2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

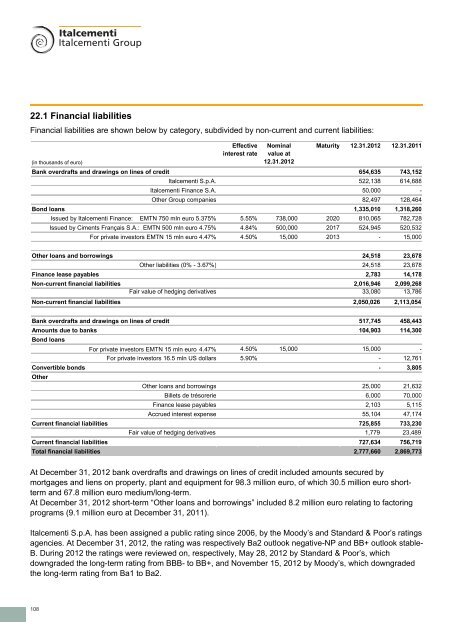

22.1 Financial liabilities<br />

Financial liabilities are shown below by category, subdivided by non-current and current liabilities:<br />

Effective Nominal Maturity 12.31.<strong>2012</strong> 12.31.2011<br />

interest rate value at<br />

(in thousands of euro)<br />

12.31.<strong>2012</strong><br />

Bank overdrafts and drawings on lines of credit 654,635 743,152<br />

<strong>Italcementi</strong> S.p.A. 522,138 614,688<br />

<strong>Italcementi</strong> Finance S.A. 50,000 -<br />

Other <strong>Group</strong> companies 82,497 128,464<br />

Bond loans 1,335,010 1,318,260<br />

Issued by <strong>Italcementi</strong> Finance: EMTN 750 mln euro 5.375% 5.55% 738,000 2020 810,065 782,728<br />

Issued by Ciments Français S.A.: EMTN 500 mln euro 4.75% 4.84% 500,000 2017 524,945 520,532<br />

For private investors EMTN 15 mln euro 4.47% 4.50% 15,000 2013 - 15,000<br />

Other loans and borrowings 24,518 23,678<br />

Other liabilities (0% - 3.67%) 24,518 23,678<br />

Finance lease payables 2,783 14,178<br />

Non-current financial liabilities 2,016,946 2,099,268<br />

Fair value of hedging derivatives 33,080 13,786<br />

Non-current financial liabilities 2,050,026 2,113,054<br />

Bank overdrafts and drawings on lines of credit 517,745 458,443<br />

Amounts due to banks 104,903 114,300<br />

Bond loans<br />

For private investors EMTN 15 mln euro 4.47% 4.50% 15,000 15,000 -<br />

For private investors 16.5 mln US dollars 5.90% - 12,761<br />

Convertible bonds - 3,805<br />

Other<br />

Other loans and borrowings 25,000 21,632<br />

Billets de trésorerie 6,000 70,000<br />

Finance lease payables 2,103 5,115<br />

Accrued interest expense 55,104 47,174<br />

Current financial liabilities 725,855 733,230<br />

Fair value of hedging derivatives 1,779 23,489<br />

Current financial liabilities 727,634 756,719<br />

Total financial liabilities 2,777,660 2,869,773<br />

At December 31, <strong>2012</strong> bank overdrafts and drawings on lines of credit included amounts secured by<br />

mortgages and liens on property, plant and equipment for 98.3 million euro, of which 30.5 million euro shortterm<br />

and 67.8 million euro medium/long-term.<br />

At December 31, <strong>2012</strong> short-term “Other loans and borrowings” included 8.2 million euro relating to factoring<br />

programs (9.1 million euro at December 31, 2011).<br />

<strong>Italcementi</strong> S.p.A. has been assigned a public rating since 2006, by the Moody’s and Standard & Poor’s ratings<br />

agencies. At December 31, <strong>2012</strong>, the rating was respectively Ba2 outlook negative-NP and BB+ outlook stable-<br />

B. During <strong>2012</strong> the ratings were reviewed on, respectively, May 28, <strong>2012</strong> by Standard & Poor’s, which<br />

downgraded the long-term rating from BBB- to BB+, and November 15, <strong>2012</strong> by Moody’s, which downgraded<br />

the long-term rating from Ba1 to Ba2.<br />

108