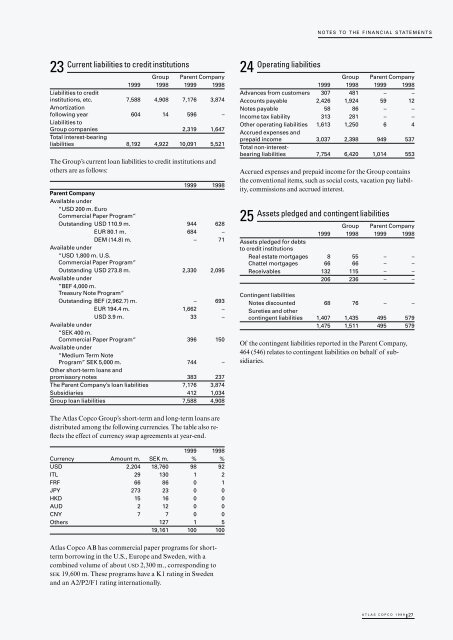

Current liabilities to credit institutions<br />

Group Parent Company<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Liabilities to credit<br />

institutions, etc.<br />

Amortization<br />

7,588 4,908 7,176 3,874<br />

following year<br />

Liabilities to<br />

604 14 596 –<br />

Group companies<br />

Total interest-bearing<br />

2,319 1,647<br />

liabilities 8,192 4,922 10,091 5,521<br />

The Group’s current loan liabilities to credit institutions and<br />

others are as follows:<br />

<strong>1999</strong> 1998<br />

Parent Company<br />

Available under<br />

“USD 200 m. Euro<br />

Commercial Paper Program“<br />

Outstanding USD 110.9 m. 944 628<br />

EUR 80.1 m. 684 –<br />

DEM (14.8) m.<br />

Available under<br />

“USD 1,800 m. U.S.<br />

Commercial Paper Program“<br />

– 71<br />

Outstanding USD 273.8 m.<br />

Available under<br />

”BEF 4,000 m.<br />

Treasury Note Program“<br />

2,330 2,095<br />

Outstanding BEF (2,962.7) m. – 693<br />

EUR 194.4 m. 1,662 –<br />

USD 3.9 m.<br />

Available under<br />

“SEK 400 m.<br />

33 –<br />

Commercial Paper Program“<br />

Available under<br />

“Medium Term Note<br />

396 150<br />

Program” SEK 5,000 m.<br />

Other short-term loans and<br />

744 –<br />

promissory notes 383 237<br />

The Parent Company’s loan liabilities 7,176 3,874<br />

Subsidiaries 412 1,034<br />

Group loan liabilities 7,588 4,908<br />

The <strong>Atlas</strong> <strong>Copco</strong> Group’s short-term and long-term loans are<br />

distributed among the following currencies. The table also reflects<br />

the effect of currency swap agreements at year-end.<br />

<strong>1999</strong> 1998<br />

Currency Amount m. SEK m. % %<br />

USD 2,204 18,760 98 92<br />

ITL 29 130 1 2<br />

FRF 66 86 0 1<br />

JPY 273 23 0 0<br />

HKD 15 16 0 0<br />

AUD 2 12 0 0<br />

CNY 7 7 0 0<br />

Others 127 1 5<br />

19,161 100 100<br />

<strong>Atlas</strong> <strong>Copco</strong> AB has commercial paper programs for shortterm<br />

borrowing in the U.S., Europe and Sweden, with a<br />

combined volume of about USD 2,300 m., corresponding to<br />

SEK 19,600 m. These programs have a K1 rating in Sweden<br />

and an A2/P2/F1 rating internationally.<br />

24<br />

Operating liabilities<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Group Parent Company<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Advances from customers 307 481 – –<br />

Accounts payable 2,426 1,924 59 12<br />

Notes payable 58 86 – –<br />

Income tax liability 313 281 – –<br />

Other operating liabilities 1,613 1,250 6 4<br />

Accrued expenses and<br />

prepaid income 3,037 2,398 949 537<br />

Total non-interestbearing<br />

liabilities 7,754 6,420 1,014 553<br />

Accrued expenses and prepaid income for the Group contains<br />

the conventional items, such as social costs, vacation pay liability,<br />

commissions and accrued interest.<br />

25<br />

Assets pledged and contingent liabilities<br />

Group Parent Company<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Assets pledged for debts<br />

to credit institutions<br />

Real estate mortgages 8 55 – –<br />

Chattel mortgages 66 66 – –<br />

Receivables 132 115 – –<br />

206 236 – –<br />

Contingent liabilities<br />

Notes discounted 68 76 – –<br />

Sureties and other<br />

contingent liabilities 1,407 1,435 495 579<br />

1,475 1,511 495 579<br />

Of the contingent liabilities reported in the Parent Company,<br />

464 (546) relates to contingent liabilities on behalf of subsidiaries.<br />

ATLAS COPCO <strong>1999</strong> 27