Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

of <strong>Atlas</strong> <strong>Copco</strong> Controls resulted in a capital gain before tax of<br />

223 for the <strong>Atlas</strong> <strong>Copco</strong> Group.<br />

Other operating income includes commissions received of 26<br />

(39), capital gains of 38 (190) on the sale of fixed assets, surplus<br />

due to repatriation of pension debt – (18), and profits from insurance<br />

activities. Other operating income for the Parent Company<br />

includes commissions received totaling 94 (61), capital gains of<br />

21 (–) on the divestment of real estate and surplus due to repatriation<br />

of pension debt – (10).<br />

Other operating expenses refer to operating exchange-rate<br />

losses attributable to operations.<br />

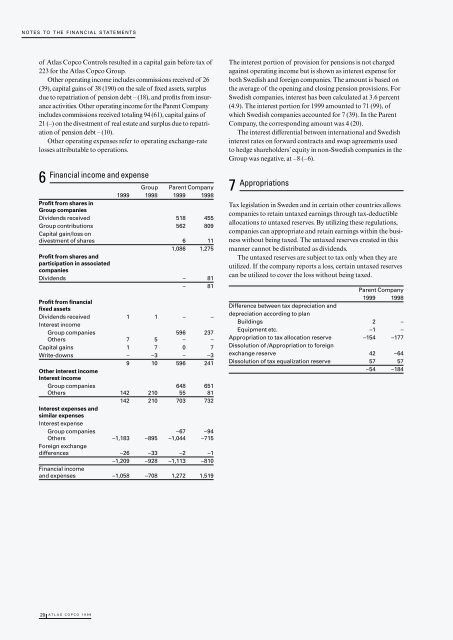

6<br />

Financial income and expense<br />

Group Parent Company<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Profit from shares in<br />

Group companies<br />

Dividends received 518 455<br />

Group contributions<br />

Capital gain/loss on<br />

562 809<br />

divestment of shares 6 11<br />

Profit from shares and<br />

participation in associated<br />

companies<br />

1,086 1,275<br />

Dividends – 81<br />

– 81<br />

Profit from financial<br />

fixed assets<br />

Dividends received 1 1 – –<br />

Interest income<br />

Group companies 596 237<br />

Others 7 5 – –<br />

Capital gains 1 7 0 7<br />

Write-downs – –3 – –3<br />

9 10 596 241<br />

Other interest income<br />

Interest income<br />

Group companies 648 651<br />

Others 142 210 55 81<br />

142 210 703 732<br />

Interest expenses and<br />

similar expenses<br />

Interest expense<br />

Group companies –67 –94<br />

Others –1,183 –895 –1,044 –715<br />

Foreign exchange<br />

differences –26 –33 –2 –1<br />

–1,209 –928 –1,113 –810<br />

Financial income<br />

and expenses –1,058 –708 1,272 1,519<br />

20 ATLAS COPCO <strong>1999</strong><br />

The interest portion of provision for pensions is not charged<br />

against operating income but is shown as interest expense for<br />

both Swedish and foreign companies. The amount is based on<br />

the average of the opening and closing pension provisions. For<br />

Swedish companies, interest has been calculated at 3.6 percent<br />

(4.9). The interest portion for <strong>1999</strong> amounted to 71 (99), of<br />

which Swedish companies accounted for 7 (39). In the Parent<br />

Company, the corresponding amount was 4 (20).<br />

The interest differential between international and Swedish<br />

interest rates on forward contracts and swap agreements used<br />

to hedge shareholders’ equity in non-Swedish companies in the<br />

Group was negative, at –8 (–6).<br />

7 Appropriations<br />

Tax legislation in Sweden and in certain other countries allows<br />

companies to retain untaxed earnings through tax-deductible<br />

allocations to untaxed reserves. By utilizing these regulations,<br />

companies can appropriate and retain earnings within the business<br />

without being taxed. The untaxed reserves created in this<br />

manner cannot be distributed as dividends.<br />

The untaxed reserves are subject to tax only when they are<br />

utilized. If the company reports a loss, certain untaxed reserves<br />

can be utilized to cover the loss without being taxed.<br />

Parent Company<br />

<strong>1999</strong> 1998<br />

Difference between tax depreciation and<br />

depreciation according to plan<br />

Buildings 2 –<br />

Equipment etc. –1 –<br />

Appropriation to tax allocation reserve<br />

Dissolution of /Appropriation to foreign<br />

–154 –177<br />

exchange reserve 42 –64<br />

Dissolution of tax equalization reserve 57 57<br />

–54 –184