Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Remuneration and other fees for members of<br />

the Board, the President and CEO, and other<br />

members of the Group management<br />

In <strong>1999</strong>, the Chairman of the Board received SEK 1,000,000.<br />

The Vice Chairman received SEK 350,000 on an annual basis<br />

and of the Board members not employed by the Company,<br />

each received board fees that amounted to SEK 275,000 on an<br />

annual basis.<br />

Board member Paul-Emmanuel Janssen also received fees<br />

from Group companies of SEK 200,000 and board member Hari<br />

Shankar Singhania received fees from Group companies in the<br />

amount of SEK 27,000.<br />

The President and Chief Executive Officer, Giulio Mazzalupi,<br />

received a salary of SEK 5,387,884 plus a bonus of SEK 1,937,000.<br />

In addition, he has a pension commitment from the Company<br />

equal to 47 percent of base salary upon retirement, payable from<br />

age 65.<br />

Pension commitments for the Business Area Executives are<br />

either defined contribution in nature or a mixture of defined<br />

contribution and defined benefit. For commitments which are<br />

defined contribution only, contributions in <strong>1999</strong> were in the range<br />

16 to 22 percent of pensionable salary. For other commitments,<br />

the pensions estimated to become payable upon retirement after<br />

35 to 40 years of employment are in the range 35 to 70 percent of<br />

pensionable salaries.<br />

Regarding termination of the President and Chief Executive<br />

Officer and the Business Area Executives, severance is not paid<br />

if notice is given by the employee. If the Company terminates<br />

the employment prior to retirement, the maximum Company<br />

commitment is to pay two years’ final base salary. However, for<br />

one of the Business Area Executives, the maximum Company<br />

commitment is to pay final base salary plus continued health<br />

benefits, both for 12 months.<br />

Activities of the Board of Directors of<br />

<strong>Atlas</strong> <strong>Copco</strong> AB during the year <strong>1999</strong><br />

The Board of Directors of the Company had ten members, one<br />

of which is the President and Chief Executive Officer, elected by<br />

the <strong>Annual</strong> General Meeting and three members, with three personal<br />

deputies, appointed by the unions.<br />

During <strong>1999</strong>, there were ten meetings, of which one was held<br />

outside Sweden and two were per capsulam meetings. Each<br />

meeting was governed by an approved agenda. The agenda also<br />

covered the follow-up on major investments made. To ensure an<br />

efficient process at each meeting, the Board members received a<br />

package of written documentation prior to the meeting that<br />

reflected a procedure intended to ensure that all matters raised<br />

are supported by such sufficient and relevant information as is<br />

required to form a basis for a decision. Members of the Group<br />

management were regularly present at the Board meetings. In<br />

between meetings, there were regular contacts between the<br />

Chairman and the President. Each Board member received a<br />

written update from the President on major events in those<br />

months when there was no Board meeting.<br />

To ensure that decisions on major matters would not be<br />

unduly delayed, the Board appointed smaller committees<br />

among its members to follow up and make proposals to the<br />

Board regarding such matters. A remuneration committee was<br />

appointed during the year.<br />

The Company’s external auditors reported in person their<br />

observations from the annual audit and presented their views<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

on the internal control in the Group at the February meeting.<br />

In April <strong>1999</strong>, the Board adopted its Rules of Procedure and<br />

Written Instructions.<br />

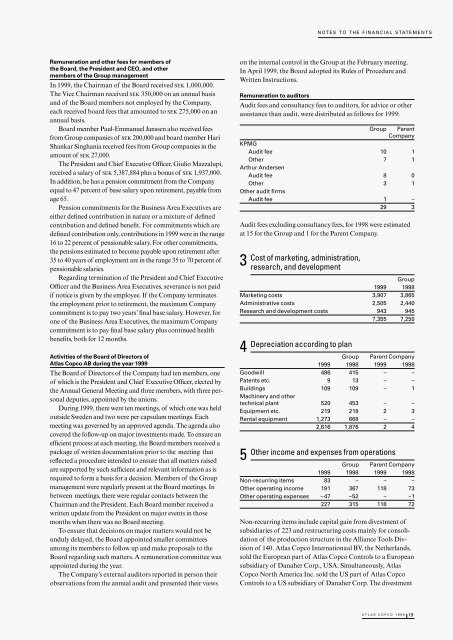

Remuneration to auditors<br />

Audit fees and consultancy fees to auditors, for advice or other<br />

assistance than audit, were distributed as follows for <strong>1999</strong>:<br />

Group Parent<br />

Company<br />

KPMG<br />

Audit fee 10 1<br />

Other<br />

Arthur Andersen<br />

7 1<br />

Audit fee 8 0<br />

Other<br />

Other audit firms<br />

3 1<br />

Audit fee 1 –<br />

29 3<br />

Audit fees excluding consultancy fees, for 1998 were estimated<br />

at 15 for the Group and 1 for the Parent Company.<br />

3<br />

Cost of marketing, administration,<br />

research, and development<br />

Group<br />

<strong>1999</strong> 1998<br />

Marketing costs 3,907 3,865<br />

Administrative costs 2,505 2,440<br />

Research and development costs 943 945<br />

7,355 7,250<br />

4<br />

Depreciation according to plan<br />

Group Parent Company<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Goodwill 486 415 – –<br />

Patents etc. 9 13 – –<br />

Buildings 109 109 – 1<br />

Machinery and other<br />

technical plant 520 453 – –<br />

Equipment etc. 219 218 2 3<br />

Rental equipment 1,273 668 – –<br />

2,616 1,876 2 4<br />

5<br />

Other income and expenses from operations<br />

Group Parent Company<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Non-recurring items 83 – – –<br />

Other operating income 191 367 118 73<br />

Other operating expenses –47 –52 – –1<br />

227 315 118 72<br />

Non-recurring items include capital gain from divestment of<br />

subsidiaries of 223 and restructuring costs mainly for consolidation<br />

of the production structure in the Alliance Tools Division<br />

of 140. <strong>Atlas</strong> <strong>Copco</strong> Internationaal BV, the Netherlands,<br />

sold the European part of <strong>Atlas</strong> <strong>Copco</strong> Controls to a European<br />

subsidiary of Danaher Corp., USA. Simultaneously, <strong>Atlas</strong><br />

<strong>Copco</strong> North America Inc. sold the US part of <strong>Atlas</strong> <strong>Copco</strong><br />

Controls to a US subsidiary of Danaher Corp. The divestment<br />

ATLAS COPCO <strong>1999</strong> 19