2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2012</strong> <strong>Annual</strong> <strong>Report</strong><br />

Presentation 4<br />

General information 14<br />

<strong>Annual</strong> <strong>Report</strong> Consolidated <strong>Annual</strong> <strong>Report</strong> Directors’ report 30<br />

Sustainability disclosure <strong>Italcementi</strong> S.p.A. <strong>Annual</strong> <strong>Report</strong> Consolidated financial statements 63<br />

Extraordinary session 351<br />

Termination plans<br />

At December 31, <strong>2012</strong> provisions for termination plans totaled 73.6 million euro (37.5 million euro in 2011) and<br />

related mainly to Italy for 69.3 million euro in connection with re-organization plans affecting <strong>Italcementi</strong> S.p.A.,<br />

Calcestruzzi and C.T.G.<br />

20. Provisions<br />

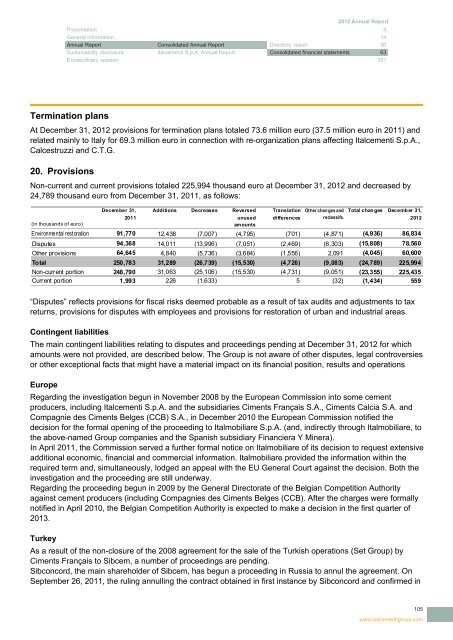

Non-current and current provisions totaled 225,994 thousand euro at December 31, <strong>2012</strong> and decreased by<br />

24,789 thousand euro from December 31, 2011, as follows:<br />

Decem ber 31, Additions Decr eases Reversed Translation Other changes and Total chan ges Decemb er 31,<br />

2011<br />

unused differences<br />

reclassifs.<br />

<strong>2012</strong><br />

(in thousands of euro)<br />

am ounts<br />

Environmental restoration 91,770 12,438 (7,007) (4,795) (701) (4,871) (4,936) 86,834<br />

Disputes 94,368 14,011 (13,996) (7,051) (2,469) (6,303) (15,808) 78,560<br />

Other provisions 64,645 4,840 (5,736) (3,684) (1,556) 2,091 (4,045) 60,600<br />

Total 250,783 31,289 (26,739) (15,530) (4,726) (9,083) (24,789) 225,994<br />

Non-current portion 248,790 31,063 (25,106) (15,530) (4,731) (9,051) (23,355) 225,435<br />

Current portion 1,993 226 (1,633) 5 (32) (1,434) 559<br />

“Disputes” reflects provisions for fiscal risks deemed probable as a result of tax audits and adjustments to tax<br />

returns, provisions for disputes with employees and provisions for restoration of urban and industrial areas.<br />

Contingent liabilities<br />

The main contingent liabilities relating to disputes and proceedings pending at December 31, <strong>2012</strong> for which<br />

amounts were not provided, are described below. The <strong>Group</strong> is not aware of other disputes, legal controversies<br />

or other exceptional facts that might have a material impact on its financial position, results and operations<br />

Europe<br />

Regarding the investigation begun in November 2008 by the European Commission into some cement<br />

producers, including <strong>Italcementi</strong> S.p.A. and the subsidiaries Ciments Français S.A., Ciments Calcia S.A. and<br />

Compagnie des Ciments Belges (CCB) S.A., in December 2010 the European Commission notified the<br />

decision for the formal opening of the proceeding to Italmobiliare S.p.A. (and, indirectly through Italmobiliare, to<br />

the above-named <strong>Group</strong> companies and the Spanish subsidiary Financiera Y Minera).<br />

In April 2011, the Commission served a further formal notice on Italmobiliare of its decision to request extensive<br />

additional economic, financial and commercial information. Italmobiliare provided the information within the<br />

required term and, simultaneously, lodged an appeal with the EU General Court against the decision. Both the<br />

investigation and the proceeding are still underway.<br />

Regarding the proceeding begun in 2009 by the General Directorate of the Belgian Competition Authority<br />

against cement producers (including Compagnies des Ciments Belges (CCB). After the charges were formally<br />

notified in April 2010, the Belgian Competition Authority is expected to make a decision in the first quarter of<br />

2013.<br />

Turkey<br />

As a result of the non-closure of the 2008 agreement for the sale of the Turkish operations (Set <strong>Group</strong>) by<br />

Ciments Français to Sibcem, a number of proceedings are pending.<br />

Sibconcord, the main shareholder of Sibcem, has begun a proceeding in Russia to annul the agreement. On<br />

September 26, 2011, the ruling annulling the contract obtained in first instance by Sibconcord and confirmed in<br />

105<br />

www.italcementigroup.com