Financial Report and Registration Document 2010 - Groupe Seb

Financial Report and Registration Document 2010 - Groupe Seb

Financial Report and Registration Document 2010 - Groupe Seb

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

CORPORATE GOVERNANCE<br />

GROUP MANAGEMENT BODIES<br />

To benefi t from the defi ned benefi t plans, <strong>Groupe</strong> SEB executives must<br />

have occupied functions within the Group Executive Committee or Group<br />

Management Board for at least eight years.<br />

The scheme is capped at 41% of the reference remuneration (including<br />

benefits from m<strong>and</strong>atory plans).<br />

Furthermore, the Board of Directors Meeting of 19 March <strong>2010</strong> decided,<br />

in addition to the above rules, to limit the reference remuneration used as<br />

the calculation basis to 36 times the annual Social Security ceiling in force<br />

on the retirement date.<br />

The Group intends to outsource the entire commitment through matching<br />

payments to a fund into which the pension contributions are made on a<br />

regular basis.<br />

Severance allowance<br />

Thierry de La Tour d’Artaise shall not benefit from any compensation payment<br />

by the Board of Directors in the event of termination of his corporate m<strong>and</strong>ate<br />

as a director.<br />

The employment contract under which he joined the Group in 1994, which<br />

eventually led to his appointment as Chief Executive Officer of the Group,<br />

was suspended on 1 March 2005 for the duration of his corporate m<strong>and</strong>ate<br />

as a director.<br />

This contract stipulates that (as for other members of the Group Executive<br />

Committee) in the event of termination of his contract by the employer (except<br />

for reasons of serious professional misconduct, or in the event of a change<br />

in the control of the Group), he would benefi t from a severance package<br />

equal to two years of his total remuneration. In application of the TEPA law,<br />

a new rider to this contract defines the conditions of performance to which<br />

this allowance is subject. It is fixed at two years of remuneration (basic pay<br />

+ bonus), which can vary according to the extent of achievement of targets<br />

over the previous four financial years, as follows:<br />

if the average rate of target achievement is less than 50%, no allowance<br />

is payable;<br />

if the average rate is between 50% <strong>and</strong> 100%, the allowance shall be<br />

between 75% <strong>and</strong> 100%, based on a linear calculation;<br />

if the average rate is above 100%, the allowance shall remain at 100%.<br />

The Board of Directors reserves the right to reduce this allowance by a<br />

maximum of one-half if the last trading year showed a net loss; however, the<br />

allowance may not be less than the fixed basic salary plus bonus for the last<br />

financial year if application of the performance criteria based on achievement<br />

of targets gives entitlement to payment of an allowance.<br />

The employment contract binding Thierry de La Tour d’Artaise includes no<br />

allowances concerning a non-competition clause.<br />

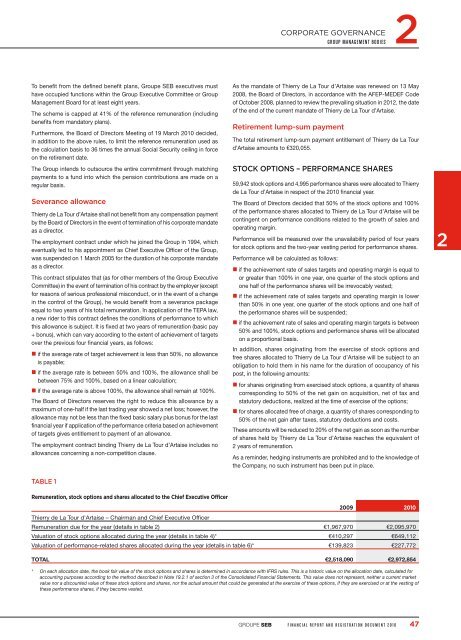

TABLE 1<br />

As the m<strong>and</strong>ate of Thierry de La Tour d’Artaise was renewed on 13 May<br />

