Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Atlas Copco - Annual Report 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

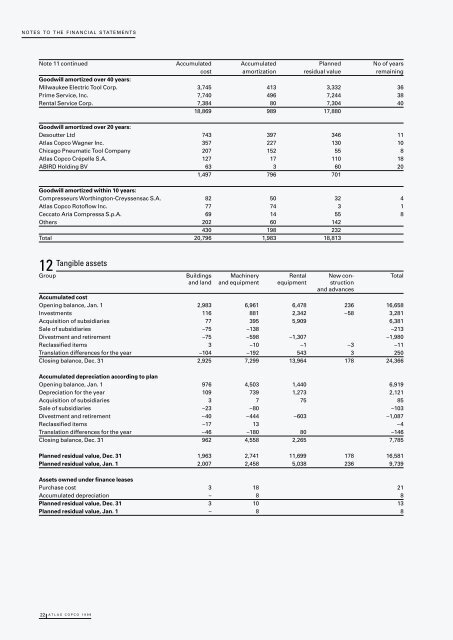

NOTES TO THE FINANCIAL STATEMENTS<br />

Note 11 continued Accumulated Accumulated Planned No of years<br />

cost amortization residual value remaining<br />

Goodwill amortized over 40 years:<br />

Milwaukee Electric Tool Corp. 3,745 413 3,332 36<br />

Prime Service, Inc. 7,740 496 7,244 38<br />

Rental Service Corp. 7,384 80 7,304 40<br />

18,869 989 17,880<br />

Goodwill amortized over 20 years:<br />

Desoutter Ltd 743 397 346 11<br />

<strong>Atlas</strong> <strong>Copco</strong> Wagner Inc. 357 227 130 10<br />

Chicago Pneumatic Tool Company 207 152 55 8<br />

<strong>Atlas</strong> <strong>Copco</strong> Crépelle S.A. 127 17 110 18<br />

ABIRD Holding BV 63 3 60 20<br />

1,497 796 701<br />

Goodwill amortized within 10 years:<br />

Compresseurs Worthington-Creyssensac S.A. 82 50 32 4<br />

<strong>Atlas</strong> <strong>Copco</strong> Rotoflow Inc. 77 74 3 1<br />

Ceccato Aria Compressa S.p.A. 69 14 55 8<br />

Others 202 60 142<br />

430 198 232<br />

Total 20,796 1,983 18,813<br />

12<br />

Tangible assets<br />

Group Buildings Machinery Rental New con- Total<br />

and land and equipment equipment struction<br />

and advances<br />

Accumulated cost<br />

Opening balance, Jan. 1 2,983 6,961 6,478 236 16,658<br />

Investments 116 881 2,342 –58 3,281<br />

Acquisition of subsidiaries 77 395 5,909 6,381<br />

Sale of subsidiaries –75 –138 –213<br />

Divestment and retirement –75 –598 –1,307 –1,980<br />

Reclassified items 3 –10 –1 –3 –11<br />

Translation differences for the year –104 –192 543 3 250<br />

Closing balance, Dec. 31 2,925 7,299 13,964 178 24,366<br />

Accumulated depreciation according to plan<br />

Opening balance, Jan. 1 976 4,503 1,440 6,919<br />

Depreciation for the year 109 739 1,273 2,121<br />

Acquisition of subsidiaries 3 7 75 85<br />

Sale of subsidiaries –23 –80 –103<br />

Divestment and retirement –40 –444 –603 –1,087<br />

Reclassified items –17 13 –4<br />

Translation differences for the year –46 –180 80 –146<br />

Closing balance, Dec. 31 962 4,558 2,265 7,785<br />

Planned residual value, Dec. 31 1,963 2,741 11,699 178 16,581<br />

Planned residual value, Jan. 1 2,007 2,458 5,038 236 9,739<br />

Assets owned under finance leases<br />

Purchase cost 3 18 21<br />

Accumulated depreciation – 8 8<br />

Planned residual value, Dec. 31 3 10 13<br />

Planned residual value, Jan. 1 – 8 8<br />

22 ATLAS COPCO <strong>1999</strong>