Download - FDCL

Download - FDCL

Download - FDCL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

70<br />

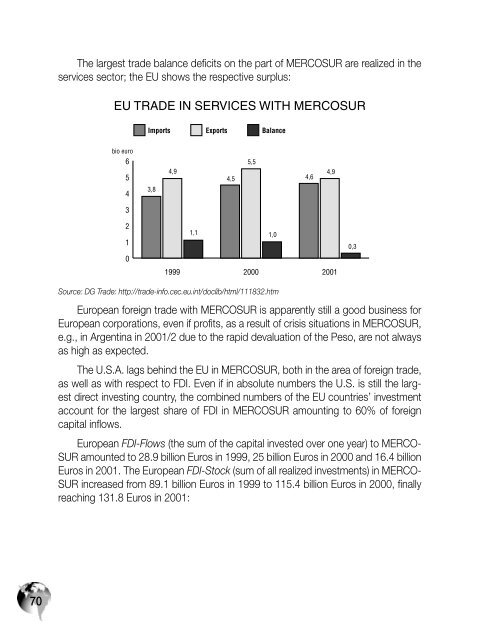

The largest trade balance deficits on the part of MERCOSUR are realized in the<br />

services sector; the EU shows the respective surplus:<br />

EU TRADE IN SERVICES WITH MERCOSUR<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Source: DG Trade: http://trade-info.cec.eu.int/doclib/html/111832.htm<br />

European foreign trade with MERCOSUR is apparently still a good business for<br />

European corporations, even if profits, as a result of crisis situations in MERCOSUR,<br />

e.g., in Argentina in 2001/2 due to the rapid devaluation of the Peso, are not always<br />

as high as expected.<br />

The U.S.A. lags behind the EU in MERCOSUR, both in the area of foreign trade,<br />

as well as with respect to FDI. Even if in absolute numbers the U.S. is still the largest<br />

direct investing country, the combined numbers of the EU countries’ investment<br />

account for the largest share of FDI in MERCOSUR amounting to 60% of foreign<br />

capital inflows.<br />

European FDI-Flows (the sum of the capital invested over one year) to MERCO-<br />

SUR amounted to 28.9 billion Euros in 1999, 25 billion Euros in 2000 and 16.4 billion<br />

Euros in 2001. The European FDI-Stock (sum of all realized investments) in MERCO-<br />

SUR increased from 89.1 billion Euros in 1999 to 115.4 billion Euros in 2000, finally<br />

reaching 131.8 Euros in 2001: