Financial Report and Registration Document 2010 - Groupe Seb

Financial Report and Registration Document 2010 - Groupe Seb

Financial Report and Registration Document 2010 - Groupe Seb

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

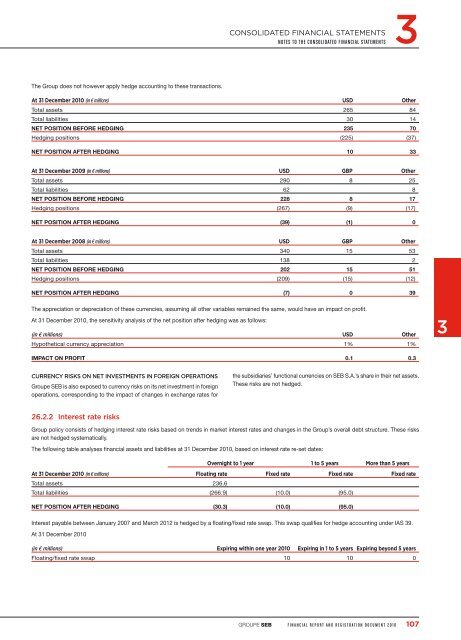

The Group does not however apply hedge accounting to these transactions.<br />

At 31 December <strong>2010</strong> (in € millions) USD Other<br />

Total assets 265 84<br />

Total liabilities 30 14<br />

NET POSITION BEFORE HEDGING 235 70<br />

Hedging positions (225) (37)<br />

NET POSITION AFTER HEDGING 10 33<br />

At 31 December 2009 (in € millions) USD GBP Other<br />

Total assets 290 8 25<br />

Total liabilities 62 8<br />

NET POSITION BEFORE HEDGING 228 8 17<br />

Hedging positions (267) (9) (17)<br />

NET POSITION AFTER HEDGING (39) (1) 0<br />

At 31 December 2008 (in € millions) USD GBP Other<br />

Total assets 340 15 53<br />

Total liabilities 138 2<br />

NET POSITION BEFORE HEDGING 202 15 51<br />

Hedging positions (209) (15) (12)<br />

NET POSITION AFTER HEDGING (7) 0 39<br />

The appreciation or depreciation of these currencies, assuming all other variables remained the same, would have an impact on profit.<br />

At 31 December <strong>2010</strong>, the sensitivity analysis of the net position after hedging was as follows:<br />

(in € millions) USD Other<br />

Hypothetical currency appreciation 1% 1%<br />

3<br />

IMPACT ON PROFIT 0.1 0.3<br />

CURRENCY RISKS ON NET INVESTMENTS IN FOREIGN OPERATIONS<br />

<strong>Groupe</strong> SEB is also exposed to currency risks on its net investment in foreign<br />

operations, corresponding to the impact of changes in exchange rates for<br />

the subsidiaries’ functional currencies on SEB S.A.’s share in their net assets.<br />

These risks are not hedged.<br />

26.2.2 Interest rate risks<br />

Group policy consists of hedging interest rate risks based on trends in market interest rates <strong>and</strong> changes in the Group’s overall debt structure. These risks<br />

are not hedged systematically.<br />

The following table analyses financial assets <strong>and</strong> liabilities at 31 December <strong>2010</strong>, based on interest rate re-set dates:<br />

Overnight to 1 year 1 to 5 years More than 5 years<br />

At 31 December <strong>2010</strong> (in € millions)<br />

Floating rate Fixed rate Fixed rate Fixed rate<br />

Total assets 236.6<br />

Total liabilities (266.9) (10.0) (95.0)<br />

NET POSITION AFTER HEDGING (30.3) (10.0) (95.0)<br />

Interest payable between January 2007 <strong>and</strong> March 2012 is hedged by a floating/fixed rate swap. This swap qualifies for hedge accounting under IAS 39.<br />

At 31 December <strong>2010</strong><br />

(in € millions) Expiring within one year <strong>2010</strong> Expiring in 1 to 5 years Expiring beyond 5 years<br />

Floating/fixed rate swap 10 10 0<br />

GROUPE SEB<br />

FINANCIAL REPORT AND REGISTRATION DOCUMENT <strong>2010</strong><br />

107