2008, the Board of Directors, in accordance with the AFEP-MEDEF Code<br />

of October 2008, planned to review the prevailing situation in 2012, the date<br />

of the end of the current m<strong>and</strong>ate of Thierry de La Tour d’Artaise.<br />

Retirement lump-sum payment<br />

The total retirement lump-sum payment entitlement of Thierry de La Tour<br />

d’Artaise amounts to €320,055.<br />

STOCK OPTIONS – PERFORMANCE SHARES<br />

59,942 stock options <strong>and</strong> 4,995 performance shares were allocated to Thierry<br />

de La Tour d’Artaise in respect of the <strong>2010</strong> financial year.<br />

The Board of Directors decided that 50% of the stock options <strong>and</strong> 100%<br />

of the performance shares allocated to Thierry de La Tour d’Artaise will be<br />

contingent on performance conditions related to the growth of sales <strong>and</strong><br />

operating margin.<br />

Performance will be measured over the unavailability period of four years<br />

for stock options <strong>and</strong> the two-year vesting period for performance shares.<br />

Performance will be calculated as follows:<br />

if the achievement rate of sales targets <strong>and</strong> operating margin is equal to<br />

or greater than 100% in one year, one quarter of the stock options <strong>and</strong><br />

one half of the performance shares will be irrevocably vested;<br />

if the achievement rate of sales targets <strong>and</strong> operating margin is lower<br />

than 50% in one year, one quarter of the stock options <strong>and</strong> one half of<br />

the performance shares will be suspended;<br />

if the achievement rate of sales <strong>and</strong> operating margin targets is between<br />

50% <strong>and</strong> 100%, stock options <strong>and</strong> performance shares will be allocated<br />

on a proportional basis.<br />

In addition, shares originating from the exercise of stock options <strong>and</strong><br />

free shares allocated to Thierry de La Tour d’Artaise will be subject to an<br />

obligation to hold them in his name for the duration of occupancy of his<br />

post, in the following amounts:<br />

for shares originating from exercised stock options, a quantity of shares<br />

corresponding to 50% of the net gain on acquisition, net of tax <strong>and</strong><br />

statutory deductions, realized at the time of exercise of the options;<br />

for shares allocated free of charge, a quantity of shares corresponding to<br />

50% of the net gain after taxes, statutory deductions <strong>and</strong> costs.<br />

These amounts will be reduced to 20% of the net gain as soon as the number<br />

of shares held by Thierry de La Tour d’Artaise reaches the equivalent of<br />

2 years of remuneration.<br />

As a reminder, hedging instruments are prohibited <strong>and</strong> to the knowledge of<br />

the Company, no such instrument has been put in place.<br />

2<br />

Remuneration, stock options <strong>and</strong> shares allocated to the Chief Executive Officer<br />

2009 <strong>2010</strong><br />

Thierry de La Tour d’Artaise – Chairman <strong>and</strong> Chief Executive Officer<br />

Remuneration due for the year (details in table 2) €1,967,970 €2,095,970<br />

Valuation of stock options allocated during the year (details in table 4)* €410,297 €649,112<br />

Valuation of performance-related shares allocated during the year (details in table 6)* €139,823 €227,772<br />

TOTAL €2,518,090 €2,972,854<br />

* On each allocation date, the book fair value of the stock options <strong>and</strong> shares is determined in accordance with IFRS rules. This is a historic value on the allocation date, calculated for<br />

accounting purposes according to the method described in Note 19.2.1 of section 3 of the Consolidated <strong>Financial</strong> Statements. This value does not represent, neither a current market<br />

value nor a discounted value of these stock options <strong>and</strong> shares, nor the actual amount that could be generated at the exercise of these options, if they are exercised or at the vesting of<br />

these performance shares, if they become vested.<br />

GROUPE SEB<br />

FINANCIAL REPORT AND REGISTRATION DOCUMENT <strong>2010</strong><br />

47