Financial Report and Registration Document 2010 - Groupe Seb

Financial Report and Registration Document 2010 - Groupe Seb

Financial Report and Registration Document 2010 - Groupe Seb

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4 NOTES<br />

COMPANY FINANCIAL STATEMENTS<br />

TO THE COMPANY FINANCIAL STATEMENTS<br />

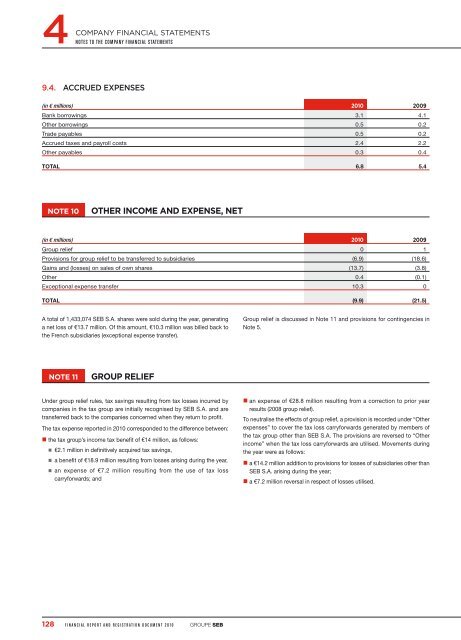

9.4. ACCRUED EXPENSES<br />

(in € millions) <strong>2010</strong> 2009<br />

Bank borrowings 3.1 4.1<br />

Other borrowings 0.5 0.2<br />

Trade payables 0.5 0.2<br />

Accrued taxes <strong>and</strong> payroll costs 2.4 2.2<br />

Other payables 0.3 0.4<br />

TOTAL 6.8 5.4<br />

NOTE 10<br />

OTHER INCOME AND EXPENSE, NET<br />

(in € millions) <strong>2010</strong> 2009<br />

Group relief 0 1<br />

Provisions for group relief to be transferred to subsidiaries (6.9) (18.6)<br />

Gains <strong>and</strong> (losses) on sales of own shares (13.7) (3.8)<br />

Other 0.4 (0.1)<br />

Exceptional expense transfer 10.3 0<br />

TOTAL (9.9) (21.5)<br />

A total of 1,433,074 SEB S.A. shares were sold during the year, generating<br />

a net loss of €13.7 million. Of this amount, €10.3 million was billed back to<br />

the French subsidiaries (exceptional expense transfer).<br />

Group relief is discussed in Note 11 <strong>and</strong> provisions for contingencies in<br />

Note 5.<br />

NOTE 11<br />

GROUP RELIEF<br />

Under group relief rules, tax savings resulting from tax losses incurred by<br />

companies in the tax group are initially recognised by SEB S.A. <strong>and</strong> are<br />

transferred back to the companies concerned when they return to profit.<br />

The tax expense reported in <strong>2010</strong> corresponded to the difference between:<br />

the tax group’s income tax benefit of €14 million, as follows:<br />

€2.1 million in definitively acquired tax savings,<br />

a benefit of €18.9 million resulting from losses arising during the year,<br />

an expense of €7.2 million resulting from the use of tax loss<br />

carryforwards; <strong>and</strong><br />

an expense of €28.8 million resulting from a correction to prior year<br />

results (2008 group relief).<br />

To neutralise the effects of group relief, a provision is recorded under “Other<br />

expenses” to cover the tax loss carryforwards generated by members of<br />

the tax group other than SEB S.A. The provisions are reversed to “Other<br />

income” when the tax loss carryforwards are utilised. Movements during<br />

the year were as follows:<br />

a €14.2 million addition to provisions for losses of subsidiaries other than<br />

SEB S.A. arising during the year;<br />

a €7.2 million reversal in respect of losses utilised.<br />

128 FINANCIAL REPORT AND REGISTRATION DOCUMENT <strong>2010</strong> GROUPE SEB