Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

Financial Exposure<br />

The objective of <strong>Atlas</strong> <strong>Copco</strong>’s financial risk policy is to minimize<br />

the financial risks to which the Group is exposed. It is designed<br />

to create stable conditions for the business operations of<br />

the divisions and contribute to a stable growth in shareholders’<br />

equity and dividend.<br />

Currency risk<br />

Changes in exchange rates affect Group earnings and equity in<br />

various ways:<br />

• Group earnings – when revenues from sales and costs for production<br />

are in different currencies (transaction risk).<br />

• Group earnings – when earnings of foreign subsidiaries are<br />

translated into SEK (translation risk).<br />

• Group shareholders’equity – when the net assets of foreign subsidiaries<br />

are translated into SEK (translation risk).<br />

Transaction risk<br />

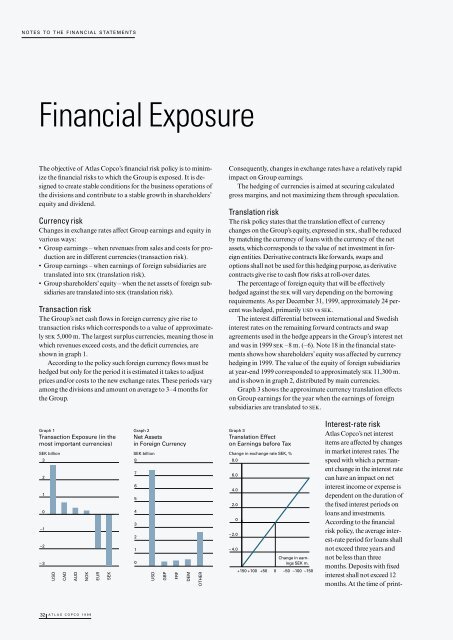

The Group’s net cash flows in foreign currency give rise to<br />

transaction risks which corresponds to a value of approximately<br />

SEK 5,000 m. The largest surplus currencies, meaning those in<br />

which revenues exceed costs, and the deficit currencies, are<br />

shown in graph 1.<br />

According to the policy such foreign currency flows must be<br />

hedged but only for the period it is estimated it takes to adjust<br />

prices and/or costs to the new exchange rates. These periods vary<br />

among the divisions and amount on average to 3–4 months for<br />

the Group.<br />

Graph 1<br />

Transaction Exposure (in the<br />

most important currencies)<br />

SEK billion<br />

3<br />

2<br />

1<br />

0<br />

–1<br />

–2<br />

–3<br />

USD<br />

CAD<br />

AUD<br />

NOK<br />

32 ATLAS COPCO <strong>1999</strong><br />

EUR<br />

SEK<br />

Graph 2<br />

Net Assets<br />

in Foreign Currency<br />

SEK billion<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

USD<br />

GBP<br />

FRF<br />

DEM<br />

OTHER<br />

Consequently, changes in exchange rates have a relatively rapid<br />

impact on Group earnings.<br />

The hedging of currencies is aimed at securing calculated<br />

gross margins, and not maximizing them through speculation.<br />

Translation risk<br />

The risk policy states that the translation effect of currency<br />

changes on the Group’s equity, expressed in SEK, shall be reduced<br />

by matching the currency of loans with the currency of the net<br />

assets, which corresponds to the value of net investment in foreign<br />

entities. Derivative contracts like forwards, swaps and<br />

options shall not be used for this hedging purpose, as derivative<br />

contracts give rise to cash flow risks at roll-over dates.<br />

The percentage of foreign equity that will be effectively<br />

hedged against the SEK will vary depending on the borrowing<br />

requirements. As per December 31, <strong>1999</strong>, approximately 24 percent<br />

was hedged, primarily USD vs SEK.<br />

The interest differential between international and Swedish<br />

interest rates on the remaining forward contracts and swap<br />

agreements used in the hedge appears in the Group’s interest net<br />

and was in <strong>1999</strong> SEK –8 m. (–6). Note 18 in the financial statements<br />

shows how shareholders’ equity was affected by currency<br />

hedging in <strong>1999</strong>. The value of the equity of foreign subsidiaries<br />

at year-end <strong>1999</strong> corresponded to approximately SEK 11,300 m.<br />

and is shown in graph 2, distributed by main currencies.<br />

Graph 3 shows the approximate currency translation effects<br />

on Group earnings for the year when the earnings of foreign<br />

subsidiaries are translated to SEK.<br />

Graph 3<br />

Translation Effect<br />

on Earnings before Tax<br />

Change in exchange rate SEK, %<br />

8.0<br />

6.0<br />

4.0<br />

2.0<br />

0<br />

– 2.0<br />

– 4.0<br />

+150 +100<br />

+50<br />

0<br />

Change in earnings<br />

SEK m.<br />

–50 –100 –150<br />

Interest-rate risk<br />

<strong>Atlas</strong> <strong>Copco</strong>’s net interest<br />

items are affected by changes<br />

in market interest rates. The<br />

speed with which a permanent<br />

change in the interest rate<br />

can have an impact on net<br />

interest income or expense is<br />

dependent on the duration of<br />

the fixed interest periods on<br />

loans and investments.<br />

According to the financial<br />

risk policy, the average interest-rate<br />

period for loans shall<br />

not exceed three years and<br />

not be less than three<br />

months. Deposits with fixed<br />

interest shall not exceed 12<br />

months. At the time of print-