Financial Report and Registration Document 2010 - Groupe Seb

Financial Report and Registration Document 2010 - Groupe Seb

Financial Report and Registration Document 2010 - Groupe Seb

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

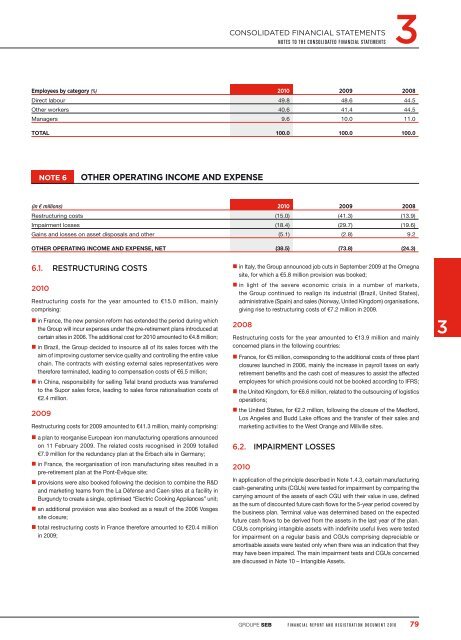

Employees by category (%) <strong>2010</strong> 2009 2008<br />

Direct labour 49.8 48.6 44.5<br />

Other workers 40.6 41.4 44.5<br />

Managers 9.6 10.0 11.0<br />

TOTAL 100.0 100.0 100.0<br />

NOTE 6<br />

OTHER OPERATING INCOME AND EXPENSE<br />

(in € millions) <strong>2010</strong> 2009 2008<br />

Restructuring costs (15.0) (41.3) (13.9)<br />

Impairment losses (18.4) (29.7) (19.6)<br />

Gains <strong>and</strong> losses on asset disposals <strong>and</strong> other (5.1) (2.8) 9.2<br />

OTHER OPERATING INCOME AND EXPENSE, NET (38.5) (73.8) (24.3)<br />

6.1. RESTRUCTURING COSTS<br />

<strong>2010</strong><br />

Restructuring costs for the year amounted to €15.0 million, mainly<br />

comprising:<br />

in France, the new pension reform has extended the period during which<br />

the Group will incur expenses under the pre-retirement plans introduced at<br />

certain sites in 2006. The additional cost for <strong>2010</strong> amounted to €4.8 million;<br />

in Brazil, the Group decided to insource all of its sales forces with the<br />

aim of improving customer service quality <strong>and</strong> controlling the entire value<br />

chain. The contracts with existing external sales representatives were<br />

therefore terminated, leading to compensation costs of €6.5 million;<br />

in China, responsibility for selling Tefal br<strong>and</strong> products was transferred<br />

to the Supor sales force, leading to sales force rationalisation costs of<br />

€2.4 million.<br />

2009<br />

Restructuring costs for 2009 amounted to €41.3 million, mainly comprising:<br />

a plan to reorganise European iron manufacturing operations announced<br />

on 11 February 2009. The related costs recognised in 2009 totalled<br />

€7.9 million for the redundancy plan at the Erbach site in Germany;<br />

in France, the reorganisation of iron manufacturing sites resulted in a<br />

pre-retirement plan at the Pont-Évêque site;<br />

provisions were also booked following the decision to combine the R&D<br />

<strong>and</strong> marketing teams from the La Défense <strong>and</strong> Caen sites at a facility in<br />

Burgundy to create a single, optimised “Electric Cooking Appliances” unit;<br />

an additional provision was also booked as a result of the 2006 Vosges<br />

site closure;<br />

total restructuring costs in France therefore amounted to €20.4 million<br />

in 2009;<br />

in Italy, the Group announced job cuts in September 2009 at the Omegna<br />

site, for which a €5.8 million provision was booked;<br />

in light of the severe economic crisis in a number of markets,<br />

the Group continued to realign its industrial (Brazil, United States),<br />

administrative (Spain) <strong>and</strong> sales (Norway, United Kingdom) organisations,<br />

giving rise to restructuring costs of €7.2 million in 2009.<br />

2008<br />

Restructuring costs for the year amounted to €13.9 million <strong>and</strong> mainly<br />

concerned plans in the following countries:<br />

France, for €5 million, corresponding to the additional costs of three plant<br />

closures launched in 2006, mainly the increase in payroll taxes on early<br />

retirement benefits <strong>and</strong> the cash cost of measures to assist the affected<br />

employees for which provisions could not be booked according to IFRS;<br />

the United Kingdom, for €6.6 million, related to the outsourcing of logistics<br />

operations;<br />

the United States, for €2.2 million, following the closure of the Medford,<br />

Los Angeles <strong>and</strong> Budd Lake offices <strong>and</strong> the transfer of their sales <strong>and</strong><br />

marketing activities to the West Orange <strong>and</strong> Millville sites.<br />

6.2. IMPAIRMENT LOSSES<br />

<strong>2010</strong><br />

In application of the principle described in Note 1.4.3, certain manufacturing<br />

cash-generating units (CGUs) were tested for impairment by comparing the<br />

carrying amount of the assets of each CGU with their value in use, defined<br />

as the sum of discounted future cash flows for the 5-year period covered by<br />

the business plan. Terminal value was determined based on the expected<br />

future cash flows to be derived from the assets in the last year of the plan.<br />

CGUs comprising intangible assets with indefinite useful lives were tested<br />

for impairment on a regular basis <strong>and</strong> CGUs comprising depreciable or<br />

amortisable assets were tested only when there was an indication that they<br />

may have been impaired. The main impairment tests <strong>and</strong> CGUs concerned<br />

are discussed in Note 10 – Intangible Assets.<br />

3<br />

GROUPE SEB<br />

FINANCIAL REPORT AND REGISTRATION DOCUMENT <strong>2010</strong><br />

79